Bitcoin and Privacy Coins Climb Amid Trump-Powell Standoff

Crypto market rises as Powell flags Trump pressure on the Fed.

On January 11 the cryptocurrency market turned higher after the head of the Fed, Jerome Powell, said the central bank faced pressure from U.S. president Donald Trump.

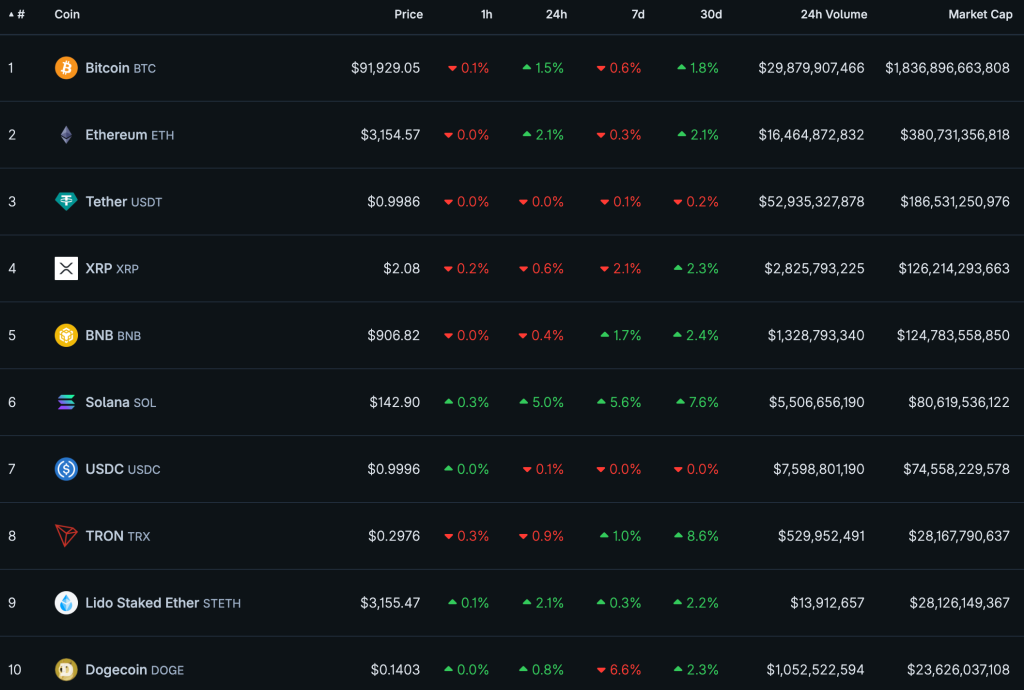

Over the past 24 hours, bitcoin rose 1.5%, testing $92,000. The price of Ethereum increased by 2.1%, and Solana by 5%.

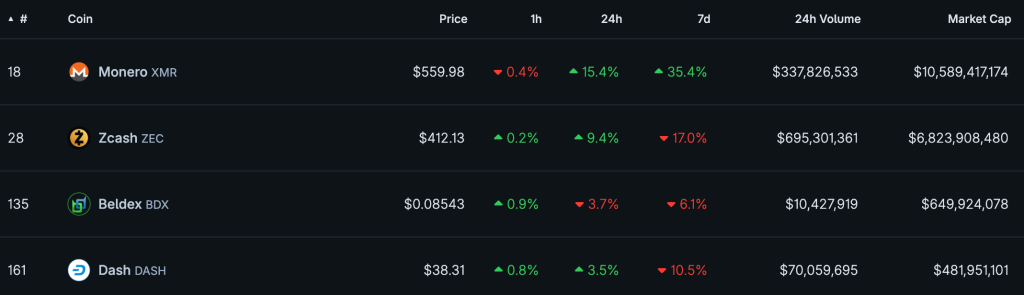

Gains were broad-based, but privacy coins led: the price of Monero jumped 15.3%, setting an all-time high around $596; Zcash added 9.4%.

Traders reacted to Powell’s video address. The Fed chair said the U.S. Department of Justice had threatened him with criminal prosecution over testimony he gave to Congress in June 2025.

“The threat of criminal prosecution is a consequence of the Fed setting rates guided by the interests of society, not the president’s preferences,” the senior official said.

His term as head of the Federal Reserve System expires in May 2026.

U.S. president Donald Trump has openly voiced dissatisfaction with Jerome Powell’s actions, insisting on more aggressive rate cuts. He repeatedly sought to influence the Fed, urging the rate down to 1% or less.

Into safe harbour

Presto Research’s Peter Chang told The Block the bitcoin rally began almost simultaneously with Powell’s address. Gold also firmed: at the time of writing the asset had risen 1.53% to $4578.

“The price action indicates that Powell’s words about a threat to the Fed’s independence sparked investor concerns about the dollar-based traditional financial system,” the specialist said.

He noted that it is trust in the dollar’s neutrality that grants the asset its reserve-currency status.

“Once the public is convinced otherwise, investors will start seeking ways to hedge risks in the traditional system. Gold and bitcoin serve exactly such instruments,” the expert added.

Kronos Research’s chief investment officer Vincent Liu told the publication that technical factors and strategic buying also underpinned the upward momentum.

“Traders are watching these moves amid wide-ranging discussions about regulation, including news of a potential bill on a digital-asset market structure to boost transparency and liquidity,” he added.

Liu highlighted three key drivers this week: Powell’s conflict with the Justice Department, news on plans to cut taxes, and the release of the consumer price index.

Macro resilience

BTSE’s chief operating officer Jeff Mei flagged the possibility of a volatility spike at the start of the U.S. session due to political tensions.

“Against the backdrop of the Trump–Fed conflict, a market dip is possible at the start of U.S. trading,” he noted.

By contrast, CoinEx Research analyst Jeff Ko sees the impact of the Justice Department–Fed conflict as limited, viewing it as merely one element of broader uncertainty.

He considers the current backdrop favourable for digital assets. The market is supported by weak U.S. employment data, rising gold prices and reduced leverage. Ko cites geopolitics as the main risk:

“Any escalation could significantly increase volatility and demand for haven assets.”

Bitrue’s head of research Andri Fauzan Adzima pointed to the fundamental resilience of the U.S. economy. GDP growth, rising real wages and slowing inflation are fostering investor interest in risk assets.

In parallel, Goldman Sachs revised its monetary-policy expectations. The bank pushed back its forecast for the first rate cut from March to June 2026, and the subsequent step to September.

“The expected Fed rate cuts, most likely in June and September, will further ease financial conditions, supplying liquidity that cryptocurrencies have historically absorbed, and signalling the early stages of a durable bull phase,” Adzima added.

Earlier, the CryptoQuant analyst known as Arab Chain suggested a near-term bitcoin reversal amid a collapse in open interest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!