Analyst predicts an ‘explosive’ Ethereum rally as supply dries up

Tom Lee and Arthur Hayes see ETH at $10,000 by year-end.

About 40% of the total supply of the world’s second-largest cryptocurrency is out of active circulation—an unprecedented level in Ethereum’s history, noted an analyst known as Crypto Gucci.

ETH’s supply is disappearing faster than ever 🔥

Over 40% of all $ETH is currently locked out of circulation and is continues to climb rapidly

Ethereum has never experienced a market cycle with all three supply vacuums active at once:

— DATs didn’t exist last cycle

— Spot ETFs… https://t.co/Y4FtW7Rmzg— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) October 14, 2025

“Ether is going through a cycle for the first time in which three liquidity-sapping forces are active at once,” he wrote.

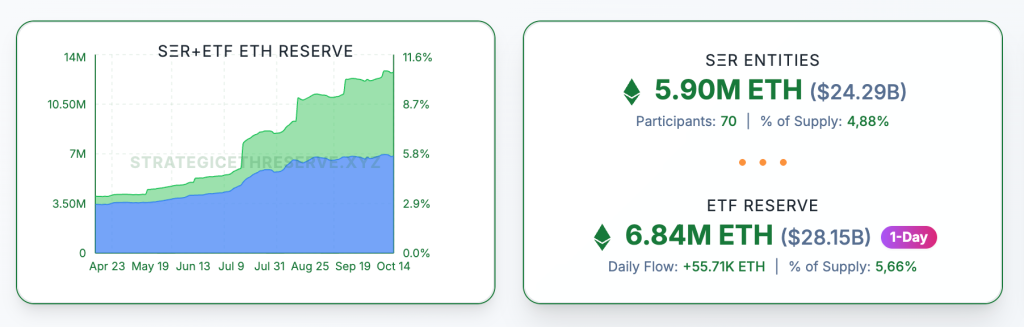

These include corporate treasuries (5.9m ETH) and spot ETFs (6.68m ETH), which were absent during the previous bull market. Together they account for 10.5% of Ethereum’s supply. The largest share is staking—48m coins, or 29.5% of the total.

The expert stressed that Ethereum has entered this cycle with record institutional demand and extremely low liquidity.

“When rising demand meets shrinking supply, the price does not just rise—it soars to the skies,” he added.

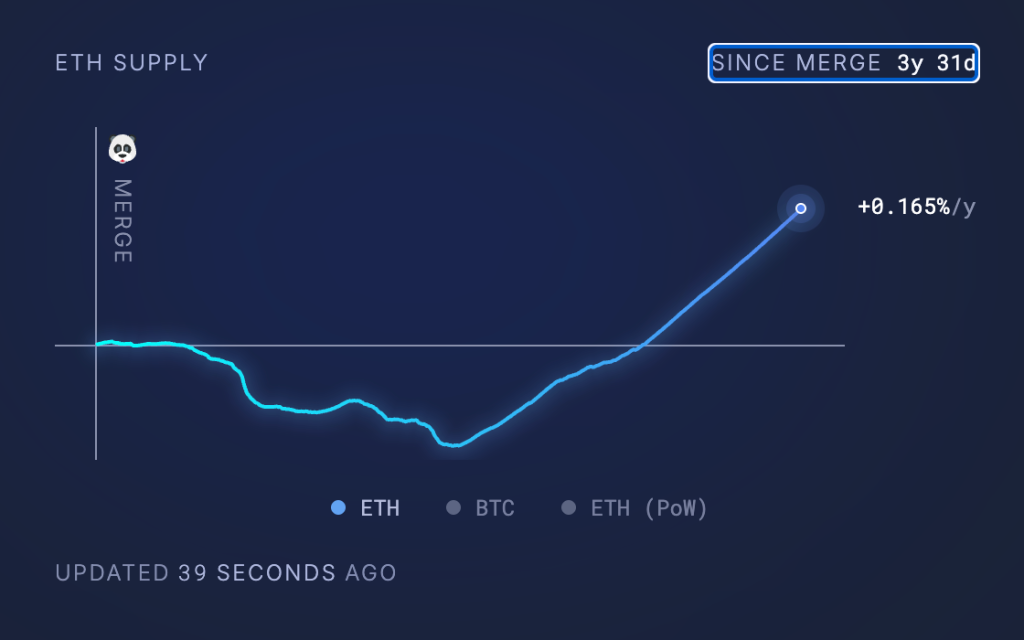

Since the network’s transition to Proof-of-Stake in 2022, the cryptocurrency’s supply has increased by 0.6%. By comparison, bitcoin’s supply rose by 4% over the same period.

Forecasts for Ethereum

Analyst Ted Pillows reckons that, thanks to institutional demand and the addition of staking to exchange-traded funds, Ethereum’s price could reach $8,000–10,000 by early 2026.

$ETH will catch up with the M2 supply in Q4.

The fair value of Ethereum is $8,000-$10,000 by Q1 2026.

With institutional bidding and staking approval, I think ETH will rally hard. pic.twitter.com/GWhdqetubr

— Ted (@TedPillows) October 13, 2025

BitMine chairman Tom Lee reaffirmed a $10,000 target for the second-largest cryptocurrency by the end of 2025.

“For Ethereum I expect a price in the range of $10,000 to $12,000,” he said on an episode of Bankless.

