Bitcoin after the halving: where next for the price?

In the second half of April the next halving of the first cryptocurrency will take place. Many market participants await the event with optimism, seeing it as no less significant than the launch of spot bitcoin ETFs in the United States.

Halving the block reward from 6.25 BTC to 3.125 BTC will make digital gold even scarcer. That implies that, with steady or rising demand, the cryptocurrency’s price will almost certainly move higher. Additional drivers of a new rally should include institutional adoption of bitcoin, reduced regulatory uncertainty and an easier monetary stance by the Fed.

Prominent market figures are issuing bold forecasts for the future path of digital gold. ForkLog has collected the most notable among them.

- Historical data point to a positive impact of halvings on investor sentiment and the price of the first cryptocurrency.

- Most market participants are confident that bitcoin will set a new high this year.

- There is a high probability of a “sell the news” scenario, implying a short-term correction after the halving.

How does the halving support bitcoin’s price?

Halving is a programmed reduction by half of the reward miners receive for adding a new block to the blockchain.

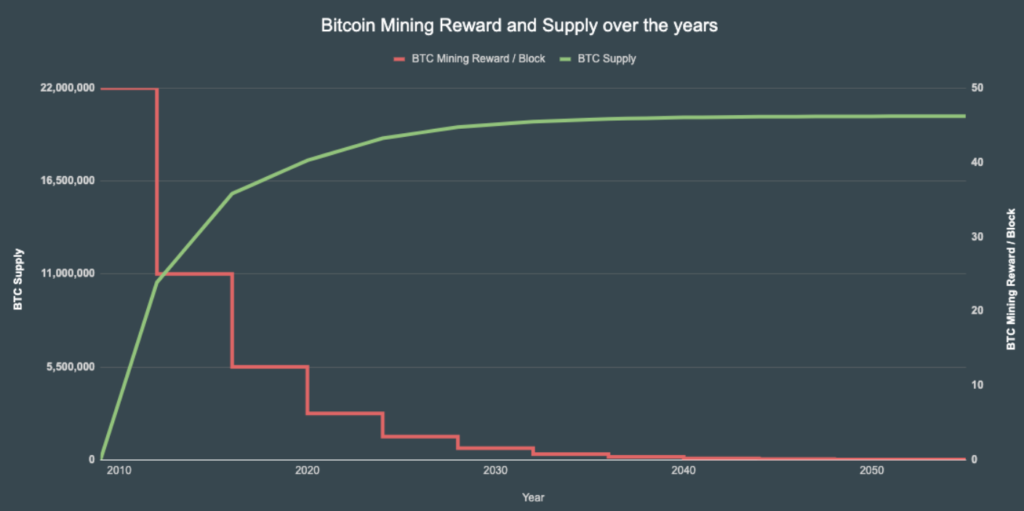

Satoshi Nakamoto coded halvings into the bitcoin network to occur every 210,000 blocks, roughly once every four years, until issuance ends with the mining of 21 million coins (expected in 2140).

The bitcoin network has undergone three halvings:

- 28 November 2012;

- 9 July 2016;

- 11 May 2020.

At the beginning, miners earned 50 BTC for each new block. After the first halving, the reward fell to 25 BTC; after the second, to 12.5 BTC; and after the third, to 6.25 BTC. The fourth halving will reduce the reward to 3.125 BTC. It is expected in April 2024 at block #840,000.

The “halving” was conceived by Satoshi as an instrument to limit issuance and restrain inflation.

Even before the first halving in 2012, Ethereum creator Vitalik Buterin explained its rationale by comparing bitcoin to a precious metal:

“The supply of gold on Earth is limited, and as we dig new gold, it becomes increasingly difficult to find, and the price goes up. In result, gold has maintained its value as a universal medium of exchange for over six thousand years, and there is hope that Bitcoin will do the same thing.”

