ARK Invest and Glassnode present a framework to improve Bitcoin metrics

ARK Invest and Glassnode developed the Coinblock indicator, which “provides a better assessment of the dynamics of demand and supply for the first cryptocurrency (Bitcoin), as well as other indicators based on it.”

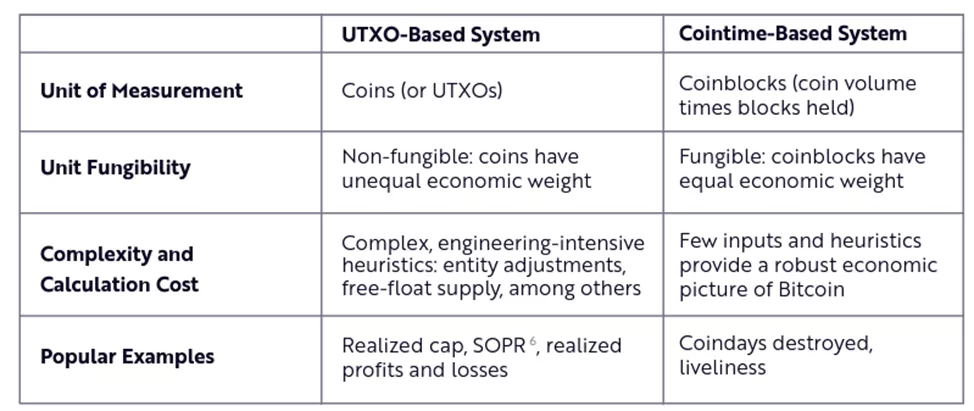

According to specialists, UTXO-based traditional solutions adjust the supply of digital gold using industry-standard heuristics, which are prone to inaccuracies.

The CoinTime Economics methodology with a Coinblock foundation provides “a more accurate picture of the real economic weight of each Bitcoin in the network.” The toolkit complements the traditional on-chain analysis framework.

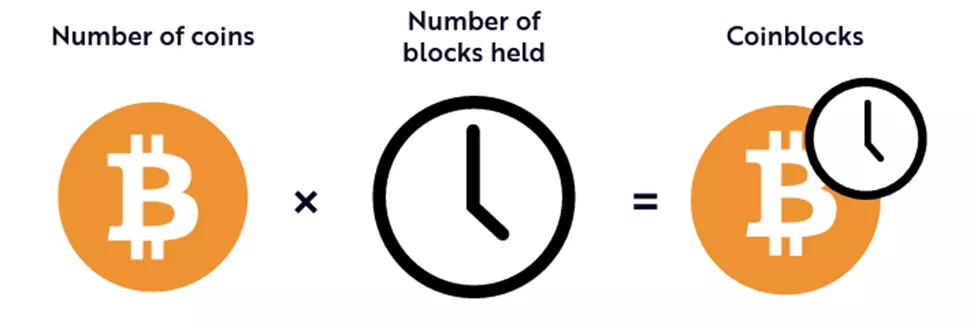

Coinblock takes into account the number of blocks formed during the period in which the coins remained unmoved.

