Analysts say bitcoin has entered the late, most fragile phase of the cycle

BRN sees a fragile late-cycle as whales pause and retail buys the dip.

Large holders of the leading cryptocurrency have slowed accumulation, while smaller investors have been buying the dip. BRN analysts called this “a classic late-cycle picture,” marked by heightened “fragility,” reports The Block.

Overnight on December 1, bitcoin fell below $85,500 after recovering to $91,000. At the time of writing, it trades around $86,400.

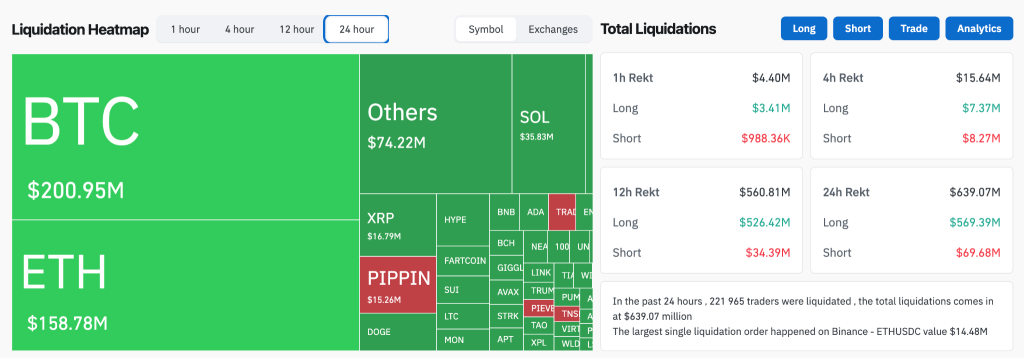

The sector’s market capitalisation slumped by $114bn to $3trn. Liquidations reached $638m, with most from longs—$569m.

BRN’s head of research, Timothy Missir, described the move as a classic “flush”, tied to liquidity and positioning.

“The market was not signalling a regime change — it was signalling stress,” the expert noted.

He said realised losses by short-term holders spiked during the sell-off, indicating an “emotional purge”. Exchange balances and inflows of stablecoins still point to buying power and potential sell-side liquidity.

What drove the correction?

The negative impulse originated in Asia. The night-time slide was a reaction to a string of adverse developments.

Analysts at QCP Capital noted that bitcoin’s drop was sparked by hawkish rhetoric from Bank of Japan governor Kazuo Ueda. His comments pushed two-year Japanese bond yields toward 1%, increasing the likelihood of a December rate hike.

Weak Chinese data compounded matters: the non-manufacturing purchasing managers’ index “contracted” for the first time in nearly three years. That intensified concerns about regional demand and the availability of global liquidity.

Sentiment also deteriorated after a statement by Strategy’s CEO Phong Le about a potential sale of bitcoin if the firm’s mNAV falls below 1. As of writing, it has 649,870 BTC worth $55.9bn under management.

According to QCP, the comments “triggered panic and forced liquidations of leveraged positions” ahead of a critical December period for the company’s index rebalancing.

Contradictions

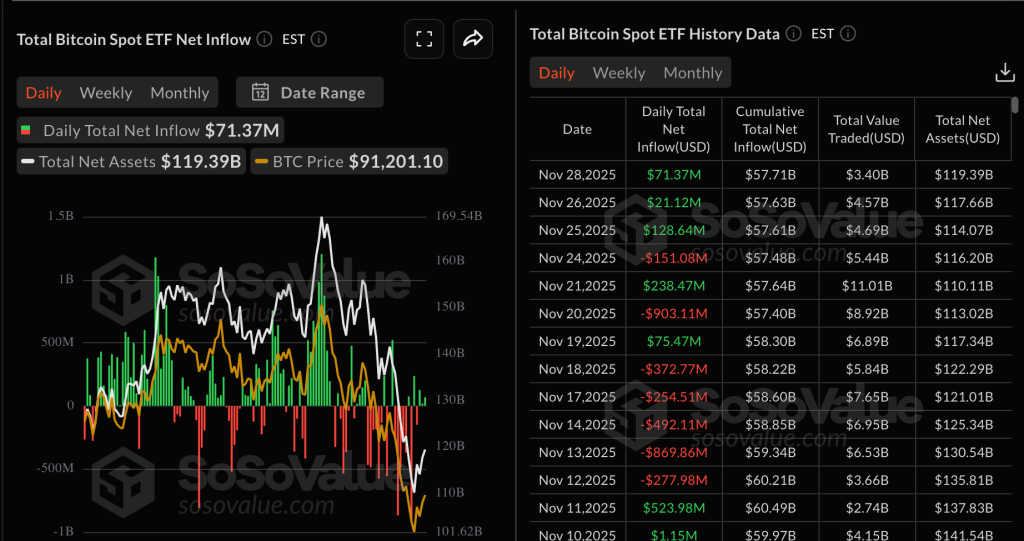

The current correction raises questions among analysts. Despite rising odds of a Fed rate cut and a return of inflows into spot bitcoin ETFs, market conditions remain mixed.

ETF inflows are especially notable against a record $3.5bn outflow in November — the worst since February.

The market ignored the positive signals. In QCP’s view, the pullback after a bounce from local lows was to be expected:

“The key question now is whether bitcoin can hold prior lows amid rising investor caution?”

What next?

Traders and investors are focused on US macro data: the PMI, ADP and JOLTS on the labour market, as well as the key PCE for inflation. According to Missir, these will determine whether the December 1 drop was “a capitulation moment or the start of a deeper downtrend.”

“Expect elevated volatility with sharp swings both ways. For stability to return, bitcoin must not only hold above $90,000, but also see confirmation in the form of sustained ETF inflows and positive on-chain metrics,” the analyst forecast.

David Brickell and Chris Mills of London Crypto Club warned traders about “choppy, unbounded ranges” in December. Liquidity stress “still lurks in the background,” they said.

Bloomberg Intelligence strategist Mike McGlone reaffirmed a $50,000 target, noting that current pressure on bitcoin could lead to a deeper correction.

In his view, further declines could be driven by a combination of factors:

- “natural market regression” towards the mean;

- a record rally in gold;

- artificially suppressed equity-market volatility;

- near-unlimited supply from altcoins.

Glassnode analysts called the $80,000–85,000 range (the average investor cost basis) a potentially resilient support zone. They said participants who opened positions recently are likely to defend that level against further downside.

Earlier, economist Timothy Peterson noted a worrying resemblance between bitcoin’s price action in the second half of this year and the bear-phase trends of the previous cycle.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!