Australia’s Stock Exchange to Launch First Spot Bitcoin ETF

On June 20, the Australian Stock Exchange (ASX) will witness the debut of its first spot Bitcoin ETF. The product from VanEck has been approved for trading, while applications from other issuers are still under review, according to Bloomberg.

BetaShares Holdings Pty and DigitalX Ltd are awaiting approval. A representative from the former informed the agency that they anticipate the registration of instruments based on digital gold and Ethereum “in the near future.”

Bloomberg noted that the first series of Bitcoin funds was listed two years ago on CBOE Australia. These did not invest directly in the leading cryptocurrency and experienced varying degrees of success.

“It remains unclear whether the higher credibility of ASX, along with the rally of the largest digital asset over the past year, will lead to wider adoption,” journalists remarked.

On June 4, trading began for the BTC-ETF from Monochrome Asset Management (IBIT) on CBOE Australia after the issuer received an AFS license from the Australian Securities and Investments Commission.

The start of IBTC trading occurred roughly a month after the launch of four spot BTC-ETFs in Hong Kong.

Earlier, Bloomberg reported that ASX might commence trading spot exchange-traded funds based on Bitcoin by the end of 2024. The platform is several times larger than CBOE Australia, leading issuers of new instruments to hope for significantly larger inflows.

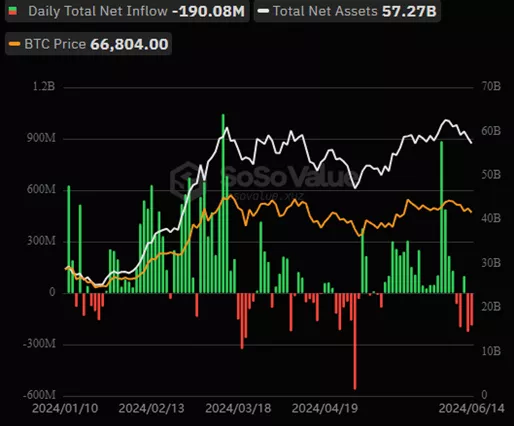

On June 14, outflows from spot BTC-ETFs in the US amounted to $190 million. Cumulative inflows since the approval of the products have fallen to $15.11 billion.

According to Glassnode, the implementation of a strategy based on the price difference between spot and derivative markets is restraining buyer pressure in Bitcoin-based exchange-traded funds.

Previously, K33 Research noted that the current situation with BTC-ETFs reflects demand rather than arbitrage between spot and futures markets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!