Open Interest on Hyperliquid Reaches Record $790 Million

Open interest on Hyperliquid hits $793M amid TradFi trading surge.

A sharp increase in trading of TradFi instruments on user markets for perpetual contracts HIP-3 has elevated open interest (OI) on Hyperliquid to $793 million.

HIP-3 open interest reached an all-time high of $790M, driven recently by a surge in commodities trading.

HIP-3 OI has been hitting new ATHs each week. A month ago, HIP-3 OI was $260M.

— Hyperliquid (@HyperliquidX) January 26, 2026

“HIP-3 OI has been hitting new all-time highs each week. A month ago, it was $260 million,” the platform’s team noted.

HIP-3 is a mechanism for improving the Hyperliquid protocol, activated in mid-October 2025. The system allows developers to launch perpetual contracts on any asset. To do this, one must stake 500,000 HYPE.

The surge in activity on DEX coincided with a global rally in the precious metals market. This week, the price of gold surpassed the $5,000 per ounce level for the first time.

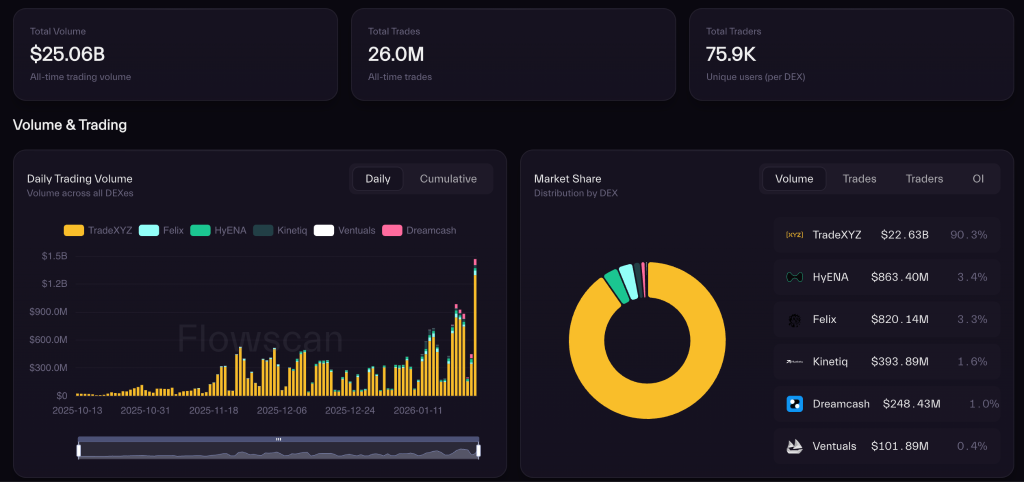

Since its launch, the cumulative trading volume within HIP-3 has exceeded $25 billion. The majority is attributed to the direction launched by TradeXYZ, a division of Hyperliquid responsible for RWA.

The largest markets currently are:

- XYZ100 — a composite index of the 100 largest public companies (turnover $12.7 billion);

- silver ($3 billion);

- Nvidia ($1.2 billion).

XYZ100 accounts for the highest open interest — $165.4 million, which is 20% of the total HIP-3 figure ($793.27 million).

The Most Liquid Platform

Hyperliquid co-founder Jeff Yan stated that the perp-DEX has become the most liquid platform in the world. According to him, the “order book depth” in the BTC/USDT pair has surpassed that of the Binance crypto exchange.

Hyperliquid has quietly achieved an important milestone of becoming the most liquid venue for crypto price discovery in the world. See below for side by side comparison of BTC perps on Binance (left) and Hyperliquid (right).

With HIP-3 teams leading the way, Hyperliquid has also… https://t.co/xu41eTqPfI pic.twitter.com/aJCFYjMoxV

— jeff.hl (@chameleon_jeff) January 26, 2026

Hyperliquid recorded a narrower spread — $1 for the Bitcoin perpetual contract. In comparison, on Binance, the equivalent spread at the same moment was about $5.5.

The cumulative sell order volume on Hyperliquid reached 140 BTC, whereas on Binance it did not exceed 80 BTC.

“Thanks to the teams working with HIP-3, we have also become the most liquid venue for perpetual contracts on traditional assets. Thank you all for your hard work as we modernize the financial system and bring all finance together in one place,” Yan noted.

Back in December, DeFi analyst Jordi warned of the risks of slashing and losses in new DEX markets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!