Also on the episode, BitMEX founder Arthur Hayes noted that he intends to “stay consistent”, so he, too, sticks to a $10,000 target.

Lee emphasised that such a rise would not be a sign of an overheated market. After peaking at $4,878 in 2021, he said, Ethereum has largely consolidated in a sideways trend.

“In essence, the asset was in an accumulation phase for all four years and only recently broke out of the range, so for me this is not a sign of a final top but rather an opening up of new price levels,” the expert explained.

The cryptocurrency approached its peak levels in August and set a new record of $4,946. At the time of writing the altcoin trades around $4,200.

MN Capital founder Michaël van de Poppe is also optimistic. During the drop on October 12th, he said, the ETH/BTC pair hit 0.032, which turned out to be an “ideal zone for buys”.

$ETH hit the ideal zone for buys and I think it’s ready for a trend switch.

What does it need?

A higher low and then we’re off towards new highs. pic.twitter.com/B0Ef0VCBVJ

— Michaël van de Poppe (@CryptoMichNL) October 14, 2025

“It needs to form a higher low, and then we are off towards new highs,” the analyst emphasised.

ETF inflows resume

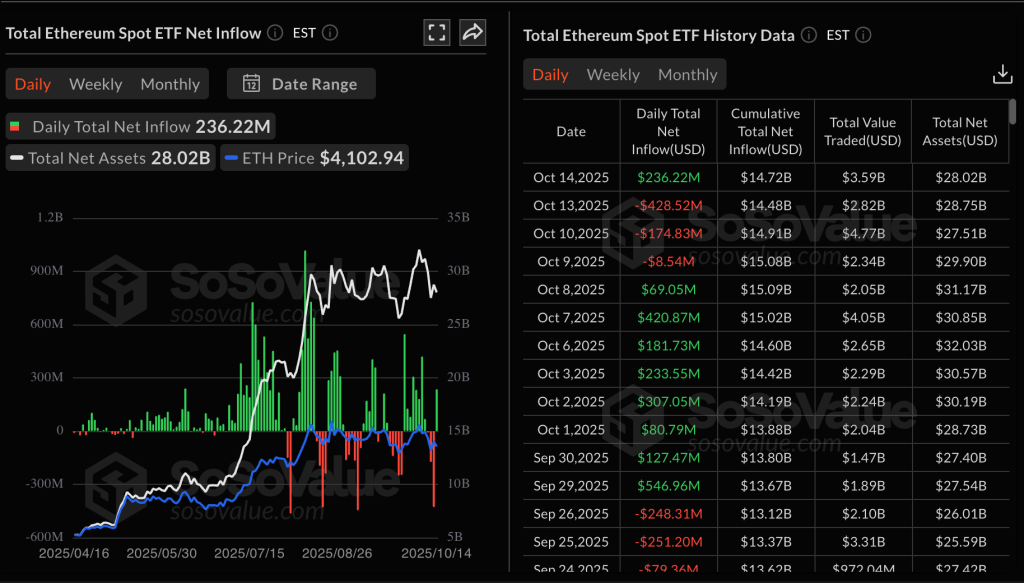

By the close on October 14th, spot Ethereum ETFs drew $236.22m. Fidelity’s FETH led with $154.62m.

At the start of the week, the instruments faced outflows totalling $183m amid one of the biggest market sell-offs.

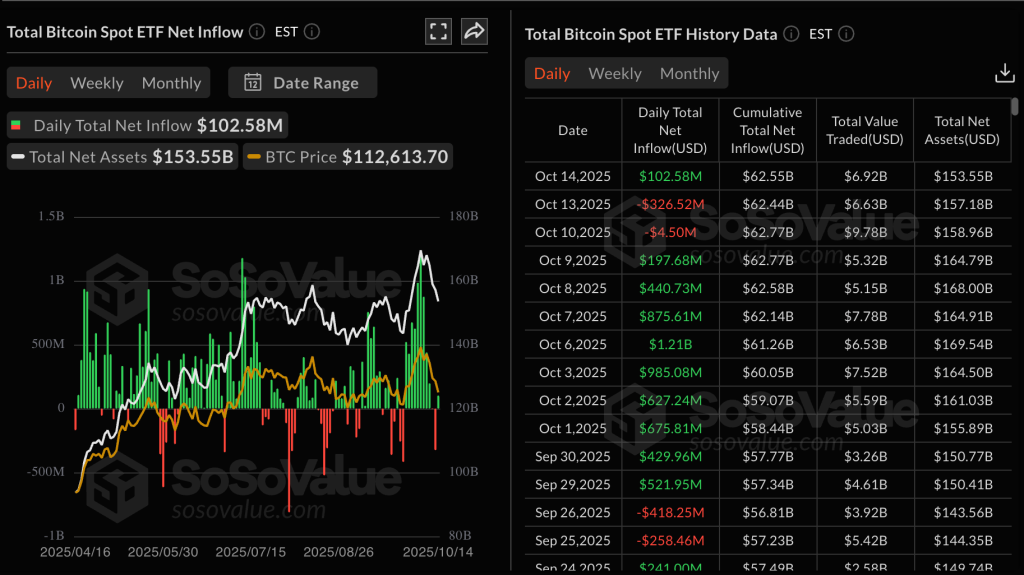

Spot bitcoin ETFs took in $102m after $330m had been withdrawn.

Earlier, the Kingdom of Bhutan announced it would move its national ID system to Ethereum. Full migration is expected by the first quarter of 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!