BitMine Faces $1000 Loss per ETH Due to BlackRock’s Plans

BlackRock's Ethereum ETF threatens corporate crypto holders, says 10x Research.

The launch of an ETF based on Ethereum with a staking feature by BlackRock threatens the business model of corporate cryptocurrency holders, according to a report by 10x Research.

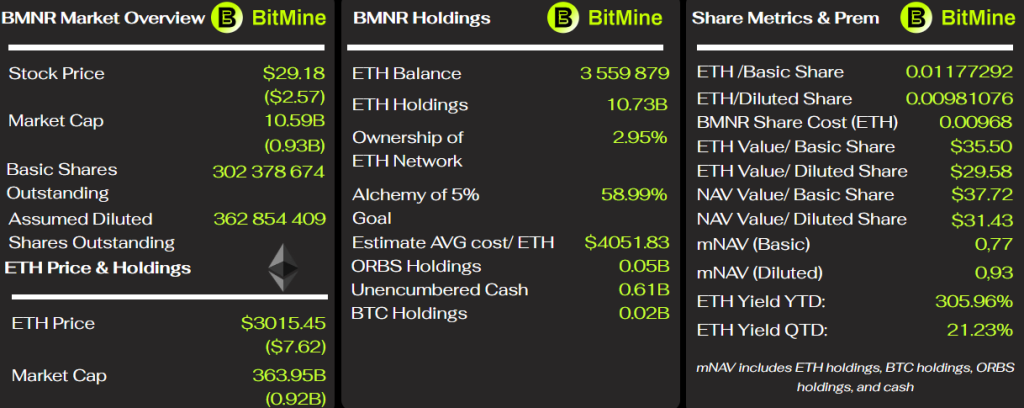

Companies like BitMine Immersion Technologies are particularly vulnerable. Analysts report that the firm is facing an unrealized loss of $3.7 billion, losing $1000 on each purchased ETH.

Markus Thielen, founder of 10x Research, compared the situation to the Hotel California. Investors cannot exit such structures without significant losses.

He notes that unlike ETFs, companies holding digital assets use “complex, opaque, and often hedge fund-like fee structures that can quietly erode returns.”

The situation for companies is further complicated by the mNAV ratio—if it is below 1, raising funds to purchase new coins becomes difficult. For BitMine, this figure stands at 0.77.

BlackRock’s offering could become a low-cost income tool for investors. Unlike corporate holders, the ETF structure is more transparent.

Analysts at 10x Research believe investors might start shifting capital to BlackRock’s ETH-ETF. Its management fee will be 0.25%, significantly lower than the hidden costs in existing structures.

In September, companies REX Shares and Osprey Funds announced the launch of an Ethereum-ETF with a staking feature in the US.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!