A hard cap on issuance is a strong foundation for price appreciation provided adoption continues. Miners have already produced 19.6 million BTC — roughly 93% of the total supply. The upcoming halving will halve the growth rate of issuance.

By various estimates, between 2.3 million BTC and 6 million BTC are lost, with little chance of recovery (lost seed phrases, deaths, and so on). More than 70% of coins are held by long-term investors — hodlers — who rarely transact. These factors further constrain the effective free float.

“Demand for Bitcoin has steadily increased over the years, accompanied by a planned decline in supply. At a minimum, this strengthens Bitcoin’s status as a store of value,” noted CoinGecko analysts.

For investors, the halving means a slower pace of new coin creation and, therefore, lower network inflation. It also implies less propensity for miners to sell — another positive for price, given that bitcoin is mined by large players with substantial reserves.

“Historical data point to a positive impact of the expected scarcity on investor psychology. Market participants anticipate higher bitcoin prices, which may be followed by increased buying,” the experts observed.

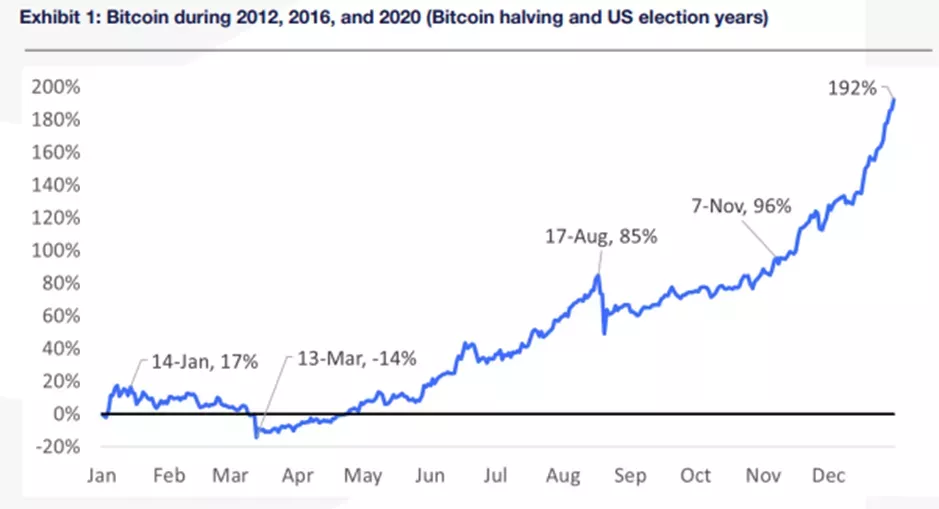

Ahead of the 2020 halving, bitcoin rose by roughly 40% on optimistic expectations and FOMO. After the reward was halved, the price climbed to around $69,000 — more than triple the peak of the previous bull phase (late 2017).

In the industry’s early days, the picture was different. The first two halvings were followed by elevated volatility for the next 12–18 months: the price could surge from $11 to $1,100 or from $230 to $20,000 — and then fall fivefold.

How will the halving affect miners?

As noted, the halving cuts miners’ rewards in half. Under current conditions, building and maintaining a bitcoin-mining operation is expensive. Market participants hope that block rewards will at least cover core costs before a significant price rise in a scarcer asset.

If bitcoin’s price does not rise meaningfully before or after the halving, many miners simply switch off their machines.

The most efficient operators remain — those that:

- have built sufficient digital reserves as a financial cushion;

- have invested in advanced hardware with high performance and relatively low energy use;

- have access to cheap electricity and, where needed, low-cost funding.

CoinShares analysts concluded that among public miners only Bitfarms, Iris, CleanSpark, TeraWulf and Cormint would be profitable after the halving if bitcoin trades below $40,000.

