Binance Kazakhstan chief on bank deals, crypto cards, and the impact of the CFTC allegations on the business

In October 2022, the cryptocurrency exchange Binance received a license in Kazakhstan.

The company has rolled out extensive educational initiatives, collaborates with regulators, consults with law enforcement, and aims to establish a full-fledged crypto hub in the country.

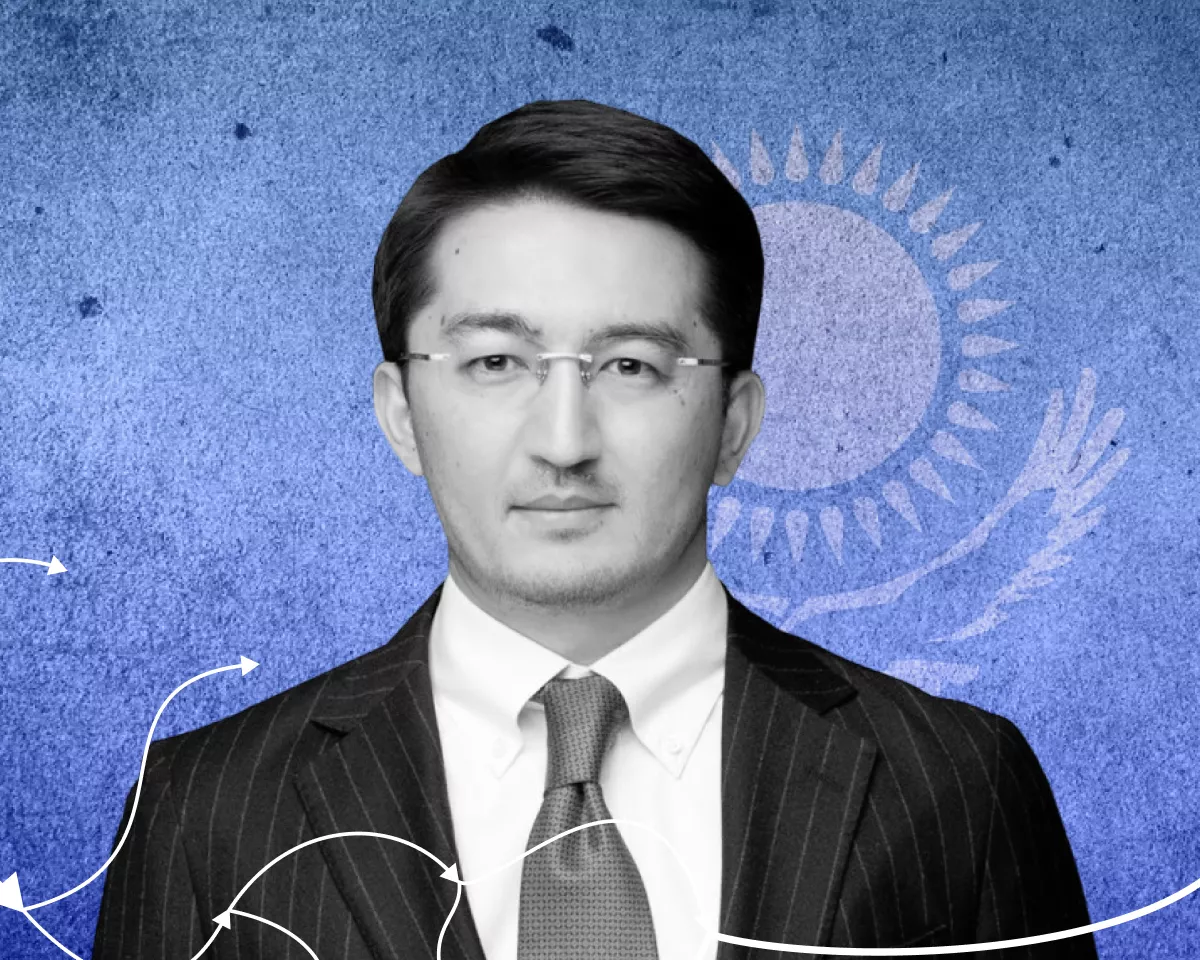

In an exclusive ForkLog interview, Binance Kazakhstan’s general manager Jaslan Madiev discussed the local team’s work, the impact of allegations from the CFTC on its operations, and a personal meeting with Changpeng Zhao.

