Spot bitcoin ETFs post $870m in second-biggest outflow

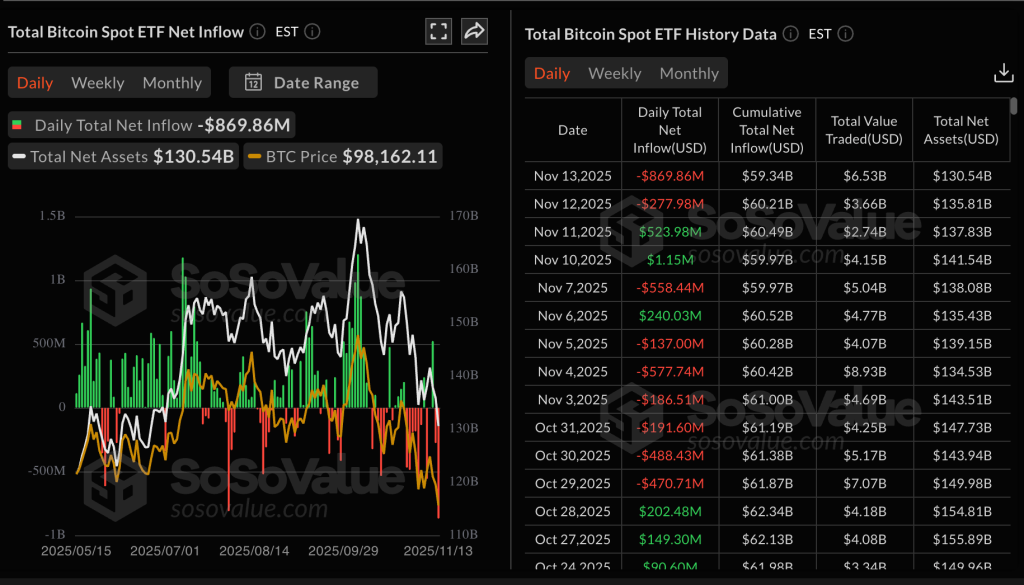

Spot bitcoin ETFs saw $869.9m pulled on Nov 13, the second-largest outflow since launch.

By the end of the 13 November session, $869.9m was pulled from exchange-traded funds based on the first cryptocurrency. It was the second-largest outflow since the products launched.

The worst showing came from BTC by Grayscale, which lost $318m. IBIT by Grayscale, FBTC by Fidelity and GBTC by Grayscale shed $256m, $119m and $64m, respectively.

The previous low point was recorded on 25 February, when aggregate daily outflows exceeded $1bn.

Assets under management fell back below $60bn, to $59.4bn.

Kronos Research CIO Vincent Liu attributed the heavy withdrawals to a shift in strategy amid macroeconomic uncertainty. Investors, he said, are rotating towards less risky assets.

“This puts pressure on short-term dynamics but does not undermine structural demand,” he added in a comment to The Block.

The record outflow coincided with a drop in the price of the first cryptocurrency below $100,000. At the time of writing bitcoin trades around $97,600, according to TradingView.

Altcoin ETFs

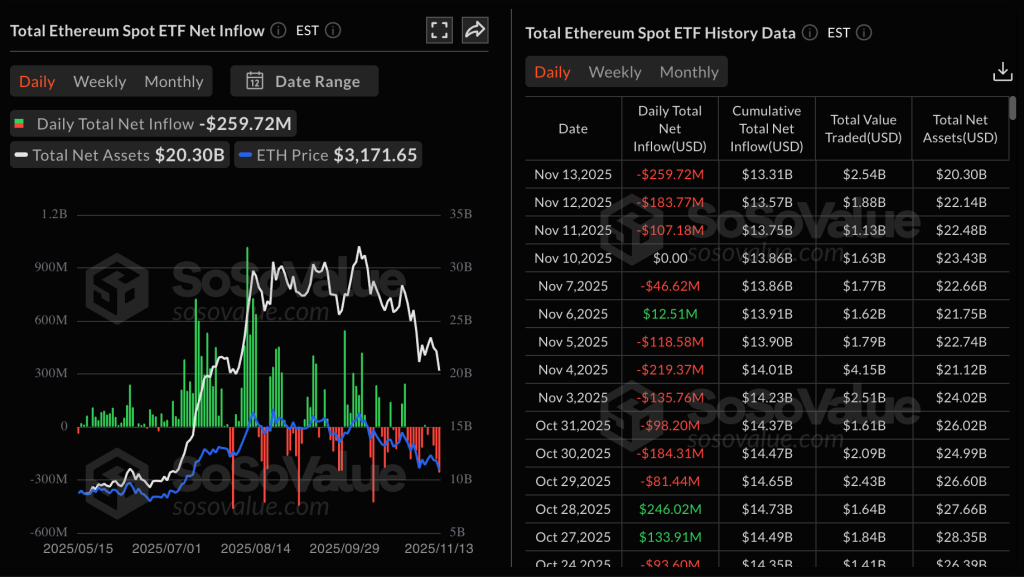

ETFs focused on the second-largest cryptocurrency saw $259.7m of outflows.

