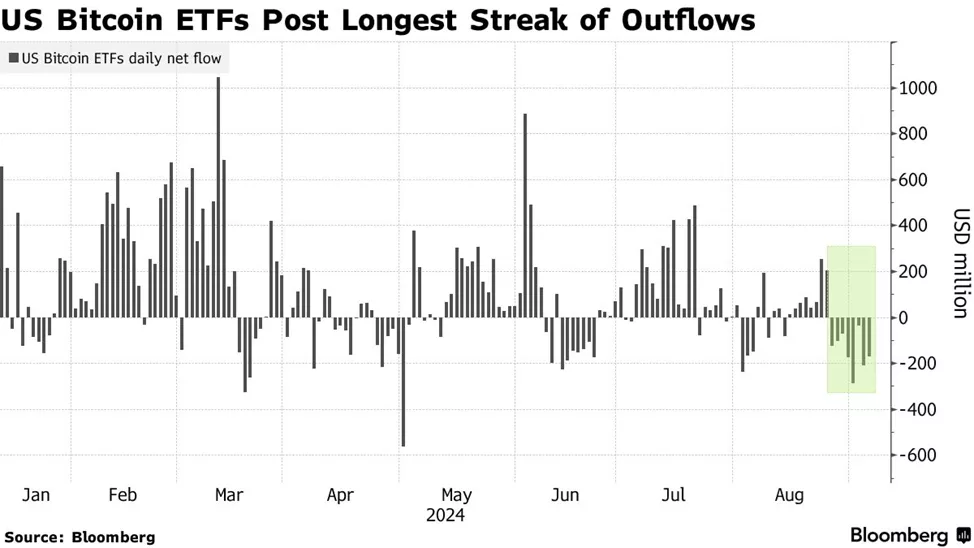

Bitcoin ETFs Witness $1.2 Billion Outflow Over Eight Days

From August 28 to September 6, spot Bitcoin ETFs experienced an outflow of $1.2 billion, according to Bloomberg.

The agency noted that this marks the longest streak of daily fund withdrawals from exchange-traded funds since their listing in January. The catalyst was a wave of flight from risky assets amid an uncertain macroeconomic landscape.

According to Jim Bianco, CEO of Bianco Research, broader adoption of ETFs will require more time. He cited the 2028 halving and significant development of on-chain tools as catalysts. Currently, exchange-traded funds serve more as a “small tourist product,” the expert added.

1/8

Spot BTC ETFs update

tl:dr

* Inflows now outflows

* Holders have record losses

* Advisors <10% of holdings (boomers never came)

* Avg trade size now <$12k. It’s not an adoption vehicle. Instead a small tourist tool and on-chain is returning to Tradfi. See posts #4 and #8— Jim Bianco (@biancoresearch) September 8, 2024

According to the specialist, “very little new money” has entered the cryptocurrency space, as most inflows are linked to “on-chain holders who returned to TradFi accounts.”

“First, patience is needed, to endure a few more seasons, including a winter or two, and to make a breakthrough in development,” Bianco suggested.

Bloomberg analyst Eric Balchunas disagreed with the assessments of the Bianco Research CEO.

Need help: If $IBIT has like >$20b in assets (in 8mo btw) and that’s considered a failure then what word should be used to describe an ETF w $7m in assets?

— Eric Balchunas (@EricBalchunas) September 8, 2024

“If [BlackRock’s product] IBIT has an AUM of $20 billion and that’s considered a failure, then what word should be used to describe an ETF with $7 billion in assets?” he inquired.

Balchunas was supported by analyst Bryan Ross.

This data could actually be interpreted as bullish; if most #ETF trades are NOT institutional, this means institutions aren’t even here yet, and we could see massive institutional inflows next time FOMO and greed show up.

— Bryan Ross (@bryanrosswins) September 8, 2024

“If most trades are not institutional, this means institutions have not yet arrived. We could see massive inflows from this market segment the next time FOMO appears,” he concluded.

By the end of the first quarter of 2024, 13 of the 25 largest US hedge funds held Bitcoin-based products, according to River.

According to Bitwise, based on reports to the SEC for April-June, 44% of managers increased investments in spot BTC-ETFs, while another 22% maintained their position size.

In May, BlackRock’s head of digital assets, Robert Mitchnick, expressed expectations of a new wave of inflows into products due to institutional participation.

In April, analysts at Bernstein made a similar forecast.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!