Analysts Identify Three Drivers of the Altcoin Season

75% of the top 50 cryptocurrencies have outperformed Bitcoin in returns over the past 90 days.

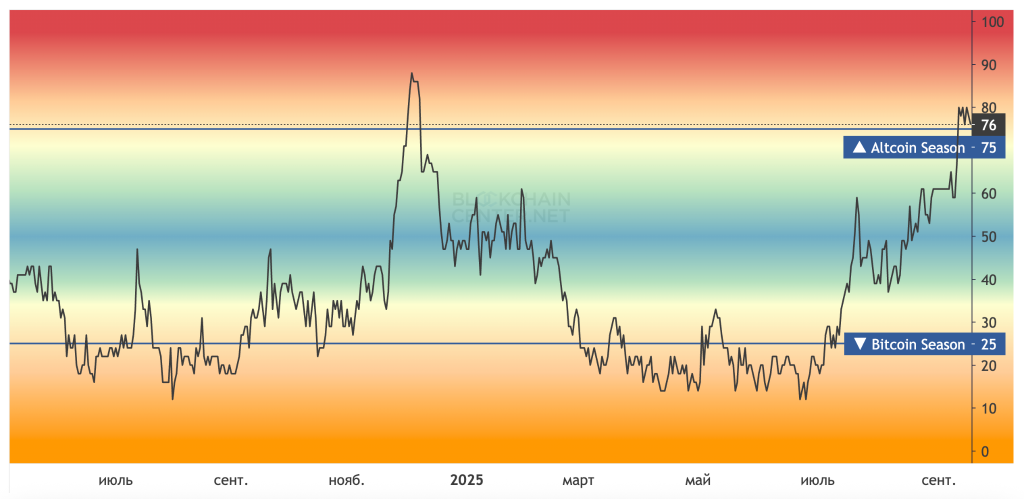

The altcoin growth period has officially begun: the altseason index has reached its highest level since late 2024. Experts have identified key growth factors for these coins, reports DLNews.

According to Blockchain Center, 75% of the top 50 cryptocurrencies have outperformed Bitcoin in returns over the past 90 days.

A similar trend is observed in the Altcoin Season Index chart from CoinGlass, which rose to 80 points on September 15.

In the past six months, Bitcoin’s market share has fallen by 6% to 58%. This decline traditionally signals the start of a period of active altcoin growth.

Forgd founder Shane Molidor explained that investors have begun rebalancing their portfolios in favor of “alternative” coins following the dominance of the first cryptocurrency at the start of the cycle.

The Fed’s Decision

The first driver of the altseason is the potential reduction of the key rate by the Fed on September 17. All market participants expect a loosening of monetary policy, which will add liquidity to the financial system and stimulate demand for high-risk assets.

Kyle Shass, founder of venture company MV global, noted that a rate cut of 0.5% instead of the expected 0.25% “could trigger a powerful and unexpected rally.”

Corporate Reserves

Molidor stated that as risk appetite grows, L2 tokens and ecosystem coins “with high TVL, trading volumes, and revenues will become prime candidates for inclusion in corporate reserves.” In his view, this will significantly increase demand for these assets and drive their growth.

“By issuing debt and purchasing crypto assets, companies create a self-sustaining dynamic of a reflexive flywheel for upward price momentum,” emphasized Derive’s head of research, Sean Dawson.

Annabelle Huang, founder of Altius, believes that the trend of public companies accumulating cryptocurrencies will continue. However, it will only affect “quality altcoins with sustainable revenues, proven economics, and healthy user metrics.”

Molidor clarified that Ethereum, Solana, and BNB meet these criteria.

Previously, Bloomberg exchange analyst James Seyffart stated the start of a “corporate” altseason. According to him, only those coins included in reserves by large companies will see growth.

Altcoin ETFs

The third catalyst identified by experts is regulatory clarity. Earlier, SEC Chairman SEC Paul Atkins stated that most tokens are not securities and called for unified rules for the crypto market.

The regulator is currently reviewing over 90 applications for spot ETFs based on various altcoins, including Solana, XRP, and Litecoin. Many believe that the approval of these instruments will be a bullish factor for the growth of the underlying cryptocurrencies.

Analysts at Bitfinex are confident that the growth period for “alternative” coins will not begin until new exchange-traded funds are approved.

Back in earlier reports, CryptoQuant author and on-chain analyst Timo Oinonen pointed to the end of the era of “mass altseasons.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!