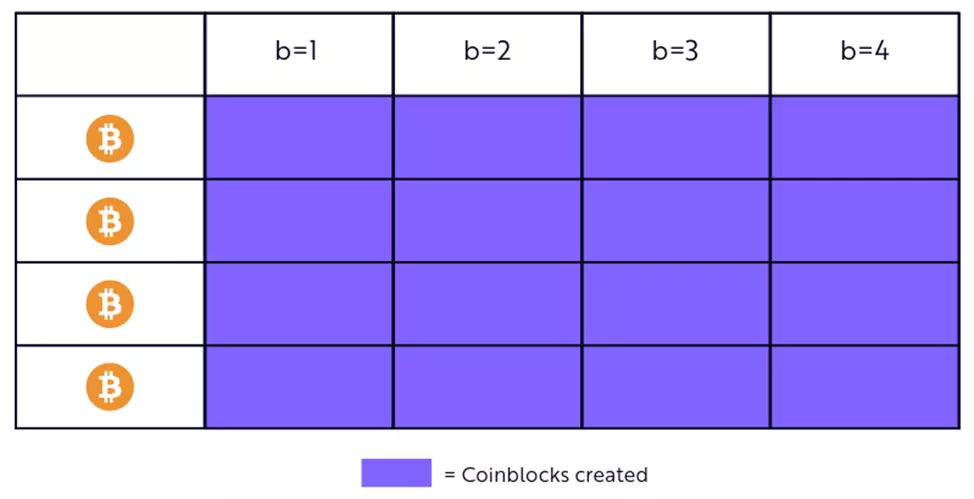

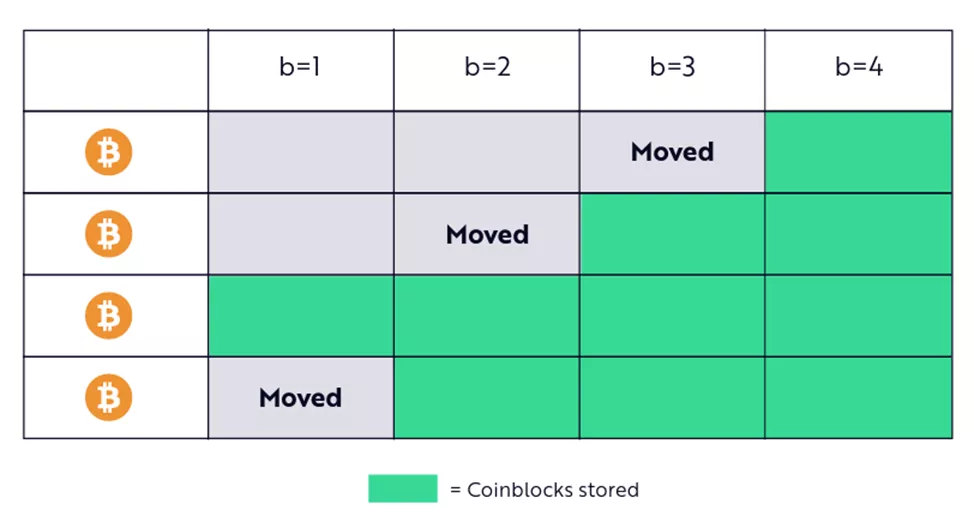

For example, if four coins are in circulation during a period of four blocks, they would generate 16 Coinblocks, as shown below.

Since the network produces a block roughly every 10 minutes, one coin generates approximately 144 Coinblocks per day: 6 blocks per hour multiplied by 24 hours (a day).

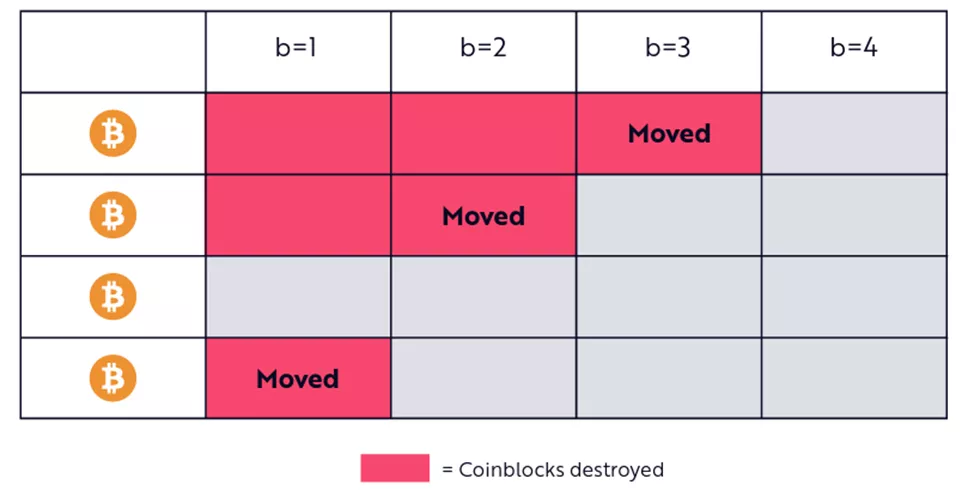

Another metric, Coinblocks Destroyed (CBD) or Coindays Destroyed (CDD) measures Bitcoin’s velocity: the volume, or the number of coins moved over a given period, and the holding period, or the time to transaction.

Every transfer of coins “destroys” all accumulated Coinblocks up to that moment, resetting Cointime to zero. This distinguishes the scenario from the UTXO model, which assigns the same weight to each Bitcoin regardless of when it last moved.

