Assets in cryptocurrency funds fall to February 2021 levels

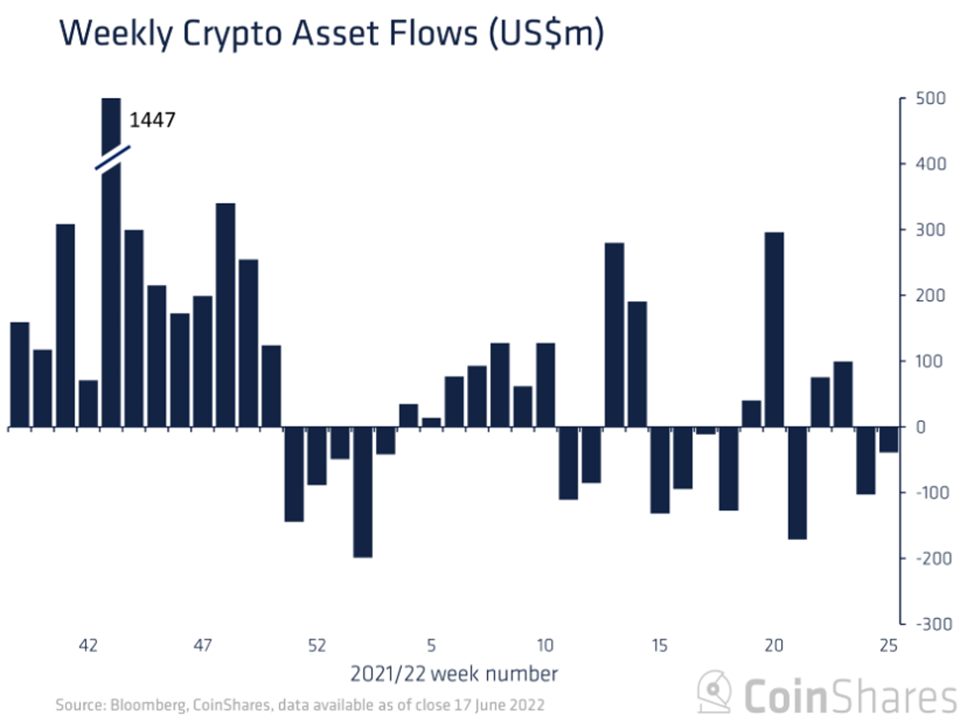

Outflows from cryptocurrency investment products for the period June 11-17 totaled $38.6 million. Analysts at CoinShares.

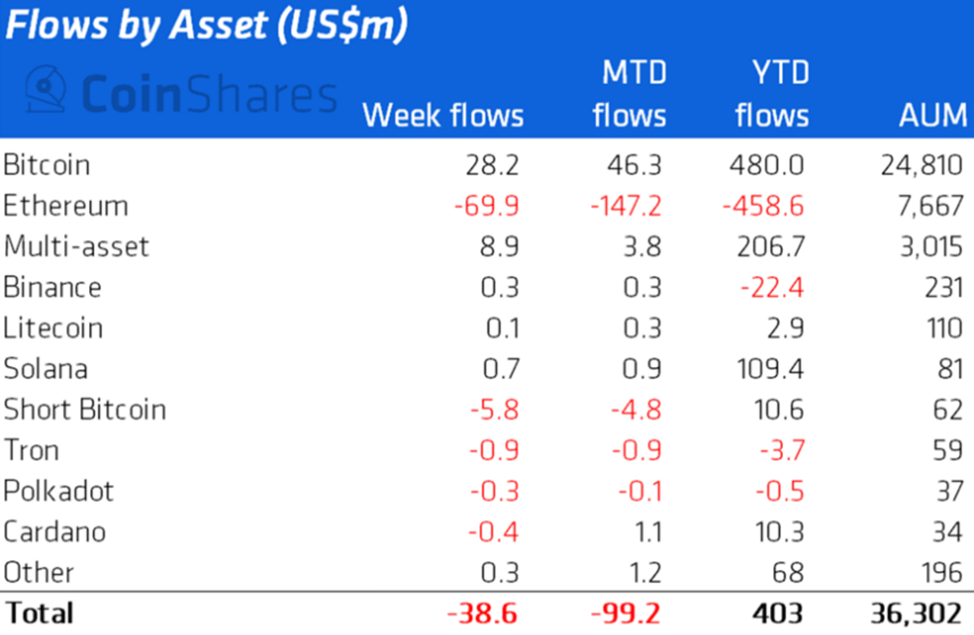

AUM fell to $36 billion. From its peak in November 2021, the figure has dropped 59%.

Compared with the previous week’s figure ($108 million), the pace of outflows slowed by almost a third.

Experts pointed to a record outflow from Bitcoin-based bearish funds, $5.8 million, which could signal that the downside momentum is nearing its apex.

Ethereum funds were the main driver of the negative momentum. Over the last seven days, outflows from them totaled $69.9 million and $458.6 million — since the start of the year.

Similarly, funds based on Bitcoin attracted about $480 million year-to-date, including $28.2 million in the last week.

Investor interest in multi-asset products remains. Inflows to them over the week rose by $8.9 million, since the start of the year by $206.7 million.

Altcoins showed a mixed picture. Increases were recorded in funds based on Litecoin, BNB and Solana; decreases in Cardano, Polkadot and Tron.

Earlier, Peter Schiff doubted Bitcoin would dip below $20,000.

Earlier, Jeffrey Gundlach admitted that Bitcoin could fall to the $10,000 level.

Follow ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!