ForkLog (FL): Hello, Jaslan. Less than a year ago you took the helm of Binance’s Kazakhstan branch, having entered the crypto industry from the traditional financial sector. What influenced this decision — personal interest in cryptocurrencies or simply an attractive offer?

Jaslan Madiev (J. M.): I have a fairly diversified background. I was an investment banker, a specialist in capital markets, CFO at the country’s largest company. I also worked in government: at the National Bank, the presidential administration, as an advisor to the prime minister, deputy minister of economy and first deputy minister of digital development, innovations and aerospace industry.

In that last role I encountered the crypto industry more closely. I directly worked on the Law on Digital Assets and brought it to Parliament.

Back then I saw that this market is a rapidly developing sector. I managed to meet Binance’s CEO Changpeng Zhao and told him that given the regulatory framework already in place, Kazakhstan has every prerequisite to become a full-fledged crypto hub.

After that I conceived the idea of taking part in developing the industry in practice as part of the Binance team, since the exchange holds a leading position. At that time the company had just posted the vacancy for a general manager in Kazakhstan.

I submitted my application, passed the interview, and since October 2022 I have been with the team. The timeframe is short, but in this period we have already done very intensive work.

FL: Did you have any savings in cryptocurrency before joining Binance? Perhaps you traded?

J. M.: I did not trade, but I was familiar with cryptocurrencies. I first heard about blockchain as a student at the Massachusetts Institute of Technology, where I earned an MBA in 2015. Since then I began periodically taking an interest in this industry, its products and various cryptocurrencies. However, my main tactical experience has come at Binance.

FL: Based on your experience, how different is the crypto business from traditional?

J. M.: These markets share similar tools, though they may be named differently. There are earn instruments such as staking, deposits, margin trading, futures — all of which exist in traditional markets.

Today cryptocurrencies can be considered a separate asset class for traditional investors. Some funds already allow allocations to such instruments. Adoption is gradual but already gaining momentum among both retail and corporate sectors.

The main difference is that the crypto market operates 24/7 and is always accessible. It minimizes the number of intermediaries, allowing users to manage their funds themselves. Banks remain part of the ecosystem, helping to build fiat channels.

FL: Tell us about Binance’s operations in Kazakhstan. How many employees are in the local team and what do they do?

J. M.: In September 2022 Binance established a subsidiary BN KZ Technologies in Kazakhstan, which obtained a license to operate a digital asset platform and engage in custodial activities at the МФЦА.

In our branch there are about 90 employees. This includes compliance specialists, operations staff, and the bulk consists of the support team. This is linked to the large number of Binance users who encounter many issues daily, and our support aims to respond as quickly as possible.

Within the MIFC, there are preferential terms for attracting expatriates, including zero personal income tax, favorable visa regimes, and unlimited quotas for family members. Taking advantage of this, Binance brings foreign specialists into its ranks, and the team keeps growing.

At present, Kazakhstan competes strongly with other regional hubs, such as France, the UAE or Bahrain.

FL: What is the team in Kazakhstan working on now?

J. M.: The regulator’s main task is to deploy a local exchange. We are finalising enhancements and hope to launch the platform by the end of the first half of the year.

In December 2022 we launched an educational program on blockchain engineering and compliance in 22 universities. It is implemented with the support of Binance Academy, the National Bank and the Astana IT Park. At this stage we are training about 300 instructors and, from May, students will be able to register for these courses to start in September. By 2026 we expect around 40,000 graduates with this specialty.

We are promoting the infrastructure of BNB Chain. To date, around 1,500 dapps have been built on this blockchain, and our aim is to attract the local developer community and existing developers to work on it.

Work is underway with Binance Labs, which manages about $7.5 billion. It incubates and accelerates startups, invests in and mentors them. Through the Launchpad platform, projects gain access to a user base for piloting their solutions.

Binance has a very large ecosystem, and we want the entire ecosystem to work toward developing Kazakhstan and its economy.

FL: Which companies does Binance collaborate with in the region?

J. M.: In January we conducted a collaboration with the country’s largest airline Air Astana to convert miles into cryptocurrency.

Binance also collaborates with the National Bank on a number of initiatives. In February we published a joint report on the state of decentralized finance in Central Asia. In addition, we are testing the integration of BNB Chain with the digital tenge, a regulator-led project.

We are outlining use cases and potential opportunities of this instrument for traditional financial institutions.

FL: Please elaborate on the use cases you are considering for this project.

J. M.: In my view, the fastest-ready use case would be to bring a large financial institution to issue on the BNB Chain a stablecoin backed by the digital tenge.

