Analyst points to potential Bitcoin rally after breaking above $27,900

The price of Bitcoin is expected to see a substantial uptick if it holds above $27,900. The level corresponds to the MVRV indicator for short-term market participants, according to CryptoQuant analyst Maartunn.

The historical interaction between Bitcoin price and short-term holder realized price (cost basis) has been quite intriguing.

Currently, Bitcoin is steadily approaching this level (at $27,900), and I anticipate a significant price surge once it surpasses it. pic.twitter.com/L7TVOO7Jf3

— Maartunn (@JA_Maartun) October 8, 2023

The specialist drew attention to the historical linkage between the two metrics. After the price cleared resistance in the form of MVRV_STH, notable uptrends were observed.

Bitfinex analysts указали на продолжение снижения числа монет в распоряжении спекулянтов до минимума почти за восемь лет. Hodlers, by contrast, increased the number of coins in wallets to a new high.

«The gap has widened over the past couple of weeks. Many short-term holders have realised small profits or minimised losses as Bitcoin’s price returned to $28,500 [roughly in line with the average cost basis]» — they explained.

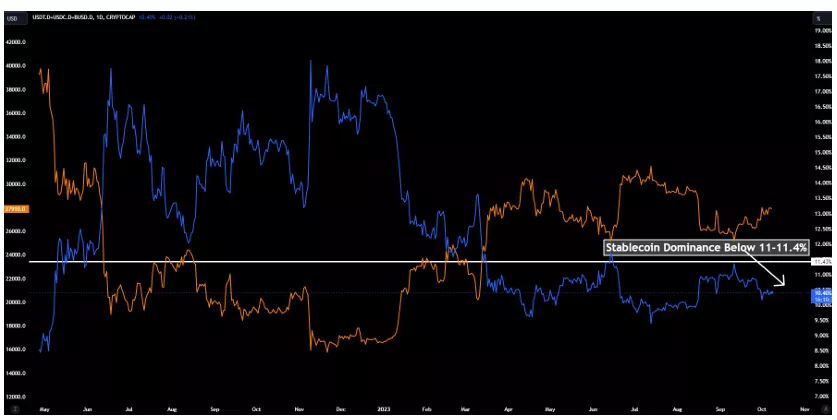

Experts examined various indicators of market cycles and concluded that digital gold has bottomed. One of them was the stablecoin dominance metric (their total market value relative to the market as a whole). The contraction of the supply of “stablecoins” indicates their conversion into digital assets, the analysts explained.

Currently the metric has fallen into the zone of 11–11.4%, which historically served as a signal of Bitcoin’s subsequent recovery. The signal is supported by the forecast increased volatility, according to specialists.

A potential rally driver could be the anticipated approval of SEC spot Bitcoin-ETF. Matrixport estimates that investors could funnel into the new product до $20-30 млрд.

Analysts emphasised that the current market capitalization of digital gold is equivalent to 10.8% of its physical counterpart. In exchange-traded funds, participants invested around ~$200 billion.

Experts also argued that Bitcoin carries no risk of confiscation relative to precious metals.

«Storing assets in bars has not only fallen out of fashion but also entails significant restrictions when crossing borders. The premier cryptocurrency offers a solution to this dilemma, enabling fast and relatively discreet movement of funds. Its primary role is to serve as a store of value, akin to gold, and a speculative financial asset» — the report states.

Earlier, BitMEX co-founder Arthur Hayes suggested that in 2024 the price of the first cryptocurrency would reach $70 000. He supported his forecast in part by the prospect of approval of spot Bitcoin-ETF.

Earlier, former BlackRock executive Steven Schoenfeld suggested that the SEC would approve the instrument within three to six months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!