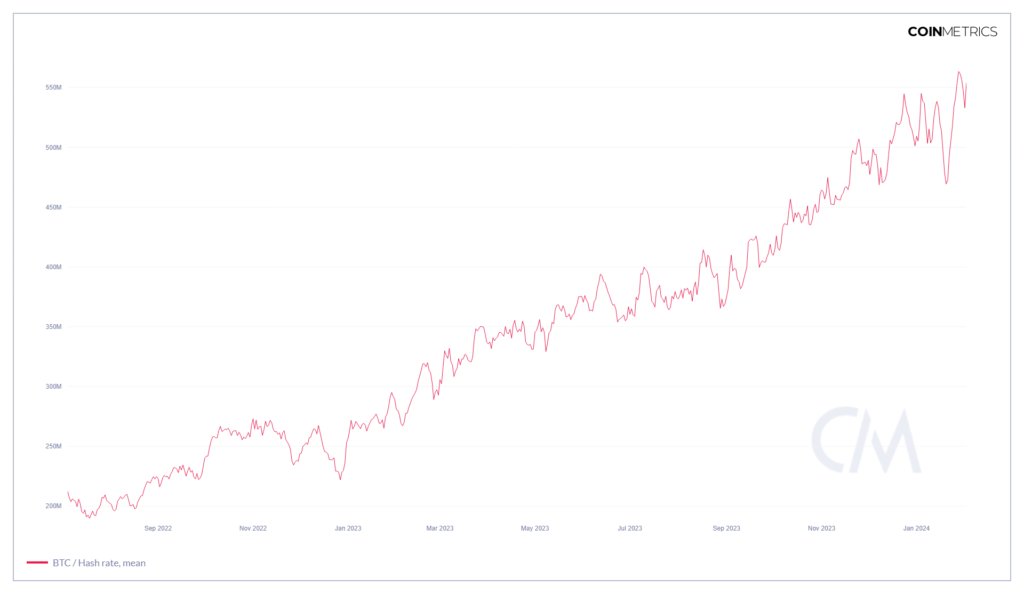

On average over the past three years, bitcoin’s hashrate has grown by 53% annually. To maintain market share and output, miners have scaled their computing power accordingly. Even so, specialists think it will be hard to offset the halving.

If many machines are switched off at once, the aggregate hashrate inevitably drops. That slows the network and lengthens block intervals.

To ensure resilience, Satoshi Nakamoto designed mining difficulty to adjust lower when mining activity falls. If the halving renders some miners unprofitable and they exit, pushing down hashrate, difficulty will follow.

That means the interval between new blocks should remain stable and transaction processing speed should not suffer from miner departures.

Mining difficulty is recalculated roughly every two weeks — every 2,016 blocks. For this reason, the crypto community worries about a timing gap between a hashrate drop and the next difficulty adjustment, during which the bitcoin network could enter a so-called “death spiral”.

Here is how that looks: difficulty stays high, profitability declines — miners power down, hashrate drops, transactions slow.

However, blockchain expert Andreas Antonopoulos believes the bitcoin network is not threatened by a “death spiral”, since miners typically operate with a long-term strategy and keep working in anticipation of the next difficulty adjustment and a return to normal conditions.

Mining profitability also depends on the price and the volume of transactions, which determine fee income. If these are high enough, the negative effect of a lower reward will be less pronounced.

In 2023, revenues were boosted by the popularity of Inscriptions — a way to record data on bitcoin’s blockchain. Glassnode analysts asserted that up to 30% of fee income last year came from Ordinals and BRC-20 tokens.

The upcoming halving will be a stress test for an industry whose income is still largely derived from block rewards. Improving efficiency and cutting operating costs will shift from preparation to prerequisites for survival.

According to CryptoQuant, miner-held bitcoin balances have fallen to levels last seen in July 2021. Experts say miners have been motivated to sell in preparation for the halving, which will halve rewards and, in the short term, profitability.

The heaviest selling — about 800 BTC per day — was observed in November–December. In early 2024, however, CryptoQuant detected signs of easing price pressure and active rebuilding of reserves by public miners.

Glassnode estimates that after the reward is cut in half, miners’ sales to cover operating and capital costs will fall from roughly $1 billion to about $500 million.

