Binance Report: Bitcoin Rally and Ethereum 2.0 Drive Record Trading Activity

Bitcoin rose to a new all-time high on the spot market, and the launch of Ethereum 2.0’s zero phase on December 1 led to a record monthly trading volume on Binance since the platform’s inception, according to the company’s report.

\n

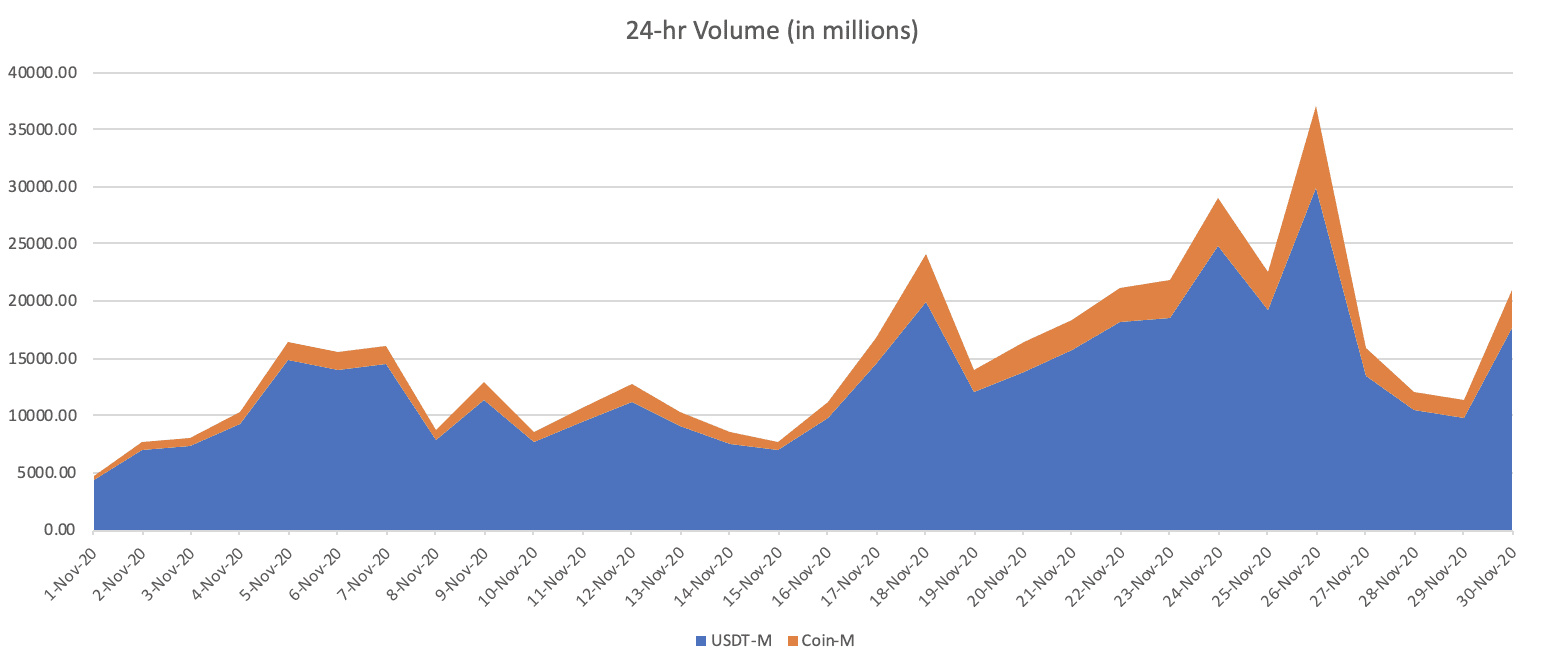

On November 26, Binance Futures’ derivatives unit recorded the highest-ever daily trading volume of $37 billion. The platform’s total turnover in November was $450 billion.

