Santiment says bitcoin is undervalued versus gold and equities

Santiment argues bitcoin is undervalued after its correlation with stocks broke.

Bitcoin is undervalued, analysts at Santiment said after examining a break in the four-year correlation between the coin’s price and the stock market.

📊 Over the past 3 months, there has been a clear correlation break between crypto and equities. Here are the major sector returns since August 11th:

🥇 Gold: +21%

🏦 S&P 500: +7%

🪙 Bitcoin: -15%🧐 Based on 4 years of a tight correlation, $BTC is arguably being undervalued. pic.twitter.com/gIWiJPZpc5

— Santiment (@santimentfeed) November 12, 2025

They noted that over the past three months the performance of key assets has diverged markedly. Since 11 August, gold has risen 21% and the S&P 500 by 7%, while bitcoin has fallen 15%.

Final threshold

Bitcoin Vector said the market’s focus is shifting to the $94,000–95,000 range, calling it the next major accumulation zone and “a critical inflection point for digital gold’s structure”.

The market’s focus is turning toward $94K–$95K, the next major accumulation zone and a critical inflection point for Bitcoin’s structure.

It’s also the annual open, a level that could trigger extreme fear and capitulation; yet for long-term holders, that same panic often marks… pic.twitter.com/AC1mCx2HrK

— Bitcoin Vector (@bitcoinvector) November 11, 2025

This level coincides with the year’s open. Reaching it could spark fear and capitulation; for long-term investors, such panic often proves a buying opportunity.

At the time of writing, bitcoin was trading around ~$104,800, down 0.4% over the past 24 hours.

November rally in doubt

Bitfinex analysts flagged the risk of a drop in the price of digital gold. For the past two weeks the asset has traded in a tight $106,000–116,000 range.

Long-term holders (LTH) taking profits are weighing on price. According to the report, LTHs are selling about 104,000 BTC a month — the most since July. Bull phases resumed only after this cohort shifted from selling to accumulating, they said.

Short-term holders (STH) who bought recently are also losing confidence. The STH-NUPL metric fell to -0.05, indicating small paper losses. If the price does not recover, this group may face forced selling.

The derivatives market also points to uncertainty. Implied volatility in options continues to fall — traders do not expect sharp price moves in the near term.

Mixed macro signals are adding to the pressure. ФРС cut interest rates, but investors are unsure about further monetary easing by the regulator. This is limiting the inflow of speculative capital.

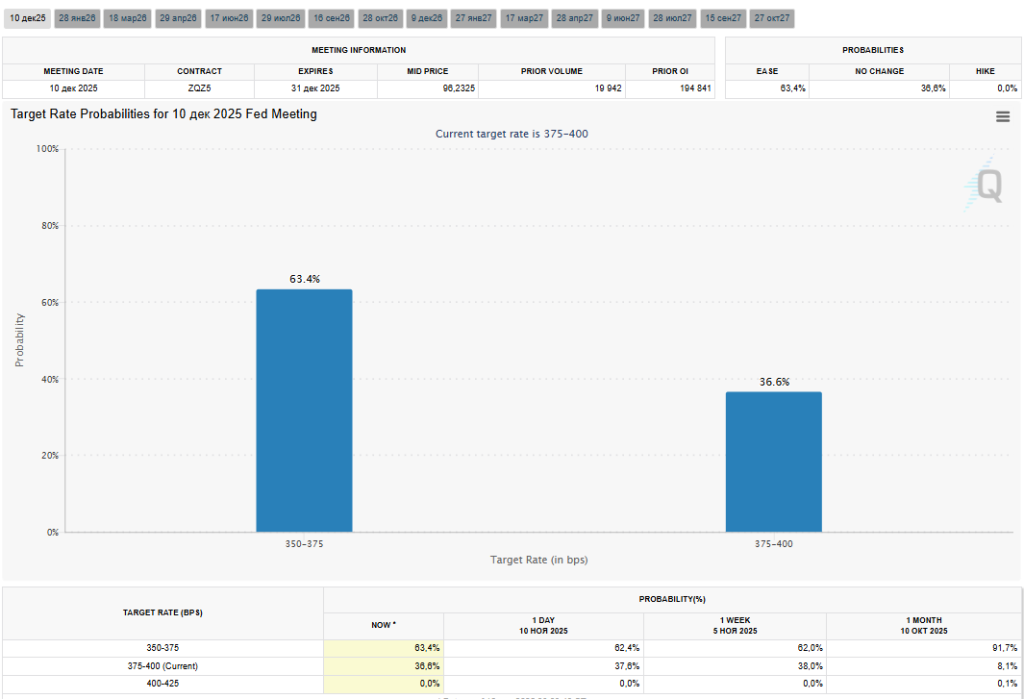

The probability of a cut at the 10 December meeting has slipped to 63.4%, having earlier approached 90%.