Miners with access to cheap electricity will enjoy a meaningful advantage. Even so, ongoing purchases of the latest high-performance rigs suggest hashrate and difficulty will keep rising, adding pressure to margins.

What prices are experts forecasting?

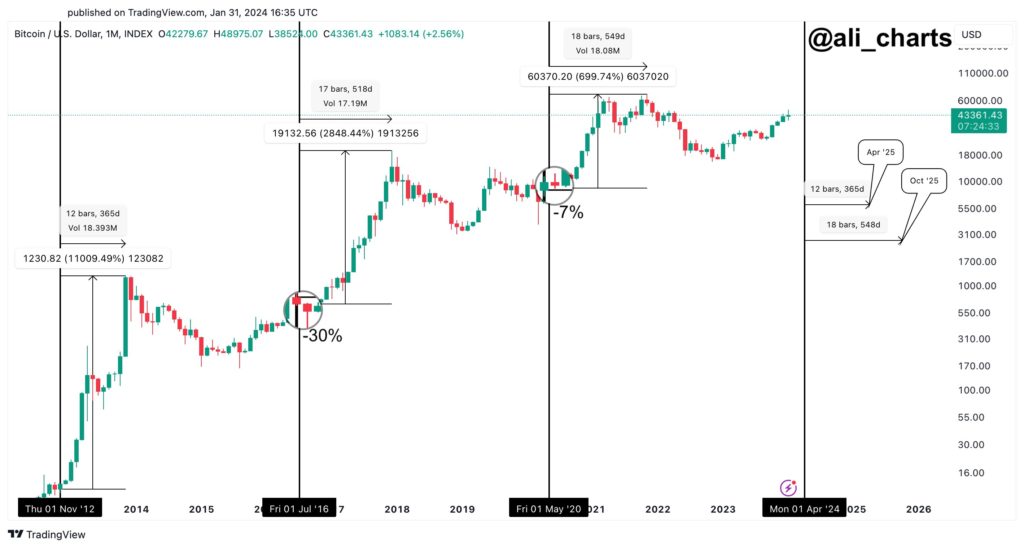

Former Binance head Changpeng Zhao ruled out a doubling of bitcoin’s price the day after the halving. Citing historical data, he suggested the ATH is likely to be revisited only a year after the event.

DecenTrader analysts are similarly cautious. In their view, the first cryptocurrency will “test investors’ resolve” with post-halving selling and only in the fourth quarter set a new ATH.

They attribute these expectations to bitcoin’s “classic behaviour” in years when block rewards are halved.

The analysts expect a burst of buying around two months before the halving, followed by “sell the news”.

“In other words, Bitcoin has around 30 days to go through a correction phase before the FOMO demand is found,” the specialists wrote.

They estimate that, amid investor optimism, bitcoin could rise to $49,000 before the halving. An alternative scenario assumes the price has already regained sufficient momentum to reach that level.

“After previous halvings, it took 220–240 days to break to new record highs. Expect a repeat of the trend — the price will reach a new ATH in mid-to-late Q4 2024. That will allow some time for a correction,” they indicated.

Bitfinex analysts are confident that a shift by the Fed from tightening to easing would be supportive for cryptocurrencies.

Such a turn would signal a waning aversion to risk among investors, prompting capital to flow into digital assets as well. A cut in the key rate could coincide with the halving, which has historically led to substantial price gains, they added.

“From a historical and technical standpoint, this is a bullish event, though a temporary dip on sell-the-news is possible,” the experts said.

Matrixport estimates that digital gold will rise to $63,140 by April and set a new all-time high by the end of 2024.

They note that a three-year bull run followed the bear phase of 2014 (-58%). After the 2018 recession (-72%), there was again positive performance over the next three years.

Expecting a repeat of cyclicality after the 65% drawdown in 2022, the analysts foresee gains in 2024–2025.

