a16z: Stablecoins have taken crypto mainstream

Since January, stablecoin transactions reached $46 trillion

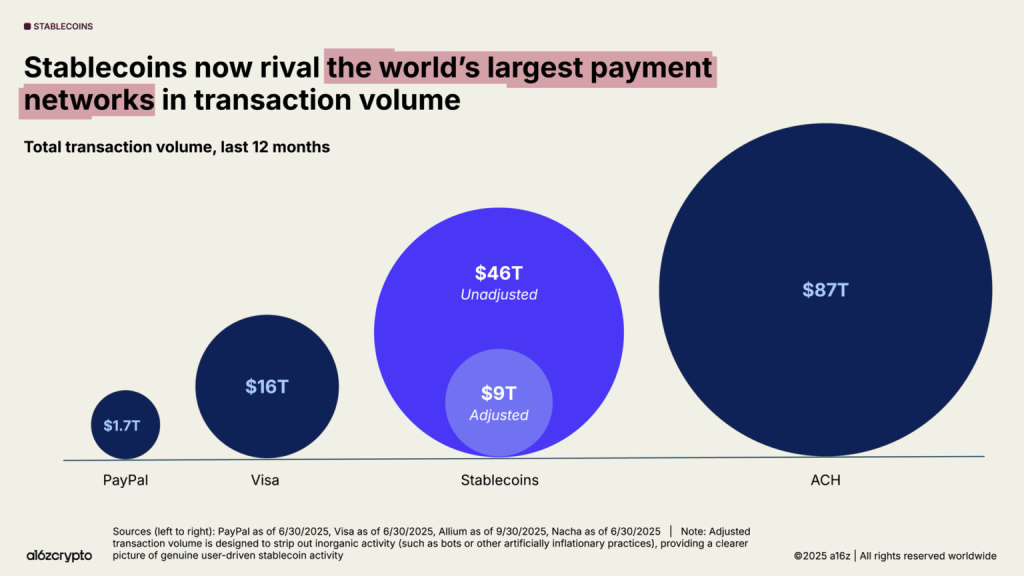

Since January, transactions with “stablecoins” have reached $46 trillion — 106% more than in the same period a year earlier. a16z Crypto analysts called the spread of stablecoins the clearest indicator of the crypto industry’s maturity.

Our latest State of Crypto report is here.

The main theme for the year is the maturation of the crypto industry:

• Traditional financial institutions and fintechs launched crypto products

• DeFi and stablecoins went mainstream

• Blockchains got faster and cheaper

• The… pic.twitter.com/xEZoO3AX5N— a16z crypto (@a16zcrypto) October 22, 2025

“Nothing signals the sector’s coming of age like the rise of fiat-pegged tokens. In previous years, they were used mainly to settle speculative crypto trades, but they have now become the fastest, cheapest and most global way to move dollars — in under one second and for less than one cent to almost anywhere in the world,” the report says.

Excluding bot activity and wash trading, stablecoin turnover totalled $9 trillion — almost half of Visa’s and five times that of PayPal.

Monthly volumes keep setting records — in September they reached $1.25 trillion.

Analysts stressed that activity barely correlated with overall crypto trading volumes. In their view, this confirms a shift from speculative to real-world use of stablecoins.

The sector’s total capitalisation has exceeded $300 billion. USDT and USDC account for 87% of the market. Some 64% of transactions are processed on the Ethereum and TRON networks.

Stablecoins “have become a significant macroeconomic force,” the analysts noted. More than 1% of the US dollar money supply now exists in the form of stablecoins.

Tether and Circle, the issuers, ranked 17th among the largest holders of US Treasuries, with more than $150 billion invested.

Analysts also noted that the number of active cryptocurrency users is 40–70 million worldwide — up by 10 million from 2024. In total, more than 716 million people own digital assets.

Earlier, Tether reported that USDT users had reached 500 million.