The value of any stablecoin is pegged to fiat, but it requires ongoing audits of its collateral. In turn, the digital tenge is a programmable token, and the National Bank can monitor collateral sufficiency automatically. Thus this asset would be attractive to financial institutions for creating various smart contracts and innovative products.

FL: Has the National Bank of Kazakhstan settled on a specific blockchain for the CBDC issuance? Could BNB Chain be the candidate?

J. M.: The National Bank can partner with anyone; there are no exclusive rights to a blockchain. The regulator is making the digital tenge interoperable so that it does not depend on a single network and can connect with various technologies.

Therefore, a CBDC could be issued on any blockchain; we simply consider BNB Chain the largest and most reliable. Compared with Ethereum, BNB Chain has at least twice as many daily active users.

At this stage Binance has signed a memorandum with the National Bank, and we are discussing a plan for this year in this area.

FL: Does Binance cooperate with Kazakh commercial banks?

J. M.: We are working on several fiat channels, including bank transfers and card acquiring. This will allow users to top up their Binance accounts with any card from a local bank and also withdraw funds. We hope to launch this service in the first half of the year.

We already have a specific bank partner with whom we are building a crypto-fiat channel. I cannot disclose it yet, as we are in development. However we are open to working with other banks as well. The market is competitive, and we must diversify channels and products.

FL: Does Binance plan to issue its own crypto card in Kazakhstan?

J. M.: Regarding issuing a prepaid crypto card under the Binance brand, we are in talks with the National Bank, which oversees this area. At the moment we cannot say definitively whether this project will go ahead.

For now we are explaining to the regulator how Binance Card works in the Middle East, the EU and Latin America. The exchange is prepared to invest funds in development, launch and pre-funding.

The turnover of cryptocurrencies in Kazakhstan is prohibited except within the AIFC. Therefore even if we obtain the National Bank’s permission to issue the card, it would be fiat by default rather than cryptocurrency. However on the back end, settlements between the user and Binance would be conducted in cryptocurrency.

FL: Tell us about Binance’s cooperation with the AIFC. Is the exchange advising regulators on supervisory practices in the crypto market?

J. M.: Since obtaining the license to operate a digital asset platform and custodial services at the AIFC, Binance has continuously collaborated with at least five regulators:

- AFSA — our direct regulator within the AIFC, which issued the license;

- National Bank, regulating payment systems and cards;

- Agency for Regulation and Development of the Financial Market, which oversees traditional banks;

- Ministry of Digital Development — the competent body in digital assets;

- Financial Monitoring Agency, which tracks suspicious transactions.

As pioneers in this market, we face a range of challenging questions. Yet thanks to a broad international track record of dealing with regulators in various countries, we contribute recommendations, helping Kazakhstan implement best practices.

In addition, we participate in AIFC-initiated public consultations on cryptocurrency trading.

FL: Do regulators support the development of the crypto industry in the country?

J. M.: This is a listening regulator; it is oriented toward developing the market for digital assets and the crypto industry in the country. It would be wrong to say it takes an overly hard line that would hinder innovation or the deployment of activities in the local market.

The head of state also supports the development of blockchain technologies and the crypto industry, as he has publicly stated on multiple occasions. We do not see Kazakhstan moving toward bans or heavy-handed regulation of new technologies.

FL: What is happening with the adoption of cryptocurrencies and the integration of crypto payments in Kazakhstan?

J. M.: Overall, progress in developing the crypto industry and crypto exchange activity is proceeding gradually.

Regarding recognizing cryptocurrencies as a means of payment — this is a very complex issue. This is an area where the National Bank must exercise its prerogative. Therefore I cannot say this will happen soon.

FL: Many regulators advocate for strict regulation of the crypto market. Do you support this position?

J. M.: My personal view is that regulation of the crypto market should be liberalised as much as possible, but in a prudent way, so as not to create additional macroprudential risks.

Clear rules of the game attract new players to the jurisdiction and help separate the shadow economy from the white zone.

Binance signed a memorandum with the Financial Monitoring Agency, under which it provides training on on-chain analytics and blockchain basics. We are committed to ensuring law enforcement is informed and able to engage properly with these tools.

I am not in favour of a hard-line regulatory approach, because that could choke innovation.

FL: How do you assess the January 2023 law “On Digital Assets”? What impact will it have on industry players?

