Altseason index hits highest since late 2024

Altcoin Season Index rose from 67 to 78 in 24 hours.

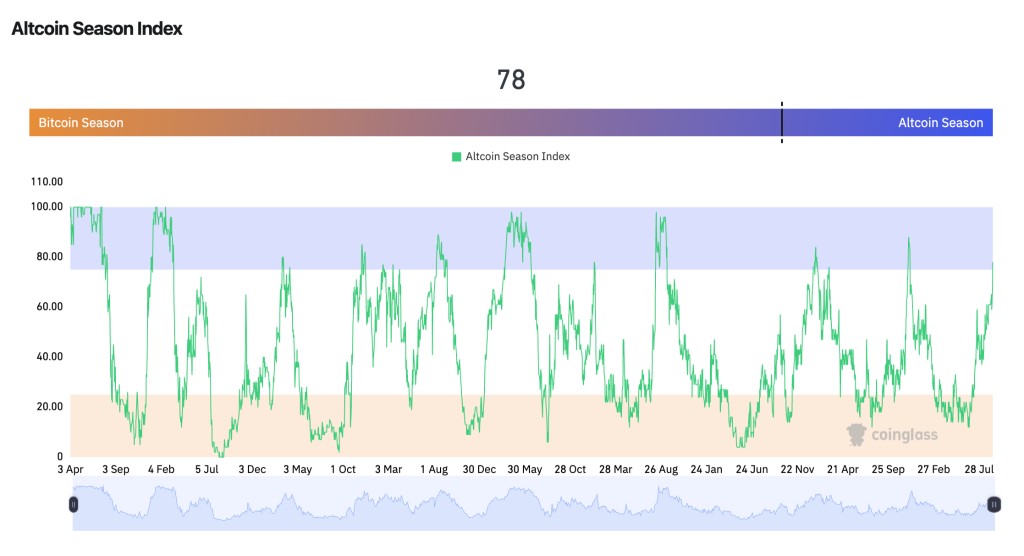

Key altcoin-market gauges have neared last year’s peaks. Over the past 24 hours the Altcoin Season Index from CoinGlass rose from 67 to 78.

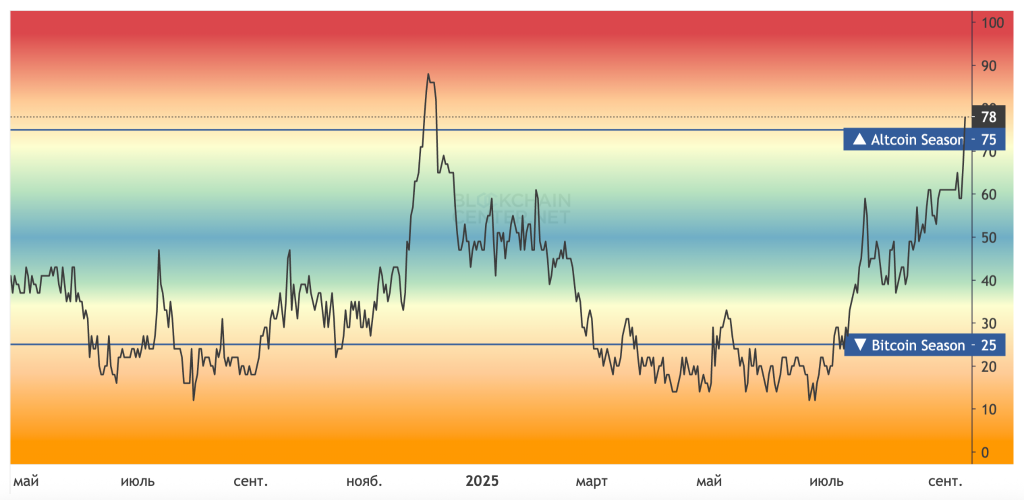

Blockchain Center’s altseason index shows a similar reading. By its criteria, to confirm the trend 75% of the top 100 cryptocurrencies by market capitalisation must outperform bitcoin over 90 days.

The gauges last reached such levels in December 2024, when the reading peaked at 88.