The world moves on-chain

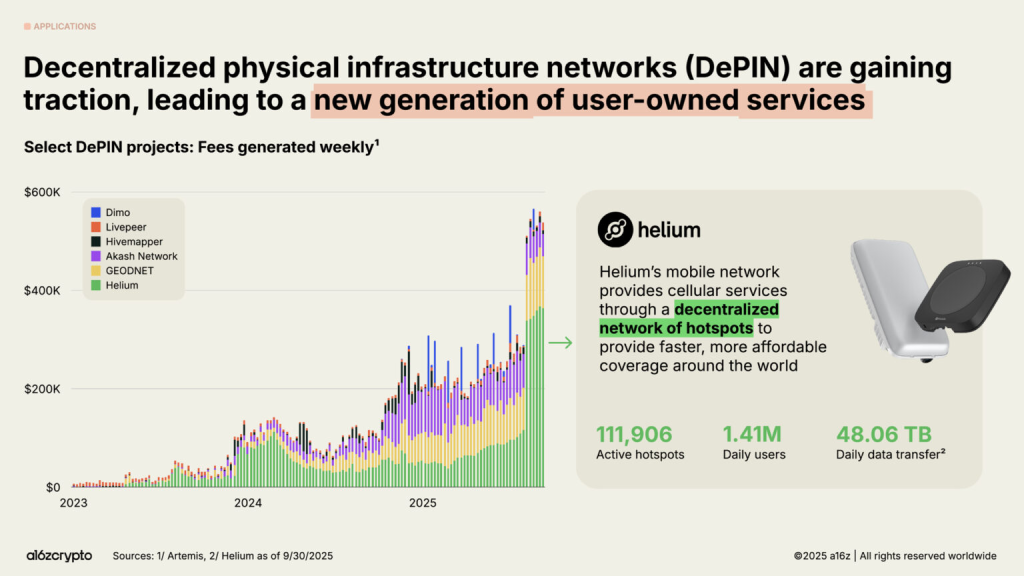

The global economy is shifting into the blockchain realm — from tokenised assets to decentralised physical infrastructure (DePIN).

“The on-chain economy has evolved from a niche playground for enthusiasts into a multi-faceted market with millions of monthly participants,” the a16z report says.

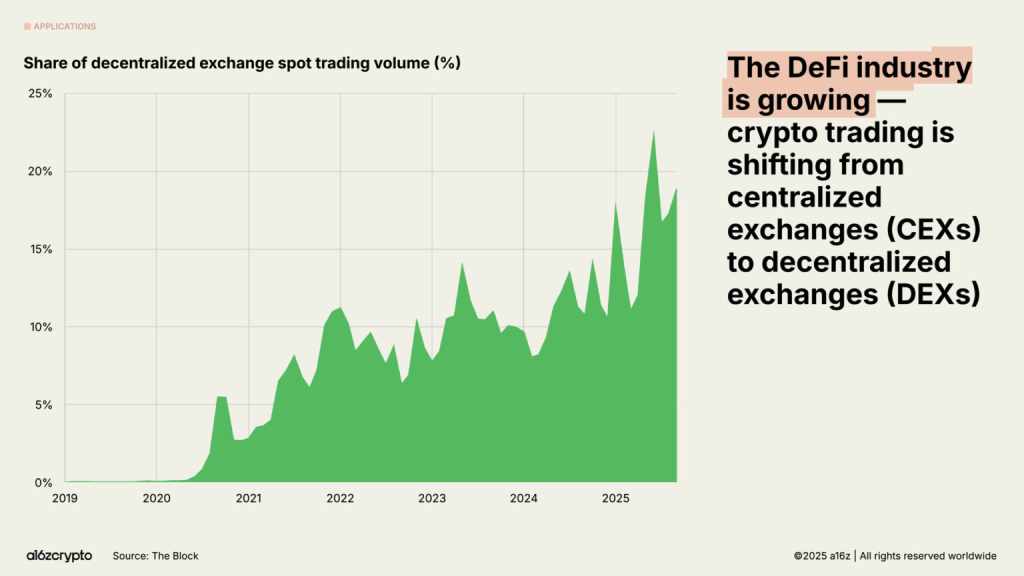

One in five spot trades now takes place on decentralized exchanges. Riding the popularity of Hyperliquid and Aster, volumes in perpetuals trading have risen eightfold over the year. Such platforms generate more than $1 billion a year, putting them in the same league as CEX.