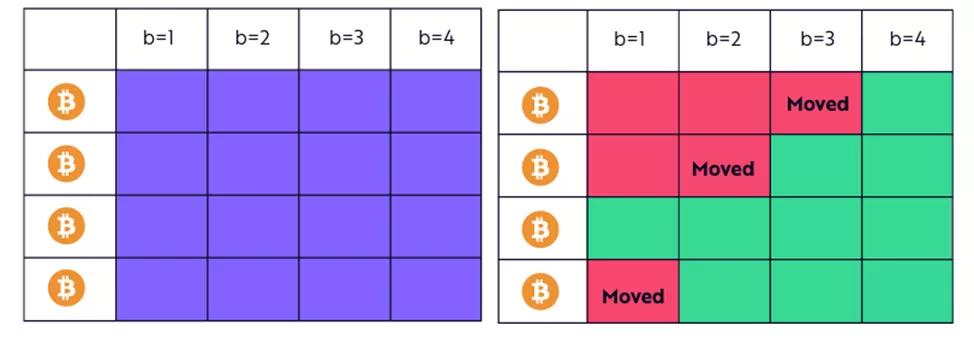

In the example below, among the 16 Coinblocks created, after moving three coins on blocks 1, 2 and 3, six Coinblocks were “destroyed,” according to the CBD definition.

A broad narrowing of Coinblocks suggests hodlers are selling. “Smart money” typically keeps large balances and trades coins at low costs, delivering higher profits and exerting a deep economic impact. In other words, large spikes in destroyed Coinblocks have correlated with Bitcoin’s price peaks.

The Coinblocks Stored (CBS) metric represents the difference between Coinblocks and CBD. The economic value of these coins is high because they belong to early Bitcoin adopters and are typically held at a profit.

In the example below, when 6 of the total 16 created Coinblocks are destroyed, 10 Coinblocks remain held:

The overall picture looks like this: 16 Coinblocks were created, six were “destroyed” and ten “remained.”

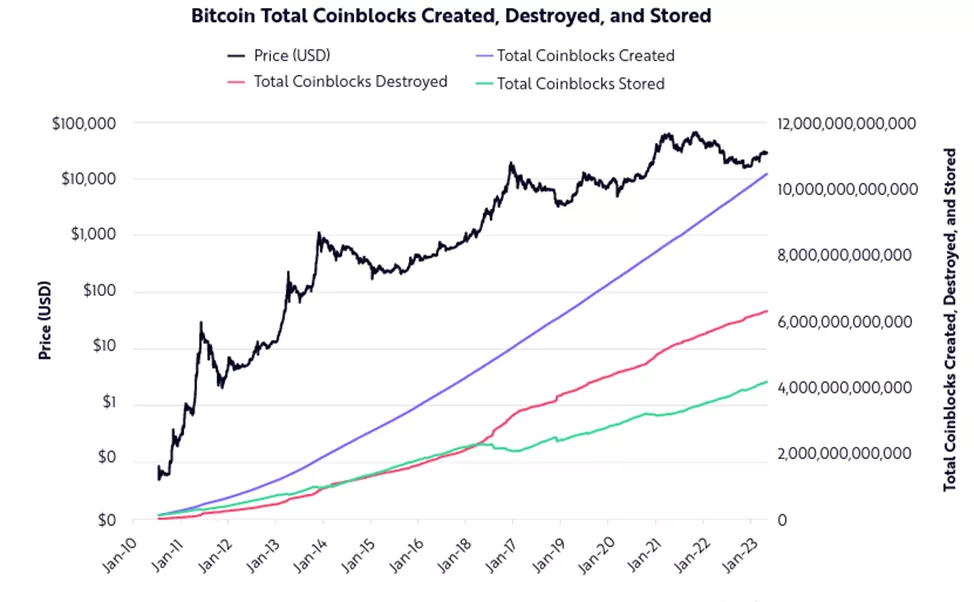

The diagram below shows the dynamics of the CoinTime components over time.

“Cointime provides a more accurate version of MVRV, Bitcoin inflation, volumes, and time-weighted cost basis,” the experts noted.

In particular, the CoinTime-adjusted inflation rate stood at 2.48% versus the traditional 1.64% (as of 7 May 2023).

In June, ARK Invest reported that the volume of the first cryptocurrency that had remained unmoved for more than a year reached a historical maximum of 70% of the coin’s total circulating supply.

Later, experts from Glassnode raised this figure to 75%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!