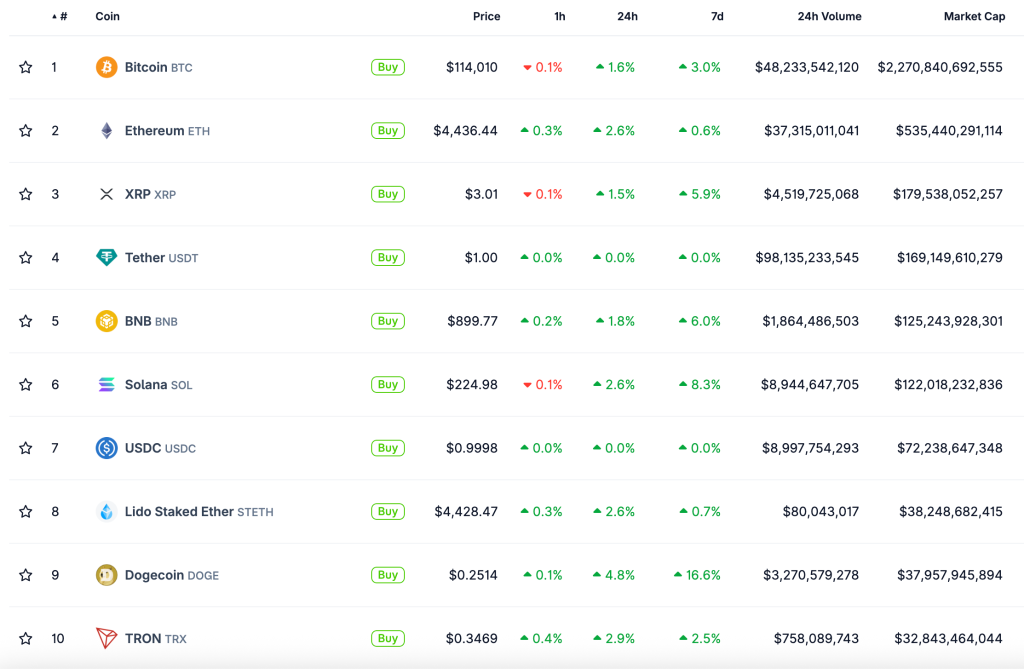

The altcoin sector’s market capitalisation has topped $1.8trn. The combined market value is 5.2% shy of its all-time high.

Over the past week most top-ten coins by market cap have outperformed bitcoin. The biggest gain came from the meme coin Dogecoin, which jumped 16.6% over the period.

What are market participants saying?

The crypto trader known as Daan Crypto Trades forecast that a rising altcoin market cap will trigger a new wave of excitement and increase demand for risk assets. This will also “help attract new investors”.

The Total Altcoin Market Cap has been knocking on the door of the 2021 all time high, which it has yet to break.

Once we do see the altcoin market as a whole back in price discovery, I expect that to kick off some wider excitement and risk on for alts. This will also help with… pic.twitter.com/gFncHkGOom

— Daan Crypto Trades (@DaanCrypto) September 10, 2025

However, everything will depend on US macroeconomic data and the Federal Reserve’s rate decision, he added.

The analyst using the pseudonym Ash Crypto said the current cycle comprised several mini-altseasons, but the sector is now primed for “parabolic growth”.

“The potential scale may exceed all expectations,” he noted.

Researcher Karan Singh Arora confirmed that traders are reverting to riskier strategies as the altseason index strengthens. In his view, current readings have reached multi-month highs, which traditionally signal a shift from bitcoin’s dominance to broad-based gains across the rest of the market.

𝗔𝗹𝘁𝘀𝗲𝗮𝘀𝗼𝗻 𝗜𝗻𝗱𝗲𝘅 𝗥𝗶𝘀𝗲𝘀 𝘁𝗼 𝟳𝟲 — 𝗛𝗶𝗴𝗵𝗲𝘀𝘁 𝗦𝗶𝗻𝗰𝗲 𝗗𝗲𝗰 𝟮𝟬𝟮𝟰 🚨

With the Altseason Index at its strongest reading in nine months, traders are beginning to lean risk-on again.

🔸 Strong $ETH breakout and outperforming $BTC

🔸 Alts rotating… pic.twitter.com/mwc24D47B1

— Karan Singh Arora (@thisisksa) September 11, 2025

Three key catalysts for Ethereum

According to Sygnum, since the Pectra upgrade in May this year, the price of the second-largest cryptocurrency has risen 140%. On 24 August it set a new all-time high at $4,946.

Analysts have repeatedly said that Ethereum is outpacing bitcoin.

Experts at the digital bank Sygnum highlighted three factors propelling ETH’s rally:

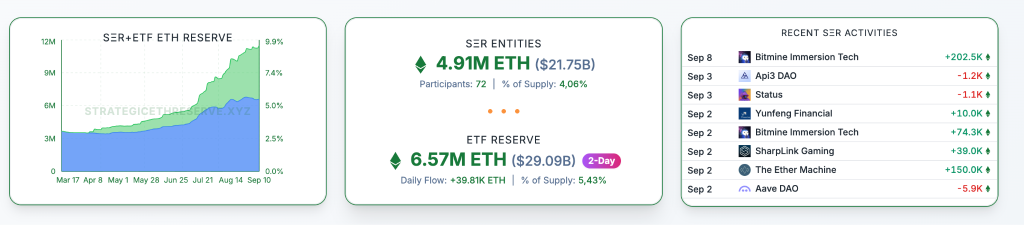

- supply shock: after Pectra went live, about 30% of Ethereum’s supply was taken out of circulation, creating scarcity;

- institutional demand: spot ETFs based on the asset have attracted $29bn, and corporate treasuries have accumulated tokens worth over $21bn;

- regulatory clarity: the SEC acknowledged that staking is not a securities offering.

“Unless the macroeconomic situation or regulators introduce unforeseen changes, Ethereum has every chance to continue rising in the current market cycle,” Sygnum emphasised.

At the time of writing the second-largest cryptocurrency trades around $4,500. Over the past 24 hours the asset has risen 2.8%, helped by positive US producer-inflation data.

Earlier, experts outlined market dynamics before and after the Federal Reserve meeting.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!