The weakest were ETHA by BlackRock (-$137m), ETHE (-$67m) and ETH by Grayscale (-$35m).

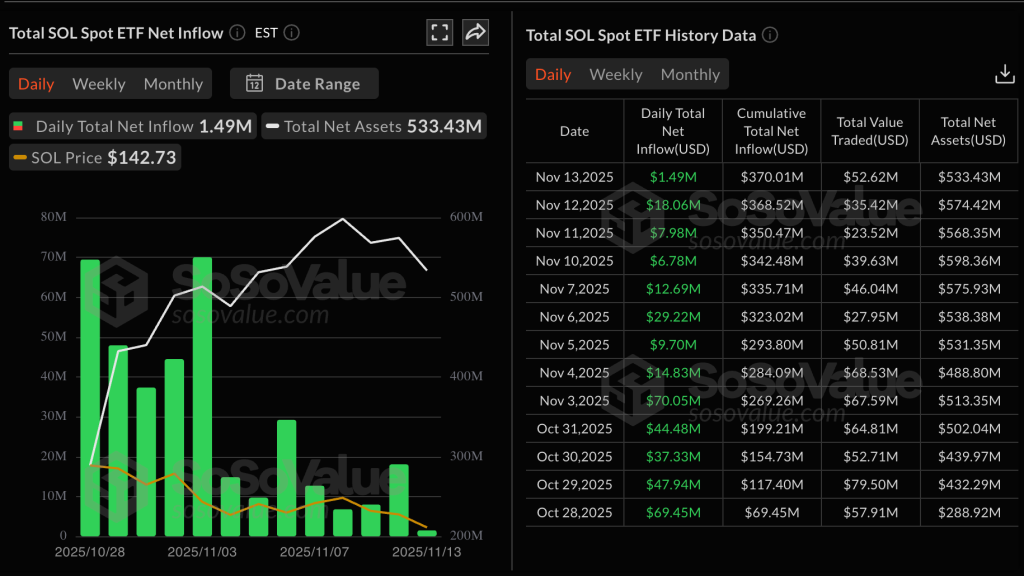

Launched in late October, Solana ETFs again bucked the broader trend and posted a small inflow. Investments totalled $1.4m.

Cumulative inflows have exceeded $370m.

Also on 13 November, trading began on Nasdaq for a spot ETF based on XRP under the ticker XRPC. The product was launched by Canary Capital.

Turnover reached $58m — the best first-day result among all ETFs launched this year, noted Bloomberg analyst Eric Balchunas. It beat expectations; the expert had forecast around $17m.

Congrats to $XRPC for $58m in Day One volume, the most of any ETF launched this year (out of 900), BARELY edging out $BSOL‘s $57m. The two of them are in league of own tho as 3rd place is over $20m away. pic.twitter.com/MjsOeceeNb

— Eric Balchunas (@EricBalchunas) November 13, 2025

Official figures for net inflows were not available at the time of writing.

Canary CEO Steven McClurg believes the XRP ETF could “easily” outpace Solana-based funds, helped by the asset’s “exceptional liquidity and global use cases.”

Canary Capital CEO Steven McClurg didn’t hold back on the @PaulBarron show.

He said an XRP ETF could easily outperform what Solana achieved.

He noted XRP’s deep liquidity and global use case, forecasting major institutional capital.$XRP was engineered for the big leagues. pic.twitter.com/ybbVAREBld

— John Squire (@TheCryptoSquire) November 13, 2025

The token’s price did not react to the launch. Over the past 24 hours, XPR fell 8.2%. At the time of writing it trades at $2.2.

On 10 November, the US provider of post-trade, clearing and settlement services DTCC added to its list five spot XRP ETFs that are in a pre-launch phase.

They include Canary’s product as well as funds from Bitwise, Franklin Templeton, 21Shares and CoinShares.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!