The RWA market, a “bridge between cryptocurrencies and traditional finance,” has reached $30 billion — a fourfold rise in a year.

Analysts paid special attention to the rapid development of DePIN. As an example, they cited the Helium network, which provides 5G coverage for 1.4 million users through 111,000 hotspots. According to forecasts, by 2028 the sector’s capitalisation will grow to $3.5 trillion.

Institutional adoption is rising, too. A host of traditional-finance giants — Citigroup, JPMorgan, Mastercard and Visa — announced crypto products.

Exchange-traded funds based on cryptocurrencies have attracted $175 billion — up 169% year on year. Corporate treasuries have accumulated 4% of the total supply of bitcoin and Ethereum, launching a new trend in the industry.

Blockchains are ready for mass adoption

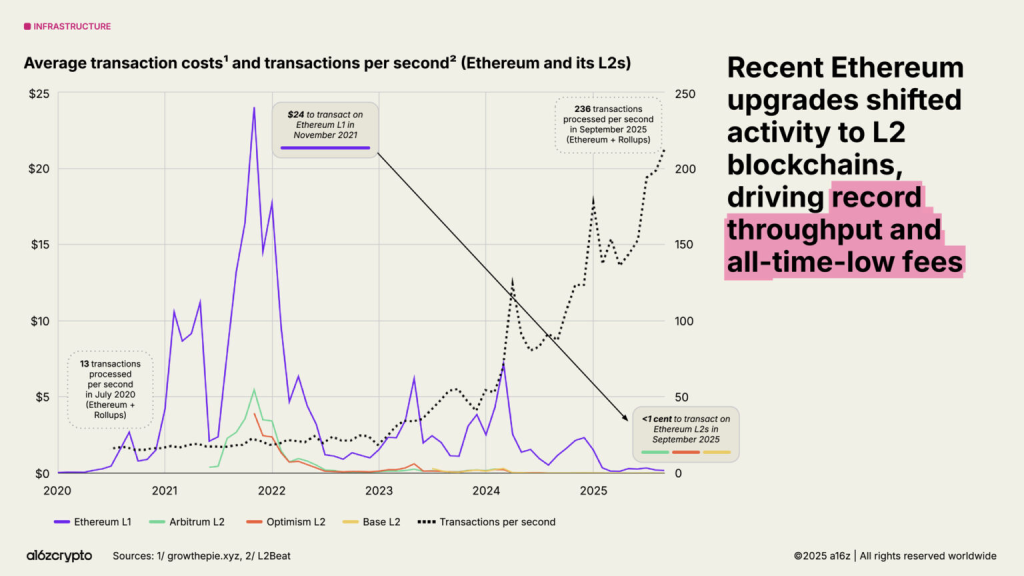

The throughput of major networks has increased 100-fold in five years — to 3,400 transactions per second. According to the experts, such progress makes blockchain infrastructure ready to meet global demand.

Current performance is comparable to Nasdaq’s processing on peak trading days, or Stripe’s global capacity on Black Friday. Meanwhile, transaction costs have fallen to historic lows: on layer-2 networks built on Ethereum, fees have dropped from $24 in 2021 to less than one cent now.

Analysts emphasised that privacy is back in focus. Related search queries spiked in 2025. This also explains the hype around Zcash and the Ethereum Foundation’s creation of a new privacy team.

In addition, they noted the rapid development of zero-knowledge systems, the shift of blockchains to post-quantum cryptography and the convergence of crypto with artificial intelligence.

In August, a16z specialists outlined a way to preserve privacy without compromising security.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!