Analysts Reject Bitcoin Crash Forecast to $35 000

Analysts reject calls for a Bitcoin slide to $35,000; see support near $55,000.

Bitcoin will find a bottom around $55,000, says an analyst known as Sykodelic.

This is a very important chart analysis for you to understand.

I am seeing people talking about $35k levels next year and it’s absolute rubbish.

Firstly, for Bitcoin to retrace 75% it actually has to fully expand, and this cycle, it just did not do that.

Those kinds of… pic.twitter.com/VZp5aAdjXe

— Sykodelic 🔪 (@Sykodelic_) December 2, 2025

He rejected forecasts that the digital gold will drop to $35,000 by 2026. Earlier, crypto investor and trader Philakone had floated such a scenario.

It’s wild that people think this is impossible. That bitcoin can’t hit $35K to $40K before Dec 2026.

All bear markets have lasted roughly 365 days exactly from the top to the very bottom in 2014, 2018, and 2022.

All bear markets dropped 78% to 86%.

So how’s this not possible? pic.twitter.com/3zDG11xNke— Philakone (@PhilakoneCrypto) November 18, 2025

«It’s wild that people think this is impossible. That bitcoin can’t hit $35K to $40K before Dec 2026. All bear markets have lasted roughly 365 days exactly from the top to the very bottom in 2014, 2018, and 2022. All bear markets dropped 78% to 86%,» he noted.

A fall in bitcoin to $35,000 from current levels would imply a 72% correction. That has happened before: the asset plunged 77% from its $69,000 peak in November 2021 to $15,000 a year later.

Sykodelic calls such claims “absolute rubbish”. In his view, drawdowns that deep occur only when expansion — measured, for example, by the RSI — “creates the right conditions”.

He stressed that Bitcoin’s price has never pierced the lower bound of the monthly Bollinger Bands.

«If this advance is the weakest on record, why should the subsequent drop be the strongest? Essentially, if we are dealing with a proper bear market and the monthly candle closes below the middle [Bollinger] band, the maximum correction target would sit around $55,000,» he said.

Gloomy prospects

Traders are stepping up hedges, bracing for a slide toward $80,000 after the New Year holidays. Derive founder Nick Forster pointed to a shift in options market structure: skew has moved in favour of puts.

Markets nuked. Liquidity vanishing. Yearn hacked.

$990M liquidated. Vol surging. Skew collapsing.

Traders loading puts at $84K/$80K for December 26, 15% betting on sub-$80K BTC into 2026.

Macro pressure rising. Bottom not confirmed.

Check out our latest update:…

— Derive.xyz (@DeriveXYZ) December 2, 2025

«The concentration of open interest at the $84,000 and $80,000 strikes expiring on 26 December shows traders are actively insuring against further downside,» the expert said.

In his assessment, this derivatives set-up signals a high probability that bitcoin will enter 2026 below $80,000.

«There is no reason to think the drop is over. The market is preparing for elevated volatility: short-term indicators are leading long-term ones, which traditionally signals expectations of sharp price moves ahead of the New Year,» Forster concluded.

VALR exchange founder Farzam Ehsani says current market swings reveal “structural vulnerability”.

«A drop below $90,000 reflects a mix of fragile market architecture and depleted liquidity. Even a moderate macro shock can now trigger a disproportionate reaction because of insufficient order-book depth,» he explained in a comment to CoinDesk.

In his view, if current dynamics persist, bitcoin could test the $60,000–$65,000 range. However, at those levels large institutional players may return, seeing the correction as an accumulation opportunity, he added.

Current conditions

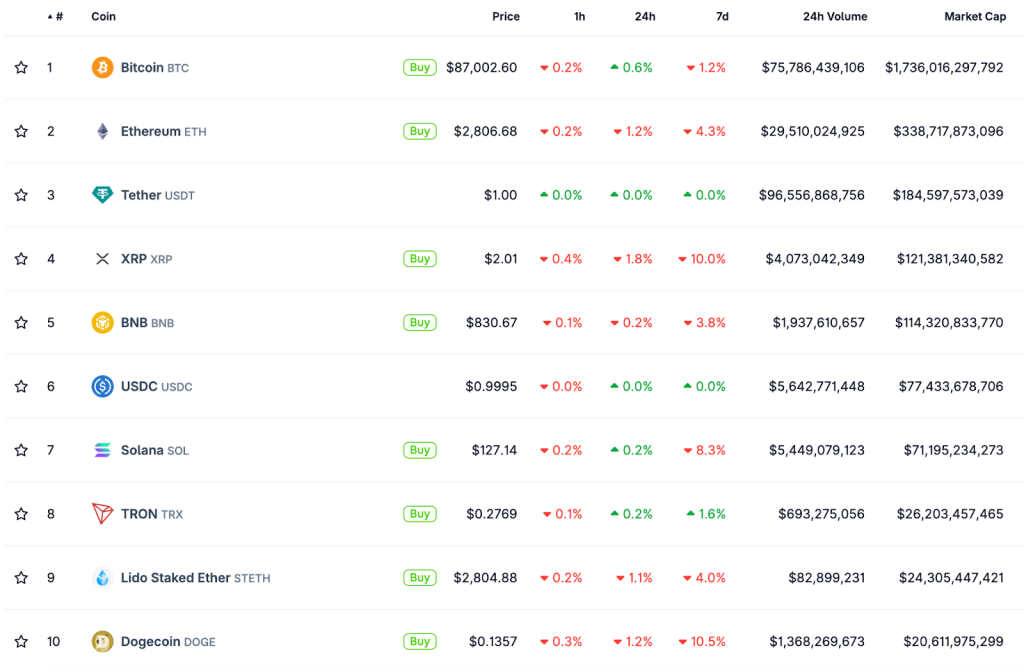

At the time of writing, the leading cryptocurrency trades around $86,900 — 30.9% below the all-time high of $126,080.

As prices fell, a popular sentiment gauge returned to the “extreme fear” zone.

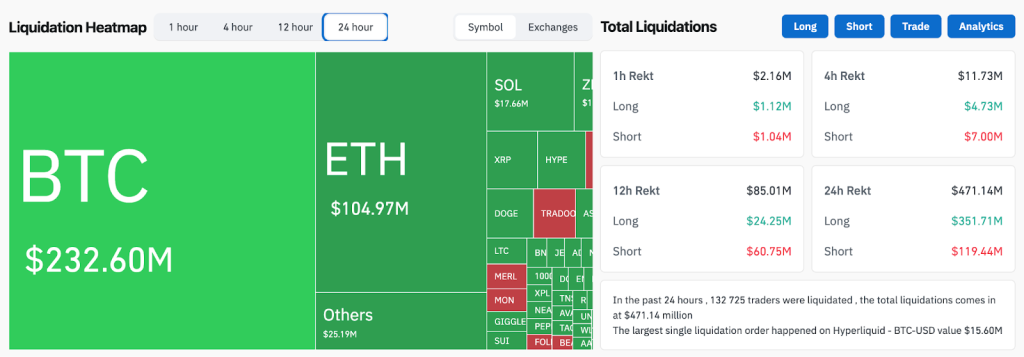

Liquidations over the past 24 hours totalled $471 million, $351 million of which were longs.

Almost all top-10 cryptoassets by market capitalisation showed muted moves.

In early December, economist Timothy Peterson noted a worrying similarity between bitcoin’s price action in the second half of this year and bear-phase trends in the previous cycle.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!