\n

Trading activity was boosted by Bitcoin hitting a new all-time high on the spot market. During November the leading cryptocurrency rose by almost 40%, and its market capitalization topped $350 billion, according to CoinGecko.

\n

Trading volume dynamics on Binance Futures. Data: Binance.

\n

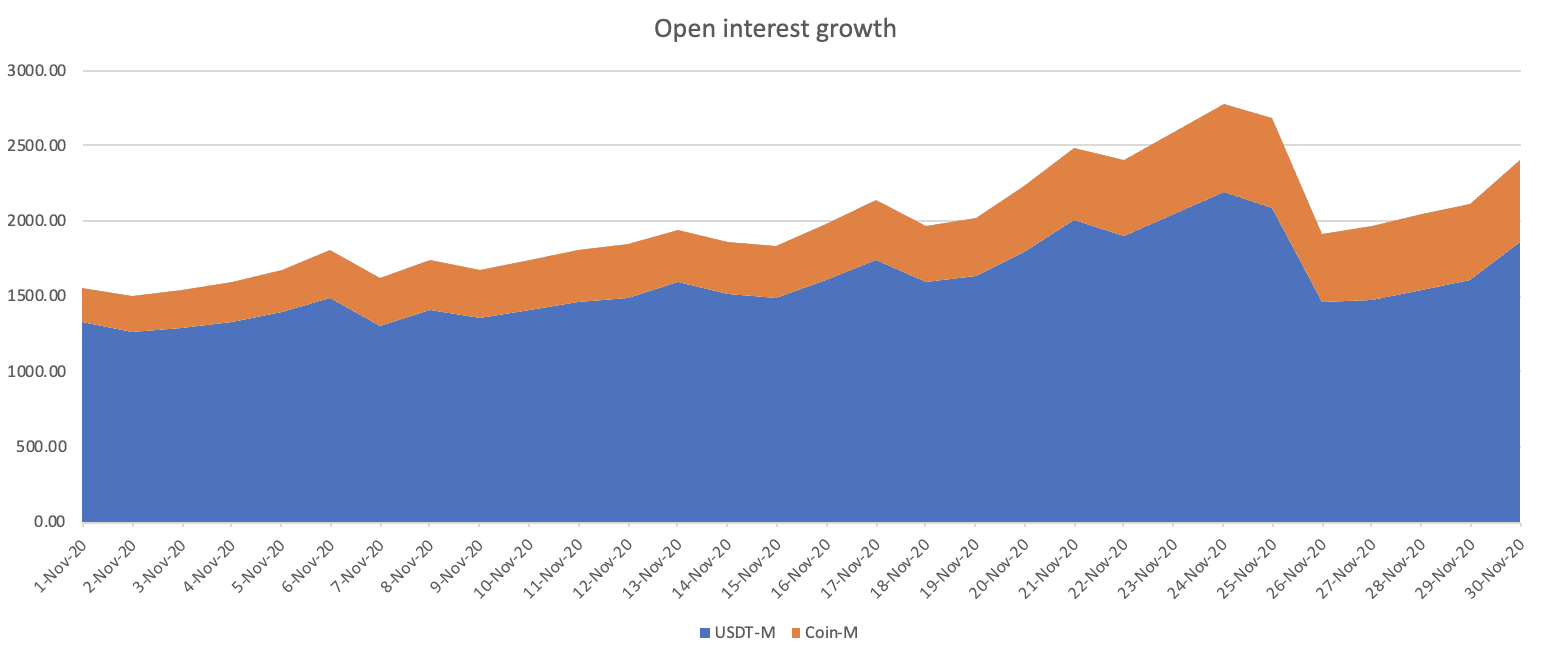

As Bitcoin neared $20,000, aggregate open interest (OI) in options reached a record $2.6 billion. The average OI in November rose 58% to $1.9 billion from $1.2 billion in October.

\n

Open interest dynamics on Binance Futures. Data: Binance.