Bitfinex believes that without new capital from spot buyers or ETF holders, bitcoin will remain range-bound. The primary support zone is $106,000–107,000; a breakdown would open the way to $100,000. For a recovery to start, the price needs to consolidate above $116,000.

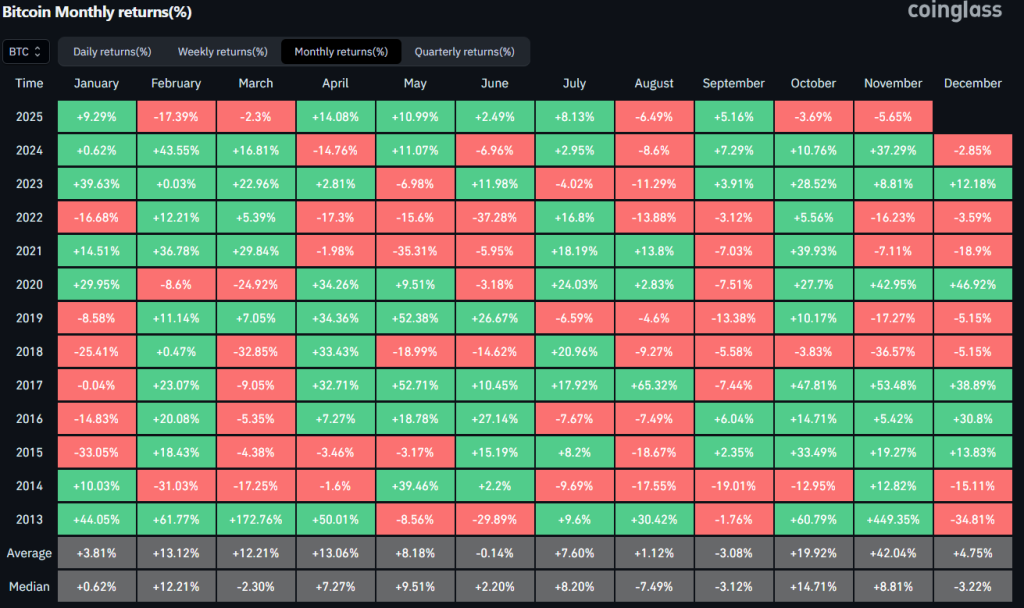

Historically, November is a strong month for bitcoin. According to Coinglass, since 2013 the average gain in November has been 42.04%.

Local bottom

The on-chain metric net unrealized profit (NUP) has fallen to a level that has historically preceded the formation of a local bottom, analyst CoinCare noted.

The Bitcoin Net Unrealized Profit (NUP) is Signaling a Potential Bottom

“Currently sitting at 0.476, the metric suggests that selling pressure has significantly eased — indicating that we may be approaching a short-term market bottom.” – By CoinCare pic.twitter.com/GOmHgI3gxK

— CryptoQuant.com (@cryptoquant_com) November 12, 2025

NUP reflects the total unrealized profit of holders whose coins are “in the money”. A high reading signals strong selling pressure.

According to CoinCare, in the current market cycle local lows formed when the metric dipped below 0.5. It now stands at 0.476.

“Selling pressure has eased significantly. This suggests that we may be approaching a short-term market bottom. In the near term, a rebound can be expected,” he concluded.

Harvest time

Morgan Stanley investment strategist Denny Galindo noted that historical data point to a four-year bitcoin price cycle: three years of gains and one year of decline.

“We are currently in the autumn season. Autumn is harvest time. So this is when you want to take your profits,” he said.

Michael Cyprys, head of research for brokers and asset managers at Morgan Stanley, added that institutional investors have begun to view the leading cryptocurrency as a bona fide part of diversified portfolios. Some indeed consider the asset “digital gold” or a hedge against inflation.

Cyprys stressed that large players adopt cryptocurrencies slowly due to complex internal processes, risk committees and long-term strategies.

However, adoption is accelerating as regulation and ETF infrastructure have lowered barriers to entry. He noted that spot funds based on bitcoin and Ethereum “have brought billions into the industry”.

In November, a Sygnum study found that institutional investors are confident cryptocurrencies will rise by year-end.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!