Bitcoin ETF Becomes Dominant Asset in Harvard’s Portfolio

Over the quarter, the university increased its BlackRock fund holdings by 280%.

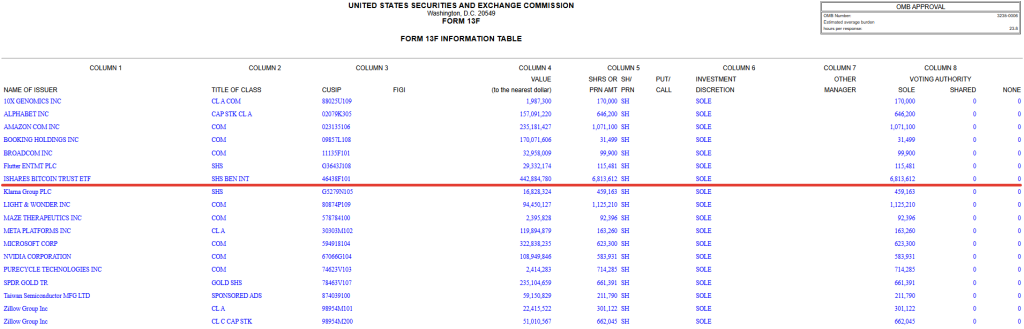

As of the end of the third quarter, Harvard University’s treasury held 6.81 million shares of BlackRock’s Bitcoin exchange-traded fund (IBIT), valued at $442.88 million. This is according to a report for the SEC.

This position has become the largest in the educational institution’s portfolio, accounting for about 20% of its current volume.

At the end of June, Harvard held IBIT shares worth $116 million. Over three months, reserves increased by 280%.

The second-largest position in the treasury is now Microsoft securities at $322.8 million, followed by Amazon ($235.18 million) and SPDR Gold Trust ($235.1 million).

Bloomberg analyst Eric Balchunas noted the unusual investment direction for American universities.

Just checked and yeah $IBIT is now Harvard’s largest position in its 13F and its biggest position increase in Q3. It’s super rare/difficult to get an endowment to bite on an ETF- esp a Harvard or Yale, it’s as good a validation as an ETF can get. That said, half a billion is a… https://t.co/oTiSL29llB pic.twitter.com/yw0tRcD1ad

— Eric Balchunas (@EricBalchunas) November 15, 2025

“It’s extremely rare and difficult to get an endowment to join an ETF, especially Harvard or Yale. It’s the best endorsement an exchange-traded product can get,” he noted.

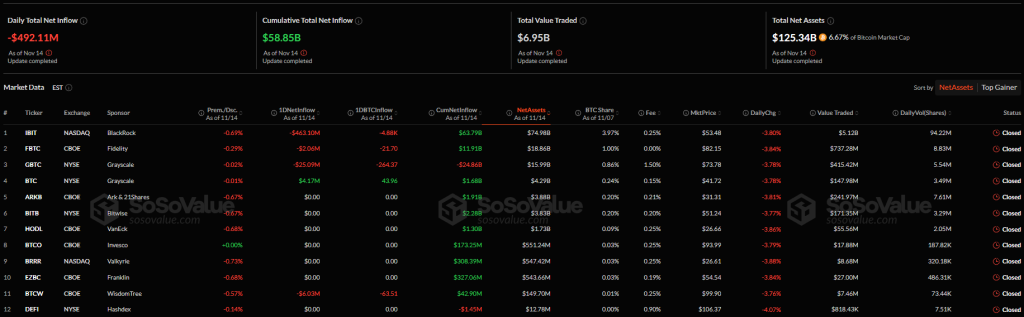

According to him, the current IBIT holdings at the university account for only 1% of the fund’s target level of $50 billion. Nevertheless, Harvard ranks 16th among the largest holders of the instrument.

Since its launch, IBIT has remained the world’s largest Bitcoin-based exchange-traded fund, with net assets under management of just under $75 billion, according to SoSoValue. BlackRock’s ETF has absorbed 3.97% of the first cryptocurrency’s issuance.

Emory University, a private research institution in Atlanta, has also increased its positions in Bitcoin ETFs. As of September 30, the institution held over 1 million shares of the Bitcoin Mini Trust ETF from Grayscale, valued at $42.9 million. Over the quarter, holdings increased by nearly 90%.

In November, a Spanish technology institute began negotiations to sell 97 BTC purchased 13 years ago.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!