Crypto ETF Outflows Surpass $750 Million Following Major Liquidations

Crypto ETF outflows hit $755M post-liquidations; market awaits regulatory clarity.

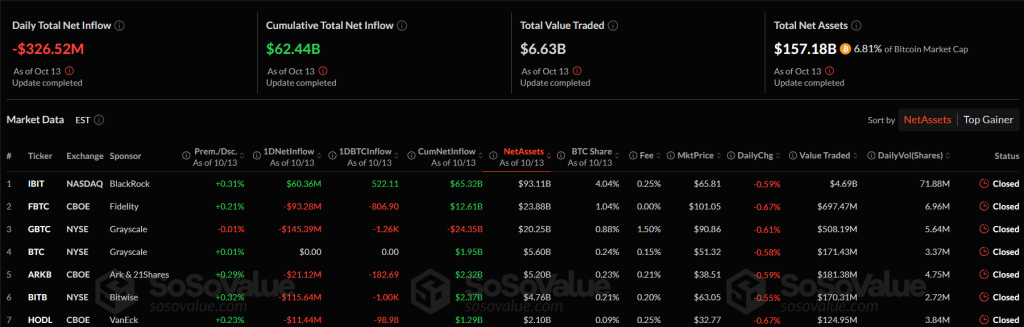

Net outflows from spot Bitcoin and Ethereum-ETFs in the United States reached $755 million on the first trading day after significant market liquidations. On October 13, $326.5 million was withdrawn from funds based on the leading cryptocurrency.

The largest outflows were recorded by Grayscale GBTC ($145.4 million) and Bitwise BITB ($115.64 million). The only fund with inflows was BlackRock’s IBIT, which attracted $60.36 million.

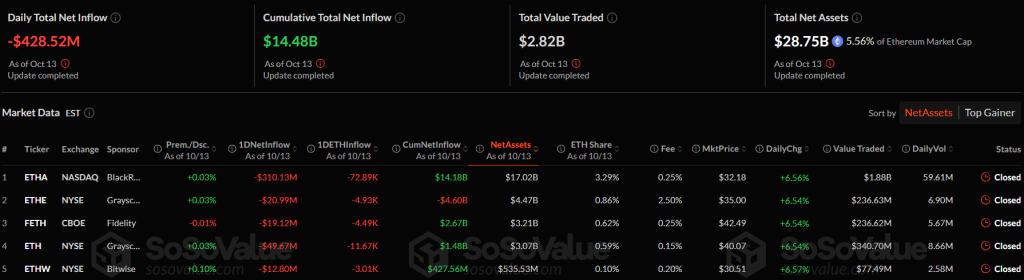

Ethereum ETFs fared worse, with total outflows reaching $428.5 million. The biggest decline was seen in BlackRock’s ETHA, which lost $310 million.

What Do Experts Say?

Analysts attributed the outflows to reactions following the market drop on October 11. This was triggered by a statement from U.S. President Donald Trump about potential 100% tariffs on Chinese goods.

“The outflows reflect caution after the liquidations. Investors are taking a pause, awaiting clear macroeconomic signals,” said Kronos Research CIO Vincent Liu.

Presto Research analyst Min Jun believes the events reflect “short-term risk management rather than a structural shift in sentiment.” He expects ETF capital flows to stabilize.

The market situation is further complicated by the temporary U.S. government shutdown. The SEC has delayed consideration of at least 16 applications for crypto ETFs, including funds based on Solana, XRP, and Dogecoin.

Bitget’s COO Vugar Usi Zade told ForkLog that the delay should not be seen as a decline in industry activity.

“We view the current situation as a temporary regulatory glitch. It has slowed the process but hasn’t changed the fundamental conditions for further market growth,” he noted.

According to the expert, once government operations resume, the market could see an “accelerated wave of approvals,” paving the way for institutional capital inflows.

A popular sentiment indicator remains in the “fear zone,” reflecting investor caution.

“Current market fluctuations offer investors a chance to adjust positions ahead of expected ETF inflows. Historically, periods of uncertainty often preceded growth,” emphasized the exchange representative.

Bitget believes that the approval of new ETFs could act as a catalyst for altcoin growth and support an upward market trend by the year’s end.

Earlier, from October 4 to 10, investors poured $3.17 billion into cryptocurrency investment products.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!