Standard Chartered: Bitcoin correction ‘has run its course’

Arthur Hayes sees bitcoin at up to $250,000 by year-end.

The cryptocurrency-market correction has run its course. Standard Chartered’s head of digital-asset research, Jeffrey Kendrick, predicted a year-end rise in bitcoin’s price, reports The Block.

He said the latest decline is comparable with two major sell-offs over the past two years. Although more painful, it is a typical retracement for the current cycle with a similar percentage depth.

“The argument is simple, and the most compelling cases usually are,” the expert noted.

Signs of a bottom

Kendrick stressed that key indicators have reached extremes, signalling proximity to a cycle low. One is Strategy’s mNAV, which dropped to 1.

“I believe the current readings make a convincing case that the correction is over and refute the idea that the halvings-linked cycle is no longer relevant. My base case is a recovery into year-end,” the analyst said.

In late October, the Standard Chartered expert said that bitcoin was unlikely to fall below $100,000 again.

Kendrick argued his case with improving macro conditions and positive flows at the time into spot ETF based on the asset.

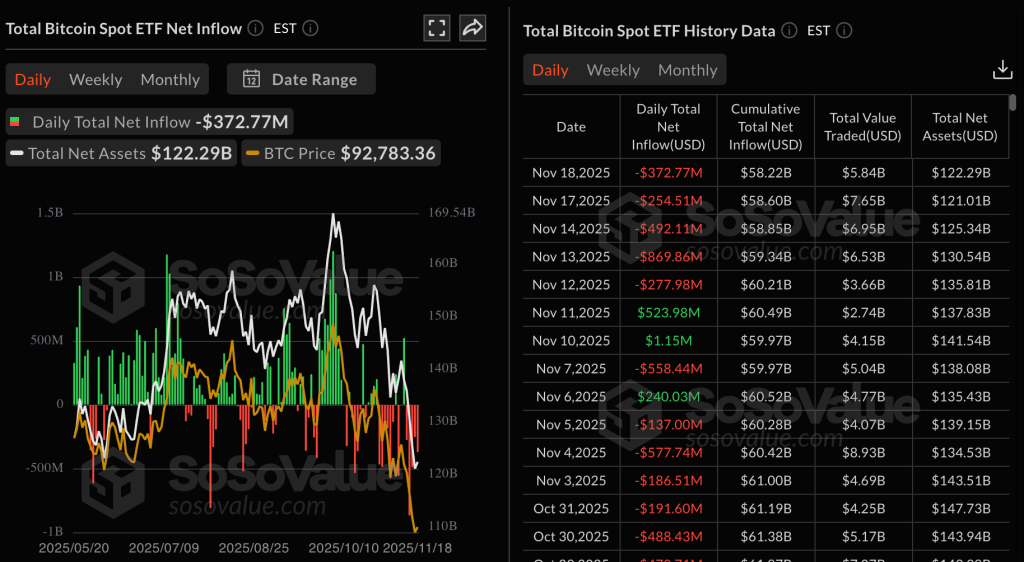

Since early November the vehicles have lost about $3 billion. In the latest session $372 million was pulled—outflows have continued for a fifth straight day.