J. M.: The Law on Digital Assets came into force on April 1, so it is too early to speak to its effects. Largely the document targets mining regulation. Before it, mining in Kazakhstan developed chaotically, with contentious issues such as the burden on the power grid.

The law contains provisions on licensing mining, penalties for illegal activity, and electricity quotas. All this will be refined in subordinate legislation; NFT and other asset-backed tokens will also be addressed. But even now this framework is a major achievement for Kazakhstan.

Binance regularly participates in parliamentary working groups and offers recommendations not only on regulatory framework but also on the legislative basis for developing the industry.

FL: Can you disclose Binance Kazakhstan’s metrics by user base?

J. M.: Overall, the number of Binance users exceeds 120 million. Country-specific figures cannot be disclosed. However as crypto adoption grows, so does the exchange’s popularity, as seen in registrations. This shows that customers trust Binance and see various opportunities in it.

Many new Web3 or blockchain projects want to list their tokens on our exchange. As part of the listing process they undergo a rigorous assessment of the development team, code and the value proposition.

Users are also becoming more curious about what lies behind a project, since these tokens offer a good alternative to traditional financial instruments. This also draws attention to the exchange.

FL: After Russia’s full-scale invasion of Ukraine and the mobilization in Kazakhstan, thousands of Russians left. Many are Binance users. Which entity services their accounts and does it comply with sanctions?

J. M.: If a Russian user moved to Kazakhstan, obtained a ВНЖ and can confirm residence, we do not see issues in providing services to them.

If there are sanctions-related questions, we comply with all procedures.

Of Binance’s 8,000 employees, nearly 10% are compliance officers who daily verify our compliance with regulatory and sanctions requirements.

We have processed more than 55,000 requests from various law enforcement agencies. We strive to respond as quickly as possible.

In cases of blocks, all user inquiries are handled by the support service.

FL: Since the start of the year there have been two arrests of Binance accounts linked to illicit exchanges. How is this work conducted?

J. M.: Large organisations like Binance actively cooperate with law enforcement across countries. Any suspicious activity detected by us may be the subject of official investigations. If there is a prosecutor’s sanction, court decision or criminal case, we can block accounts with all the consequences.

For Binance it is important that illicit activity does not flow through us, given that we are the most regulated crypto exchange. We comply with due diligence procedures, monitor certain transaction typologies, and report any suspicious transactions to regulators.

Regarding specific cases I cannot disclose details. All information available for disclosure is always published publicly by law enforcement.

FL: In light of recent events — how will the CFTC allegations against Binance and Changpeng Zhao personally affect your compliance unit?

J. M.: Binance always strives for transparency, collaborates with regulators and law enforcement in the United States and elsewhere. Our compliance team comprises individuals with government experience. At this stage the exchange provides regulators with all the information they need.

We do not presently see any difficulties for Binance Kazakhstan’s operations due to the CFTC allegation.

FL: At the start of the conversation you mentioned a personal meeting with Changpeng Zhao. What did you discuss?

J. M.: My first private meeting with CZ took place in April 2022 in Dubai, arranged with the help of colleagues from Binance. I was serving as the first deputy minister of digital development; we were launching crypto industry activities and trying to attract major players to our market. Binance, as a large ecosystem, was our top target.

At the meeting I spoke about Kazakhstan’s regulatory environment, the government’s support for high tech, and the separate AIFC regime based on English-law principles.

I think CZ was drawn to these prospects, as in May of the same year he visited Kazakhstan and met with the head of state. During that visit a memorandum was signed with the Ministry of Digital Development, in which Binance undertook to help develop a crypto hub in the country.

FL: What can you tell about CZ as a person?

J. M.: What can be said about a person who built the largest ecosystem in crypto in such a short period? A crypto exchange with a daily turnover of $65 billion, more than 120 million users in 180 countries, that cooperates with regulators in nearly 20 countries, and which, 165 days after launch, led the world in operating turnover. That speaks to CZ as a person with a clear vision.

Moreover, in my view, he does not chase profits but adheres to certain values. One of them is to ensure freedom of money for people. It’s also worth noting his simplicity, open communication with people and staff regardless of position. CZ is a very good speaker. One of his talks is like a dense lecture that immerses you in the crypto world and delivers a flood of new information.

FL: Are you happy to work under his leadership? What kind of leader is he?

J. M.: I think he is a very forward-looking and professional leader. My colleagues and I are fortunate to be in this team, working under his leadership, learning daily from his vision and gaining new insights.

Interviewed by Lina Jess.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!