Investor Pessimism Suggests Potential Market Bottom

Social media sentiment has turned extremely negative, hinting at a market turnaround.

Social media sentiment has turned extremely negative, and the notion of ‘buying the dip’ is gradually fading—classic indicators that often precede a market turnaround, according to analysts from Santiment.

“Be cautious when you see a broad consensus regarding a specific price bottom. True bottoms often form when the majority expects further decline,” experts warned.

The ratio of positive to negative comments about Bitcoin has reached its lowest level in the past month. As the price declines, the ‘dominance’ of the leading cryptocurrency in social media has risen to over 40%, becoming a main topic of ‘anxious discussions.’

Researchers observed that the recent correction did not lead to significant liquidations, and open interest in perpetual contracts “retained only a small fraction of the October figure.” This suggests that the market has exhausted the supply of long positions with excessive leverage, hinting at a possible shift in dynamics.

Although Bitcoin’s drop below the psychological level of $100,000 sparked a wave of fear, some investors have identified the $90,000 mark as critical.

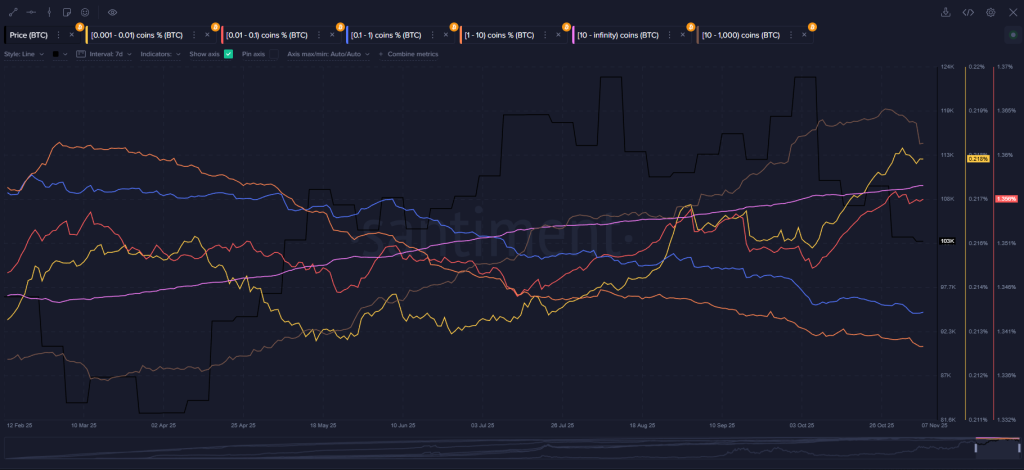

Santiment also identified a clear divergence in wallet behavior. Large holders (10-10,000 BTC) have consistently sold coins since reaching the all-time high in October. Meanwhile, small retail wallets (up to 10 BTC) continued to accumulate during the decline.

“A true signal of a bottom is likely to be the reversal of this trend,” analysts added.

Simultaneously, the 30-day MVRV on the Bitcoin chart fell to -10% for the first time in eight months. This indicates that short-term traders are incurring significant losses. Historically, such high stress among investors has corresponded to low-risk buying zones.

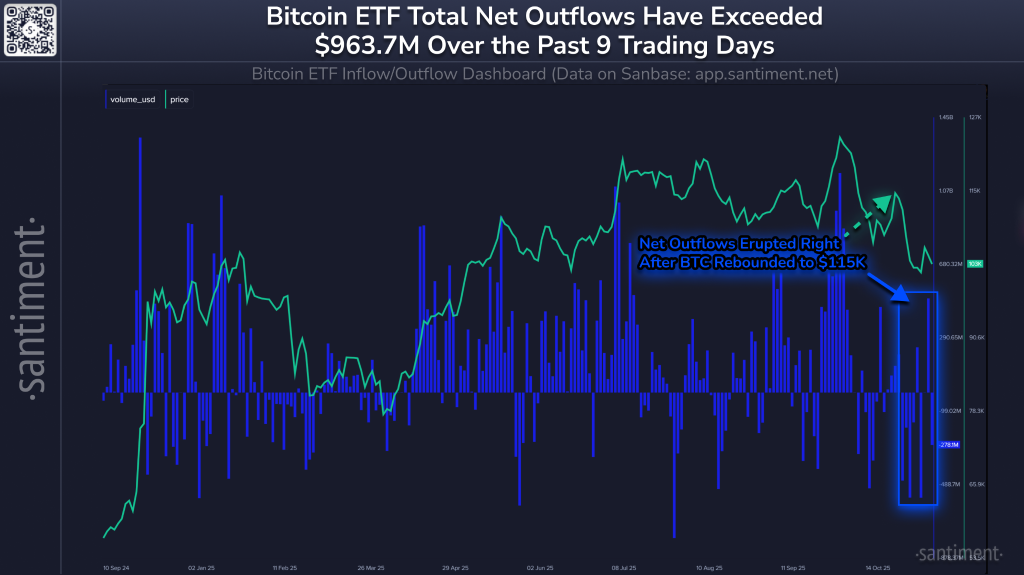

Santiment noted that a significant outflow of funds from spot Bitcoin ETFs over the past week could also be a positive sign for Bitcoin’s spot price.

“Large fund inflows often marked local price peaks, while significant withdrawals coincided with market bottoms, indicating panic among retail sellers,” analysts emphasized.

As reported by CryptoQuant, panic selling in the crypto market has concluded. According to their data, losses for investors who purchased the leading cryptocurrency over the past six months have approached 13%, a sign of capitulation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!