Analysts point to continuation of Bitcoin’s detox phase

Bitcoin rose past the $20,000 psychological level. Hodlers remain resilient, underpinning a full market detox cycle, Glassnode analysts say.

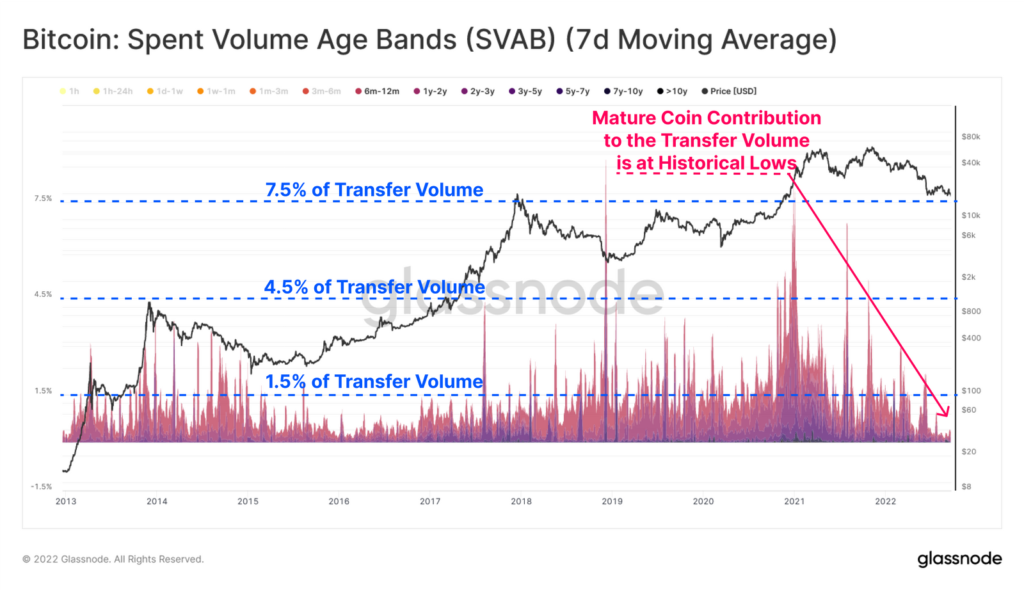

Experts examined the age bands of spent-value. Such analysis helps gauge the dominance of the “old hands” losing conviction in the viability of hodling.

The share of coins held for more than six months fell to 0.4%. At the height of the bull market in January 2021, the figure stood at 8%. On the basis of this dynamic, experts concluded that long-term investors remain faithful to their strategy, avoiding exits on any meaningful scale.

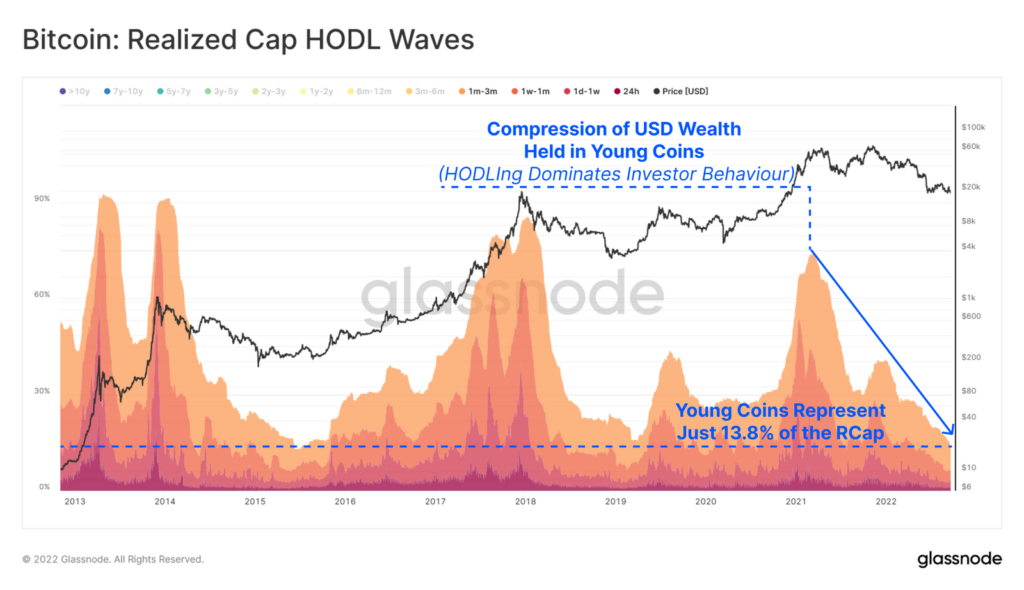

Such sentiment is corroborated by the realized-cap HODL-waves indicator. To date, the share of speculative wealth in Bitcoin, expressed in USD, has fallen to a historical low.

“Almost all market activity is concentrated in a specific cohort of young coins that have changed hands repeatedly. As supply grows, this could lead to a reduced available supply and a sharp price rise if demand strengthens,” — explained the analysts.

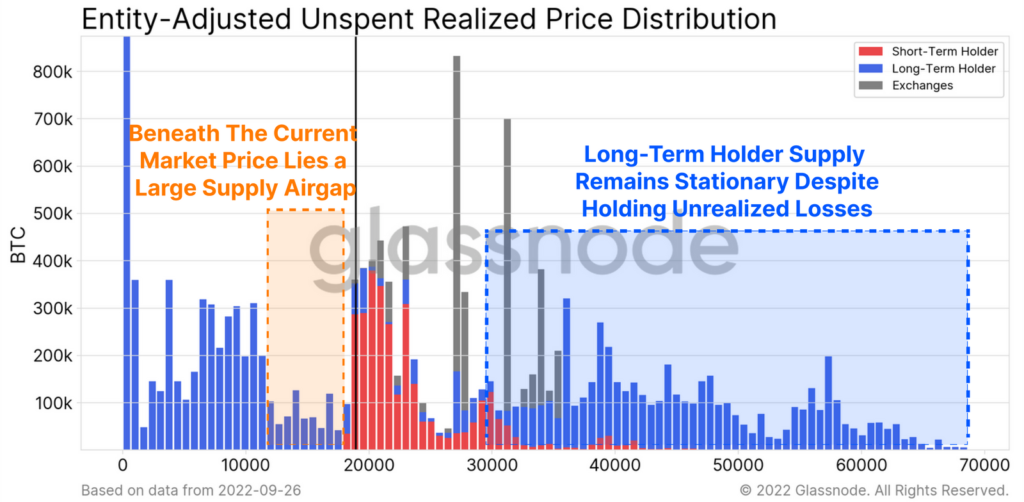

Experts also analysed the price distribution of coins among hodlers and speculators. The resulting picture led them to the following conclusions:

- Almost all coins purchased above $30,000 transition to long-term holding successfully. There is a low probability that they will be spent amid further volatility.

- Most of the spendable coins are concentrated near current prices. This reflects both the recent capitulation and an equally sized inflow of demand in the current price range of consolidation.

- In the range between $11,000–$12,000 and $18,000 there is little meaningful trading activity. A break of the current cycle’s minimum would lead to substantial unrealized losses among speculators. This, in turn, could trigger another broad capitulation.

Bitcoin crossed the $20,000 mark.

Earlier, the leading cryptocurrency reacted with a sharp correction to the Federal Reserve’s key rate hike.

Read ForkLog’s Bitcoin news in our Telegram — news on cryptocurrencies, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!