Fed raises policy rate; Bitcoin slides below $19,000

On Wednesday, 21 September, the U.S. Federal Reserve (Fed) raised the target range for its federal funds rate by 75 basis points, to 3–3.25%. The crypto market reacted with a drop.

“The central bank aims to achieve maximum employment and inflation at 2% in the long run,” the Fed said.

The Fed will also continue to shrink holdings of Treasuries and mortgage-backed securities, as well as agency debt. The Fed reiterated global economic headwinds.

Against the news, Bitcoin traded below $19,000. At one point, digital gold traded as low as $18,666.

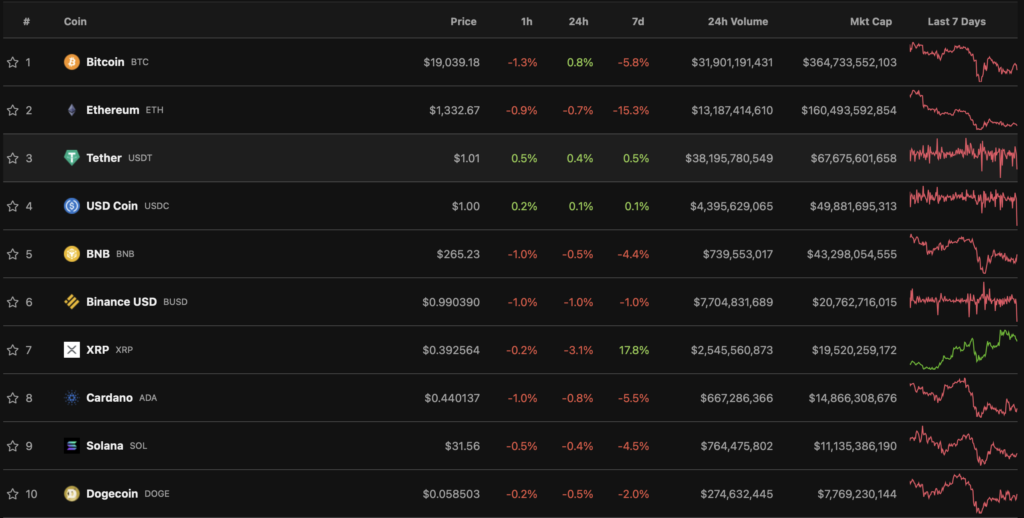

Most cryptocurrencies from top-10 by market cap were in the red zone. The biggest losses over the past 24 hours were XRP (-3.1%), Cardano (-0.8%), and Ethereum (-0.7%).

According to CoinMarketCap, the total market capitalization of cryptocurrencies stands at around $920 billion.

In March the Fed raised the target range for the federal funds rate to 0.25–0.5%. The local crypto rally continued through April — Bitcoin and Ethereum reached annual highs.

In May the Fed raised the rate again — by 50 bps. In the wake of the news Bitcoin breached the $40,000 mark, but on the same day fell below the $36,000 level, which started a prolonged correction.

In June the Fed raised the target range for the federal funds rate by 75 basis points for the first time since 1994. The reading reached 1.5–1.75%, and Bitcoin reacted with a brief rally to $22,000, after which it collapsed below $18,000.

In July the rate hike to 2.25–2.5% led to a rise in the crypto market. Bitcoin then breached $22,000, and Ethereum — $1,500.

In late summer the digital gold reacted to the remarks by Fed Chair Jerome Powell falling below the $21,000 level.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!