Pump.fun co-founder denies $436m cash-out to Kraken

Pump.fun co-founder denies $436m cash-out to Kraken, calls claims misinformation.

Pump.fun’s co-founder, who goes by the pseudonym Sapijiju, denied reports of a $436m transfer in stablecoins to the Kraken exchange.

complete misinformation from @lookonchain again. $0 have been cashed out — we’re not involved in the transactions between Kraken and Circle that you’re alleging us to be a part of.

What’s happening is a part of pump’s treasury management, where USDC from the $PUMP ICO has been… https://t.co/qd6GUnIxKH

— Sapijiju (@sapijiju) November 24, 2025

The transaction was first flagged by analysts at Lookonchain, who noted that since October 15 the platform had transferred $436.5m in USDC to the trading venue Kraken. A further $537.6m in USDC then went directly to Circle, allegedly for redemption.

It appears https://t.co/C909I8882s has cashed out at least 436.5M $USDC since Oct 15.

Since Oct 15, https://t.co/C909I8882s has deposited 436.5M $USDC into#$Kraken.

During the same period, 537.6M $USDC flowed from #Kraken to #Circle through wallet DTQK7G.

Between May 19, 2024… pic.twitter.com/WQGnUcA8l4

— Lookonchain (@lookonchain) November 24, 2025

They calculated that from May 19, 2024 to August 12, 2025, Pump.fun sold a total of 4.19m SOL (~$757m) at an average price of $181.

Sapijiju called Lookonchain’s assertions misinformation and said the project has no involvement in the transactions between Kraken and Circle.

“What’s happening is part of Pump’s treasury management, where USDC from the ICO of PUMP was moved to different wallets so the company’s funds could be reinvested. We have never worked directly with Circle,” he wrote.

Awkward timing

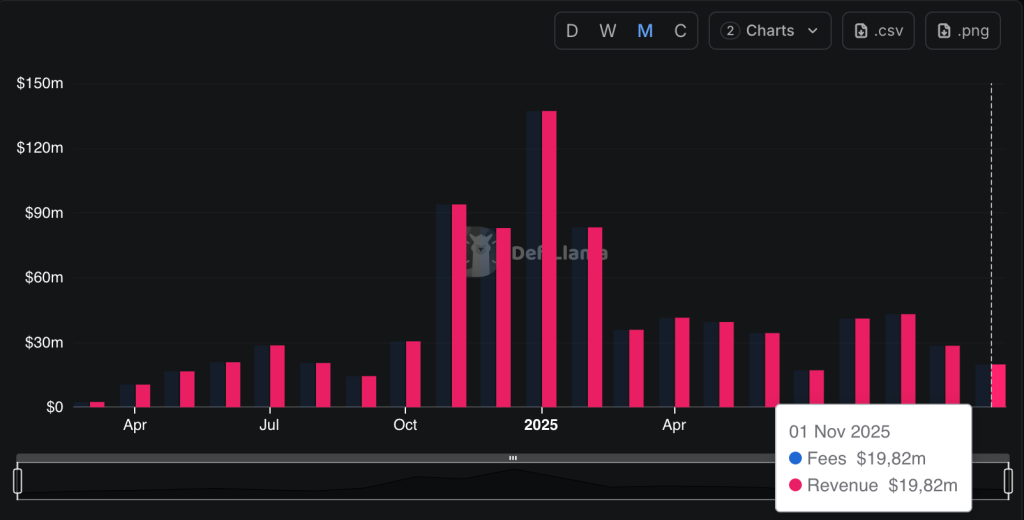

The movements coincided with a fall in Pump.fun’s monthly revenue, which has been declining for a second consecutive month. October totalled $28.4m, and partial November $19.8m.

By comparison, September revenue exceeded $43m.

Against this backdrop, community members mooted the possibility of asset sales by the team. EmberCN was among the proponents.

pump. fun (@Pumpfun) 项目方这是出金买大别野了吗🥹

最近一周时间里,pump. fun 项目方把 4.05 亿 USDC 转进了 Kraken。然后同期时间里 4.66 亿的 USDC 从 Kraken 转到 Circle (USDC 发行方),这很可能是进行了出金。

这些钱是 pump. fun 6 月份向机构私募销售 $PUMP… pic.twitter.com/16Z7GZ45XZ

— 余烬 (@EmberCN) November 24, 2025

“Is the Pump.fun team cashing out to buy a villa?” they joked.

Users reacted ambiguously to Sapijiju’s explanation. Some called his formulations evasive and said it only raised more questions.

“we’re not involved in the transactions between Kraken and Circle that you’re alleging us to be a part of.” then admits “What’s happening is a part of pump’s treasury management, where USDC from the $PUMP ICO” definitely didn’t just contradict yourself on a post you had 10 hrs to…

— voss (@onlyvoss) November 24, 2025

“First you deny involvement in transactions between Kraken and Circle, and then you explain it as ‘treasury management’ via moving ICO funds — that is a clear contradiction. After ten hours preparing the post, could such inconsistencies really not have been avoided?” one user wrote.

Another community member under the nickname EthSheepwhale fully rejected the founder’s arguments, accusing the team of “price manipulation via airdrops” and “incompetent management that led to the token falling below the ICO level”.

At the time of writing, PUMP trades at $0.0027 — 32% below its primary offering price of $0.004. The coin has also fallen by more than 70% from September’s peaks.

Supporters of Pump.fun took a more measured stance. A user under the pseudonym Matty.Sol said the platform has the right to manage ICO proceeds at its discretion.

Dismissal

DAO Gnosis, the organisation behind Safe, CoW Swap, Gnosis Chain and Gnosis Pay, voted to end its cooperation with treasury manager KPK (formerly Karpatkey). The decision was backed by 77% of the community.

GIP-143 passed on Snapshot ✅

➡️ Should the GnosisDAO terminate karpatkey Treasury Management Services?

Link to the proposal ⬇️https://t.co/hGkWX2cHoL pic.twitter.com/QTlm8xLRVD

— Gnosis (@gnosis_) November 24, 2025

The termination followed numerous complaints about high fees and unsatisfactory performance.

KPK charged 1% of assets under management and 20% of generated yield. Users also pointed to $700,000 in losses due to a misconfigured Balancer liquidity pool.

The former manager acknowledged communication problems, but noted that it reduced operating expenses from $6.3m in 2024 to $2.2m in 2025. The company also introduced a $2m cap on fees.

Questions over KPK’s effectiveness arose in other communities too. On Ethereum Name Service forums, participants stated that total returns did not even cover inflation.

Some also identified factual errors in the return calculations provided by the company.

In September, the DAO of the L2 solution Scroll paused operations after its leader resigned.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!