“Historically, halving years have been broadly optimistic: 2012 (+186%), 2016 (+126%) and 2020 (+297%),” they reported.

Historically, miners tended to accumulate coins ahead of each halving, often accompanying a 200% price rise. Extrapolating this observation implies around $125,000 by end-2024.

The experts also see macro support. They expect inflation to keep slowing, prompting the Fed to start cutting rates.

Matrixport representatives also warned of a possible sell-off in March, ahead of the halving. By their calculations, bitcoin could correct to $36,350.

A much bolder forecast came from industry veteran and Blockstream CEO Adam Back, who suggested bitcoin would break $100,000 before the halving.

On the longer-term trajectory, he agreed with BitMEX co-founder Arthur Hayes that the price could reach $750,000–$1 million by 2026.

CryptoQuant experts noted that after the previous halving digital gold rose 654%, coming close to $70,000. If historical tendencies hold, bitcoin will set a new ATH between April and October 2025, according to analyst Ali.

By his count, the length of the bull market after the last halving was 549 days.

Ali also allows for a correction in April–May, noting that after the 2016 and 2020 halvings the price fell by 30% and 7% within a month, respectively.

Separately, he highlighted the largest accumulation period in nearly three years. The Accumulation Trend Score hovered near 1 over the past four months. In his view, that signals strong conviction among large players.

A relatively conservative forecast came from Marathon Digital CEO Fred Thiel, who suggested the first cryptocurrency could reach a new high of $125,000 by the end of 2025.

“The only unique thing that Bitcoin has that equities don’t have is a limited amount of coins,” he added.

In his view, bitcoin’s supply on the market will grow more slowly than gold’s, significantly influencing the price.

Halvings have traditionally laid the groundwork for gains in bitcoin, offsetting miners’ income losses, Thiel argues. The coming event should be no exception.

The Marathon chief noted that the advent of spot bitcoin ETFs in the United States will likely increase liquidity and reduce volatility. The new instruments also make the asset more attractive to institutions.

Thiel added that the variety of ways to invest in bitcoin — direct ownership, futures and diversified fund baskets — underscores its growing integration with mainstream finance.

Despite the positives, global geopolitics, the strength of the US dollar, inflation and external factors such as energy prices and trade dynamics still affect the first cryptocurrency, Thiel said. Combined with inherent volatility and a shifting hashrate, these factors hamper adoption.

“I’m not going to predict Bitcoin at $1 million by the end of the year. I think it’s going to be a much more modest number. We’re going to see institutional money start to come in slowly but surely. Transaction volumes and inflows are going to grow over time, and all of that will bode well for the first cryptocurrency,” the mining chief explained.

By the end of the third or early in the fourth quarter of 2024, Thiel expects bitcoin to reach a new all-time high, followed by a pullback towards $40,000–50,000.

A similar forecast was made by SkyBridge Capital founder Anthony Scaramucci. He believes the price will surpass $170,000 next year.

“If Bitcoin is at $45,000 at the time of the halving, […] then the asset will reach $170,000 by the middle or end of 2025. […] Wherever the price is on the day of the halving in April, multiply it by four — Bitcoin will reach that level in the next 18 months,” the specialist noted.

Fundstrat co-founder Tom Lee expressed the view that bitcoin will reach $150,000 by the end of 2024.

“Over the next five years there will be limited supply, but with spot Bitcoin ETFs approved we potentially have huge demand, so I think something around $500,000 within five years is quite achievable,” he added.

Popular blogger PlanB suggested that after the upcoming halving bitcoin will be scarcer than gold and real estate.

Based on his Stock-to-Flow model, he allowed that the asset’s market capitalisation may not surpass gold’s — over $10 trillion. However, approaching that mark and an issuance of 20 million coins would bring the price close to $500,000.

The analyst also marked out a minimum level below which, in his opinion, the cryptocurrency will not fall: bitcoin’s 200-week moving average has reached $31,000, and the price has historically never dropped below the metric.

