Bitcoin Dips Below $108,000 Amid Trump’s Tariff Threats Against the EU

The price of the leading cryptocurrency fell by over 3% within an hour following U.S. President Donald Trump’s threat to impose a 50% tariff on EU products starting June 1.

Currently, Washington is negotiating with Brussels after the implementation of the so-called 90-day tariff truce. According to the Financial Times, the current progress does not meet U.S. expectations.

The head of the White House described the $250 billion trade deficit with the EU (originally $250 million) as “unacceptable.”

Trump mentioned restrictions, including non-monetary ones, VAT, corporate penalties, exchange rate manipulations, and lawsuits against American companies.

Shortly before, the U.S. president warned Apple that the company’s products would face a 25% tariff if production continued overseas.

Trump’s actions led to a sharp decline in risk appetite in global financial markets. Shares of European car manufacturers plummeted by 3.3-4.5%, dragging down the local stock market and dampening sentiment on Wall Street before opening. The S&P 500 futures fell by 1.5%.

Against this backdrop, gold rose by 2%, and there is demand for sovereign bonds of developed countries. Bitcoin dropped by 3% and at the time of writing is trading at $108,430.

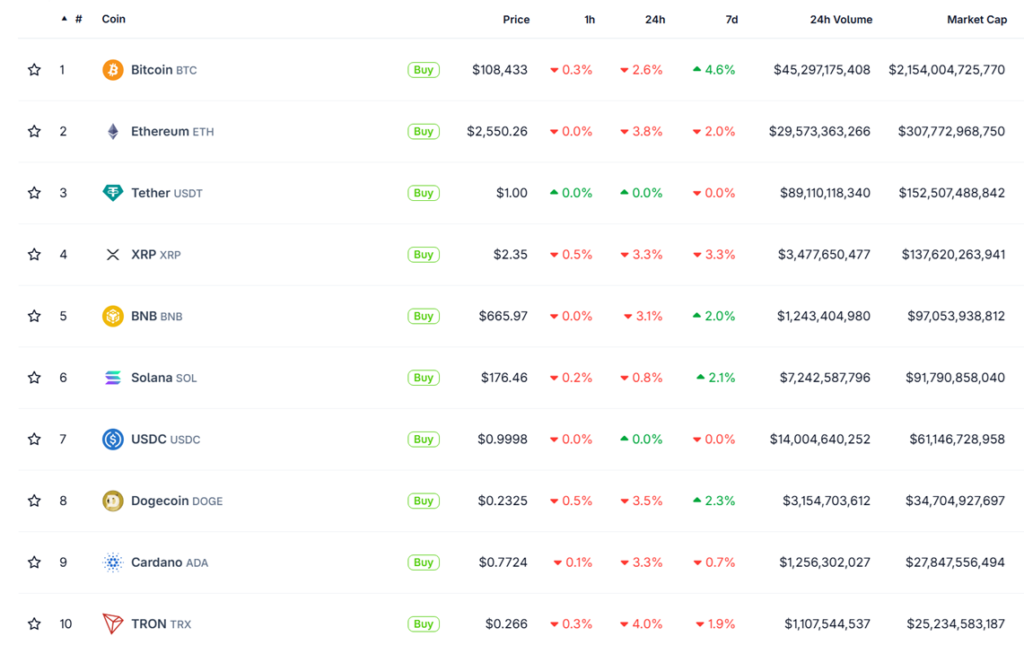

The rate of decline among the top 10 digital assets by market capitalization ranges from 2.6% to 4%.

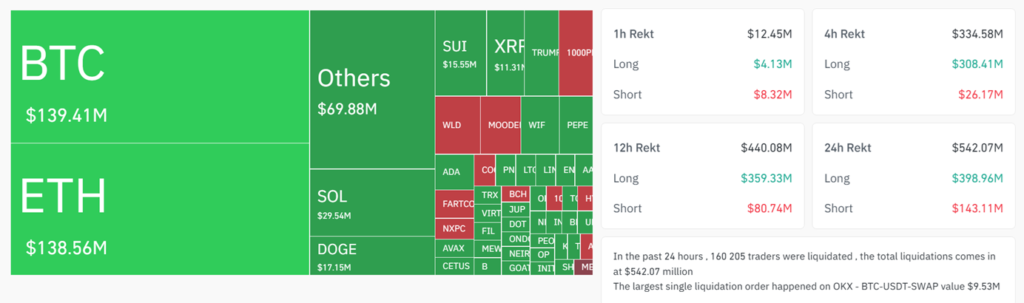

The liquidation volume over the past 24 hours reached $541.5 million, with nearly $400 million in long positions. The volume of forcibly closed positions in Bitcoin is comparable to Ethereum.

On May 22, Bitcoin reached a new high approaching $112,000 amid continued significant inflows into ETFs.

JPMorgan noted the high chances for the leading cryptocurrency in the “competition” with gold by the end of the year, partly due to corporate purchases.

Additional support continues to come from purchases by public companies. On the same day, Michael Saylor’s Strategy filed with the SEC for the issuance of preferred shares worth $2.1 billion. The firm uses the proceeds to finance corporate goals, including acquiring digital gold.

Earlier, Standard Chartered urged buying the leading cryptocurrency and predicted its price would rise to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!