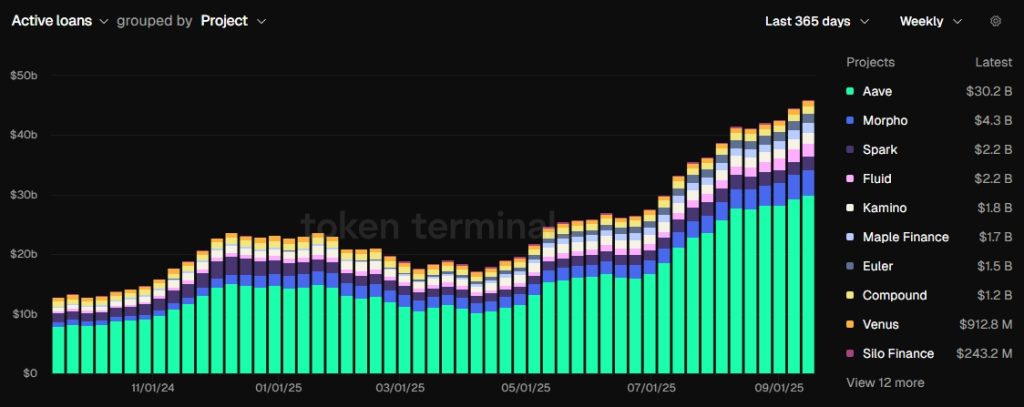

Active Loans on Aave Surpass $30 Billion

Active borrowings on Aave hit $30.2 billion, dominating with 65% market share.

The total value of active borrowings on the lending DeFi protocol Aave has reached $30.2 billion.

The project dominates the segment with a market share of approximately 65%. The second-ranking Morpho has a figure of $4.3 billion.

Aave also boasts a record TVL of $42.1 billion, according to DeFi Llama. This also places the platform in a leading position in the decentralized finance sector, albeit with a smaller margin: Lido’s volume reaches $38.4 billion, while EigenLayer’s is $19 billion.

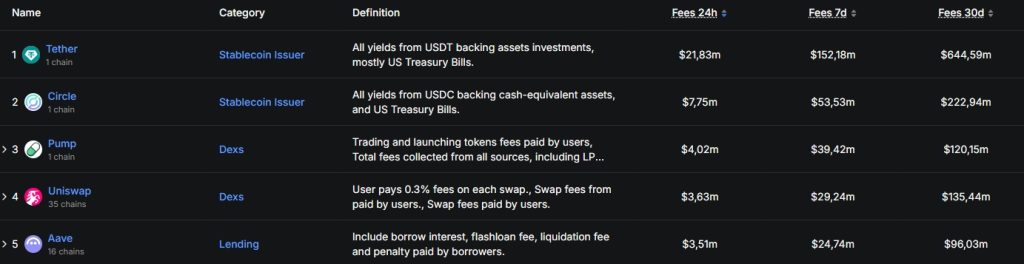

Over the past seven days, Aave earned $24.7 million in revenue. Its main components include interest payments, flash loan fees, liquidation fees, and penalties paid by borrowers.

Among DeFi protocols, the platform is surpassed in revenue only by decentralized exchanges Pump.Fun ($39.4 million) and Uniswap ($29.2 million).

However, all these platforms lag significantly behind the stablecoin issuer USDT — Tether — with a figure exceeding $152 million.

On September 15, Aave developers unveiled the roadmap for the deployment of the fourth version of the protocol during the fourth quarter of 2025.

Aave Labs just published the V4 launch roadmap 👻

It highlights milestones completed so far and the upcoming steps as Aave V4 progresses through its final stages of review, testing, and deployment. pic.twitter.com/N5EOlqNFJt

— Aave (@aave) September 15, 2025

They plan to launch a test network and publish the codebase soon. The updated interface is expected to allow the community and service providers to trial Aave v4 workflows before the public launch.

The upgrade aims to provide a more modular, efficient, and resilient protocol architecture, “expanding the space for future innovations.”

Back in August, fraudsters attacked Aave users through the Google Ads service.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!