Analysts flag subdued enthusiasm among crypto fund clients

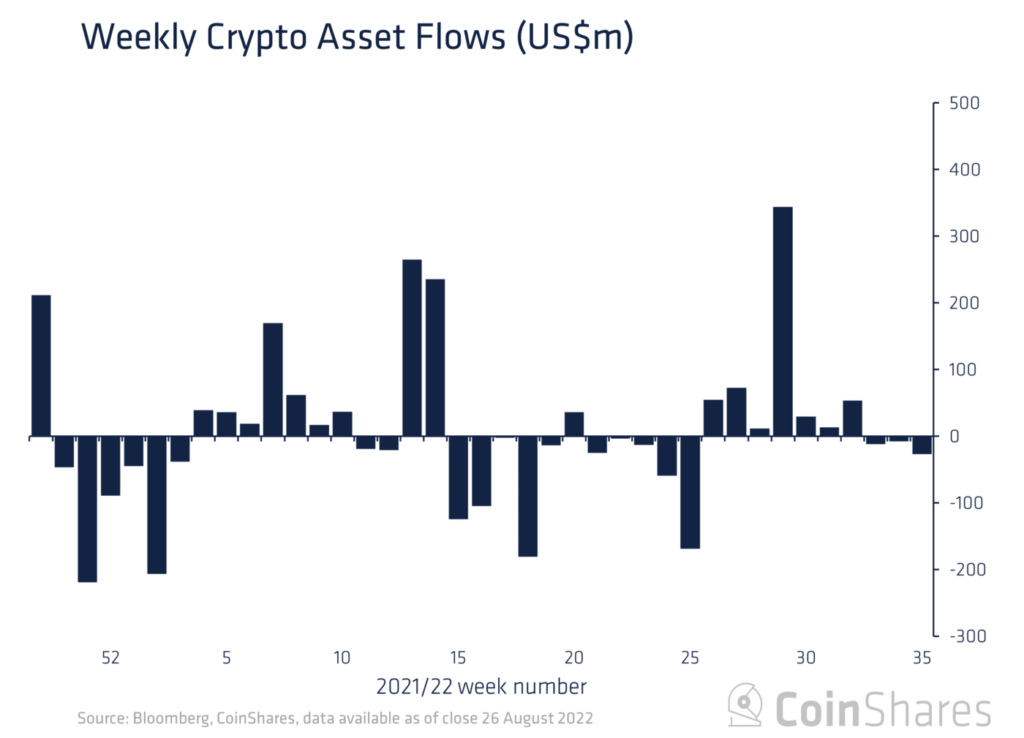

The turnover of cryptocurrency investment products for August 20–26 ($901 million) fell to the lowest level since October 2020, while outflows continued for the third straight week ($27 million). Such assessments came from CoinShares analysts.

«Although […] to some extent this dynamic is driven by seasonal effects, we also see signs of lingering apathy after the recent price drop. We believe that caution is linked to hawkish rhetoric of the Fed», — the analysts explained.

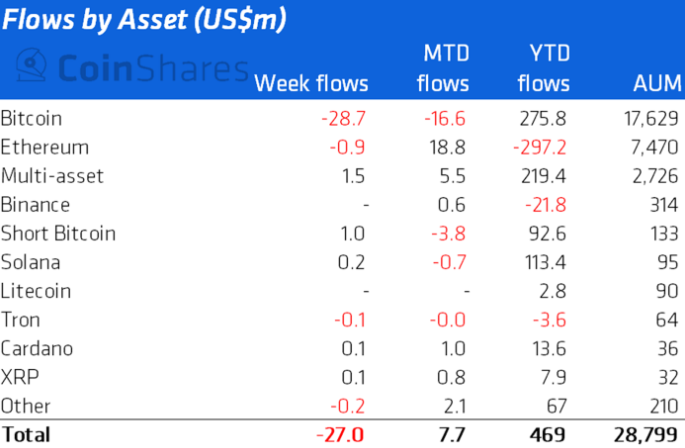

Traditional bitcoin funds saw outflows of $29 million. In products that allow shorting the first cryptocurrency, inflows of $1 million were recorded.

For the first time in the last ten weeks, Ethereum-based products posted outflows of $0.9 million. Funds based on other altcoins showed no notable changes.

Earlier, Peter Schiff, president of Euro Pacific Capital, predicted Bitcoin would fall to $10,000.

Earlier, Galaxy Digital head Mike Novogratz noted that he expects Bitcoin to stay in the $20,000–$30,000 range.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, rates and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!