Report: Fed Halts QT Due to Liquidity Shortage

Fed's reversal due to financial issues, not inflation victory, says Binance Research.

In October, the Fed reduced the key interest rate by 25 basis points and announced the cessation of the quantitative tightening (QT) program from December 1. However, the “victory over inflation” was actually a forced reversal due to mounting issues in the financial system, according to Binance Research.

Analysts pointed out that the catalyst for the decision was the U.S. government shutdown, which resulted in the Treasury General Account (TGA) balance exceeding $1 trillion. This effectively withdrew about $700 billion in liquidity from the banking system, comparable to the effect of several rate hikes.

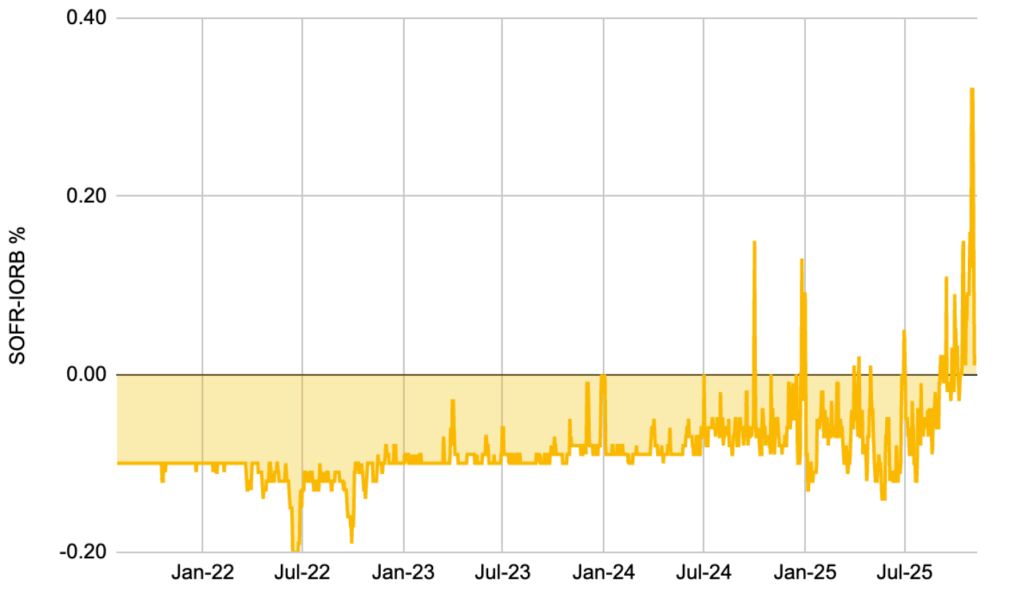

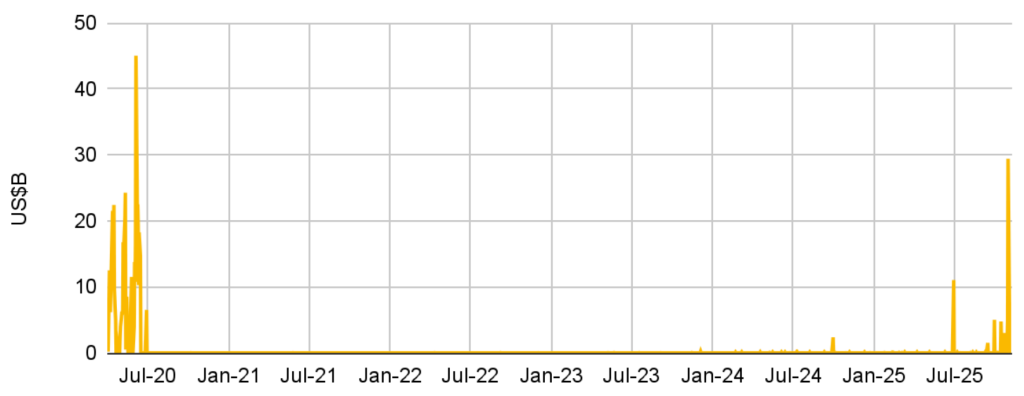

Signs of systemic stress were evident in the sharp rise in the spread between SOFR and IORB rates, as well as the record use of the Standing Repo Facility (SRF) — an emergency funding tool.

On October 31, the volume of SRF requests reached a historic high of $50.35 billion, indicating a shortage of private funding.

Researchers also noted structural issues in the economy. Despite the relative stability of the unemployment rate (3.8%), the private sector is losing jobs, with growth driven by public sector hiring.

Household debt reached a record $18.7 trillion in the second quarter of 2025, with consumer loan delinquencies rising to multi-year highs.

The “Slingshot Effect” and Bitcoin’s Role

For the cryptocurrency market, the end of QT removes a major macroeconomic obstacle of the past two years. Experts anticipate that spending from the TGA after the shutdown will create a “slingshot effect,” injecting liquidity into the markets.

By the first quarter of 2026, analysts predict the Fed will shift to a “QE-Lite” policy — purchasing short-term Treasury bills to replenish bank reserves. This, along with the strengthening narrative of Bitcoin as an “antifragile” asset amid the vulnerability of TradFi, could drive a new wave of cryptocurrency growth.

Researchers identified key risks as the potential for stagflation or a “hard landing” for the economy. They assessed the current macro situation as a “shift from headwind to tailwind” for risk assets like digital gold.

Earlier, analysts at XWIN Research outlined risks of Bitcoin falling to $60,000 due to the Fed’s “hawkish” decisions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!