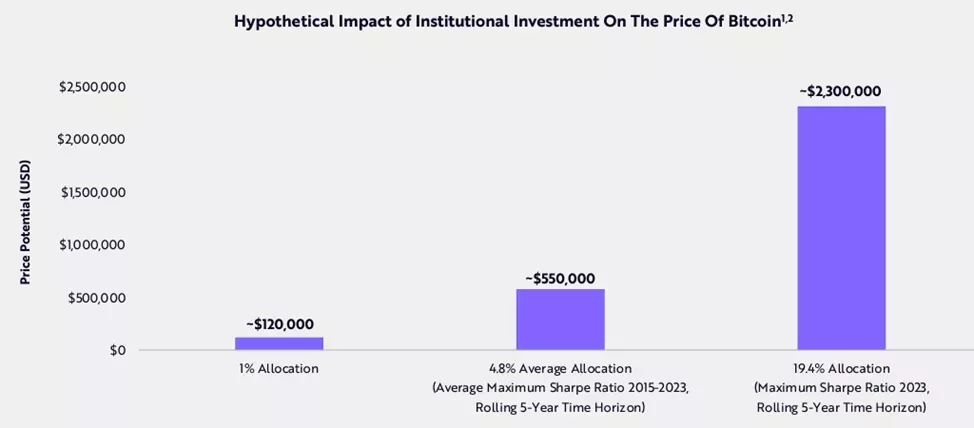

Representatives of ARK Invest suggested that by 2030 bitcoin could rise to $120,000. For that, its share in global investment portfolios would need to reach 1%.

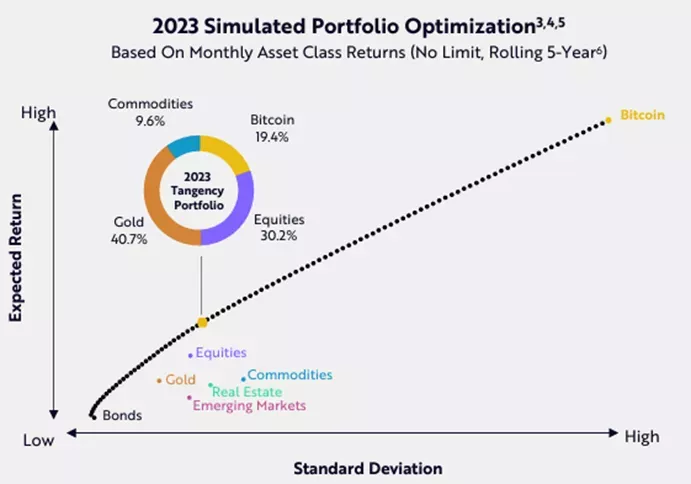

If that share climbs to 19.4%, the price would increase to $2.3 million.

The value of global portfolios was put at $250 trillion.

The 19.4% figure results from optimising risk-adjusted return parameters based on 2023 outcomes. Other portfolio components were gold (40.7%), equities (30.2%) and commodities (9.6%).

Analysts cited spot ETFs, the halving, institutional adoption and a further decline in regulatory uncertainty as drivers of higher bitcoin capitalisation.

According to a January Finder survey of 31 industry representatives, the average expected bitcoin price at the end of 2024 is $87,875.

Some 49% of respondents believe the first cryptocurrency is undervalued. Only 10% said the opposite.

Conclusions

Many experts see a positive synergy between the launch of spot bitcoin ETFs and the upcoming halving. These expectations themselves are a powerful tailwind for the price of the first cryptocurrency, which is acutely sensitive to shifts in sentiment.

The potential for the next upswing is considerable. On-chain indicators suggest the market is still far from overbought. Most analysts agree the bull run will last at least a year after the halving.

Even so, sudden corrections and the liquidation of large positions are inevitable. A post-FOMO “sell the news” is possible, as happened shortly after the spot ETFs launched.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!