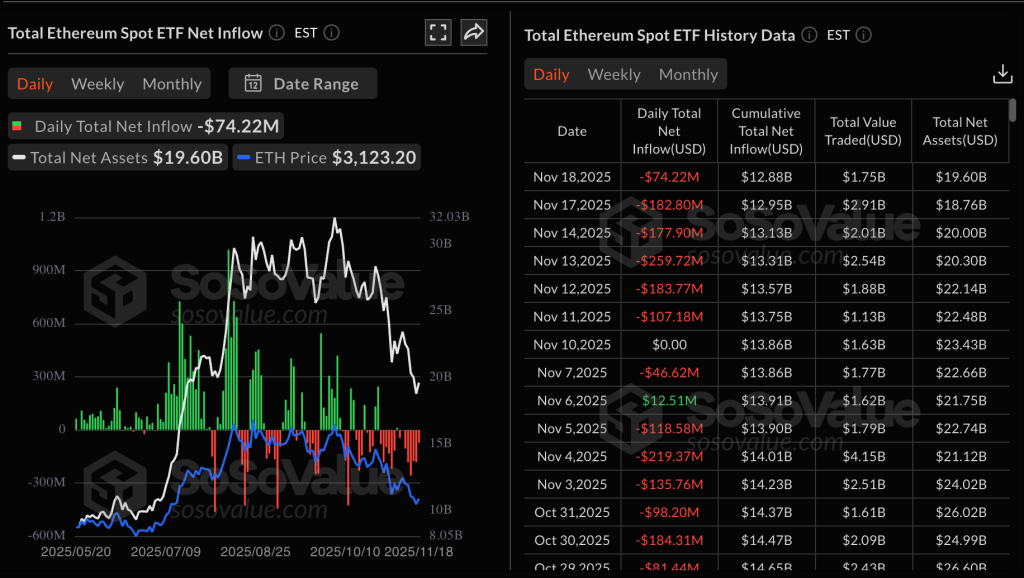

A similar pattern is seen in Ethereum-focused ETFs, which have shed $1.7 billion over the past two weeks.

Kendrick’s year-end bitcoin forecast remains $200,000, and for Ethereum — at $7,500. By 2028 he expects to see digital gold at $500,000 and the second-largest cryptocurrency at $25,000.

Why the market fell

Some experts argue the current crypto-market decline reflects a liquidity shortfall amid a US shutdown, rather than fundamentals such as ETF outflows or waning activity among DAT firms.

Arthur Hayes, the founder of BitMEX, takes a similar view. In a new essay, Snow Forecast, he noted that the market has not faced a narrative shift but the disappearance of “artificial supports”.

While the spread between futures and spot ETFs remained attractive, ETFs and crypto treasuries created steady demand, masking deteriorating liquidity.

But “when the basis falls, they quickly dump their positions”. That, Hayes argues, was the starting point of the correction.

At the same time, premiums at DAT firms collapsed: Strategy’s mNAV plunged below 1, removing two big sources of capital inflows that had supported bitcoin since spring.

Hayes said this does not signal a cycle change, but a reaction to the actual state of US dollar supply.

“Money is politics. And political rhetoric, which changes quickly, affects market expectations about the future supply of dirty fiat.”

With ETF inflows absent and DAT activity down—previously cushions against the liquidity shortfall—bitcoin is reflecting current conditions and falling in price.

Parallels with the past

Hayes drew a parallel between the second halves of 2023 and 2025: both concluded with a debt-ceiling increase followed by a liquidity drain.

He says what happens next is predictable: once politicians heed voters frustrated by rising prices, a cycle of “tough talk against the printing press” begins.

“After a sharp market drop, they have only two options: either print money again to save the system, or allow credit to contract, risking the destruction of wealthy asset holders and triggering mass layoffs,” Hayes explained.

He considers the choice obvious: inflation is a more “convenient” political risk than mass unemployment. He therefore remains confident stimulus will continue — earlier Trump announced a “dividends” programme for Americans funded by tariff revenues.

Bull case

The expert also examined the optimists’ arguments. After the shutdown, the Treasury could indeed add $100–150 billion to the system, and the Fed could halt balance-sheet reduction. But Hayes believes the liquidity drain is far larger:

“About $1 trillion of dollar liquidity has evaporated since July. Adding $150 billion is nice, but what then?”

He noted that Fed officials’ talk of the need for fresh quantitative tightening remains rhetoric. In his view, even if the “printing press” restarts later, markets will likely first retrace to fundamentally justified levels.

“Before we return to Up Only, markets must fall low enough to accelerate money printing.”

Hayes also outlined the current strategy at the Maelstrom fund. It has increased its share of stablecoins, expecting the correction to continue.

“The only asset that I believe can outperform the negative dollar-liquidity backdrop in the short term is Zcash,” he said.

Outlook

Hayes pointed out that bitcoin’s sharp drop from $125,000 to $90,000, even as stock indices hit records, is an ominous signal:

“It tells me a credit event is brewing.”

He estimates that if equities correct by 10–20% and ten-year yields approach 5%, authorities will have a “pressing need” to start printing again. That, he says, could send bitcoin to $200,000–250,000 by year-end.

The last time bitcoin was here, global liquidity was $7 trillion lower pic.twitter.com/MveSuWGWkS

— zerohedge (@zerohedge) November 18, 2025

He also expects a response from China:

“Beijing will begin reflation as soon as the US speeds up dollar creation. That will mark the start of Chinese quantitative tightening.”

At the time of writing, the leading cryptocurrency is trading around $91,300.

Earlier, the bitcoin options market pointed to a bearish phase, noted CoinDesk analyst Omkar Godbole.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!