\n

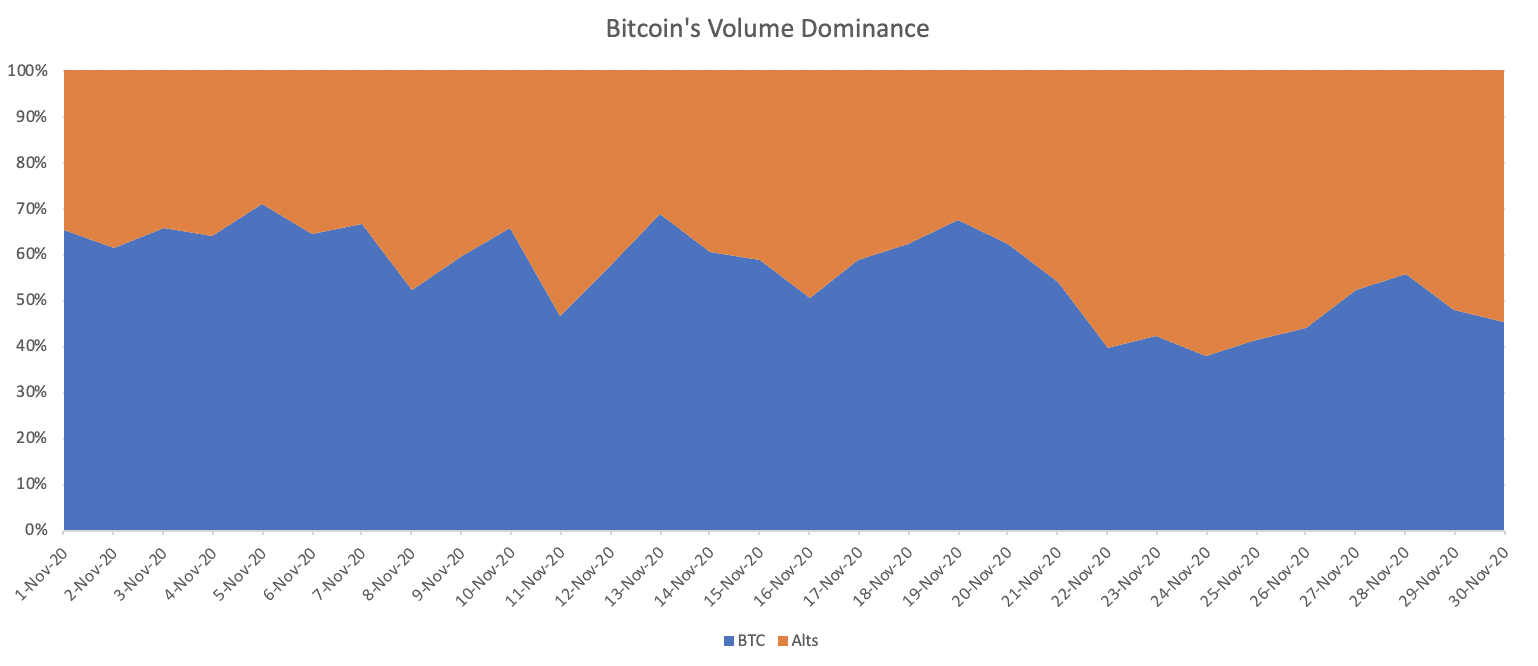

If in the first half of November market participants focused mainly on Bitcoin futures, which accounted for 60% of total trading volume, the second half shifted to altcoins.

\n

This could have been driven by the hype ahead of the launch of the zero phase of ETH2. The second-largest cryptocurrency by market capitalization rose 59% in November.

\n

Trading volume split between Bitcoin and altcoins on Binance Futures. Data: Binance.

\n

Binance announced the launch of Ethereum 2.0 staking. The platform opened access to the service on December 2.

\n

The launch of the zero phase of Ethereum 2.0: what will happen and what users can expect

\n

\n

The head of Binance, Changpeng Zhao, entered Bloomberg’s top 50 global icons and innovators.

\n

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!