Bitcoin falls, Ethereum’s record-high average fees, and other events of the week

As the week draws to a close, we recall Bitcoin’s fall, a new record for average Ethereum network fees, DeFi-sector news amid the ongoing boom, and other key events.

Bitcoin slumped to $10,000

The price of the leading cryptocurrency began the week higher and on Tuesday, September 1, rose above $12,000.

A renewed attempt to hold above the key level failed. The price пробила the $11,000 level on Thursday, September 3.

In the following days prices repeatedly опускались below the psychologically important $10,000 mark, but the cryptocurrency managed to hold it.

At the time of writing, Bitcoin was trading around $10,200.

Source: TradingView.

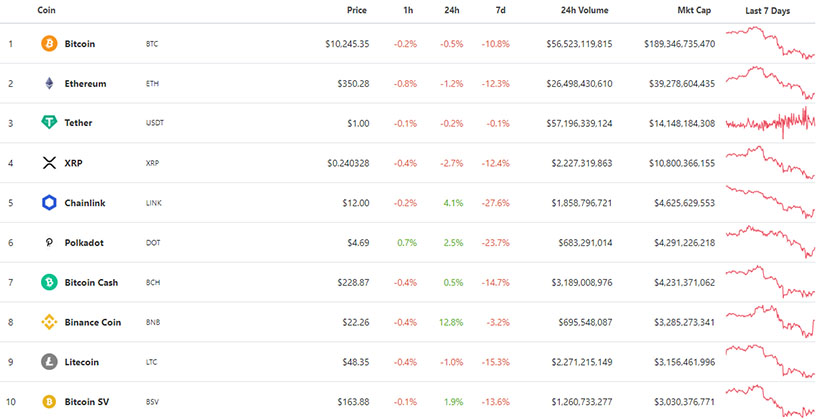

Ethereum (ETH) price by the end of the week fell below $400. The losses of the largest-cap cryptocurrencies since the start of the period are measured in double-digit percentages. The exception was Binance Coin (BNB).

Source: CoinGecko.

The market capitalization fell to around $335 billion (CoinGecko).

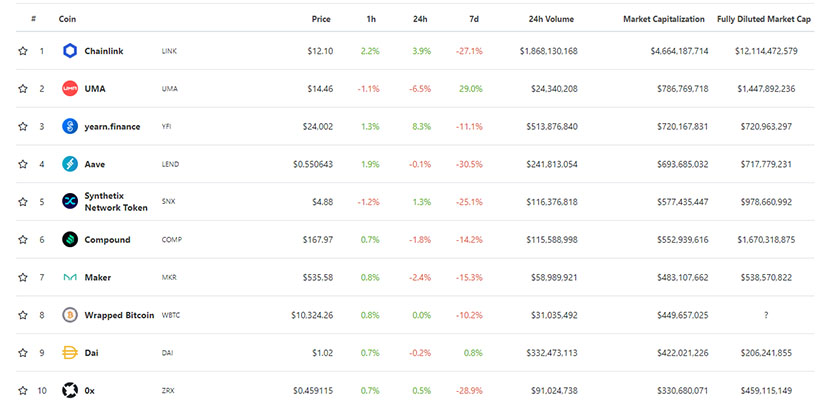

No less dramatic decline occurred in the DeFi-token sector. Of the leading coins, UMA was the only one to move against the market.

Source: CoinGecko.

The average Ethereum network fee exceeded $10

On Tuesday, September 1, the average Ethereum network fee обновил an all-time high of $10, according to Blockchair.

By comparison, Bitcoin’s fee stood at $3.57.

The rise in miner revenue from confirming transactions on Ethereum occurred amid rising popularity of Ponzi schemes and DeFi protocols, as well as greater use of stablecoins.

Russian Finance Ministry proposes amendments to the law on digital assets — mining without rewards and prison terms

The Russian Finance Ministry circulated to other agencies the text of amendments to the law on digital financial assets (ЦФА), regulating cryptocurrency activity on the territory. ForkLog получил a copy of the document from an informed source.

The Finance Ministry proposes to prohibit the circulation and issuance of cryptocurrency, with the exception of inheritance transfers and enforcement in bankruptcy and enforcement proceedings.

Not prohibited is “the use of digital currency by third parties, production of mining equipment and operations in foreign information systems.”

«При этом запрещается получение цифровой валюты в качестве платы за эти действия», – указано в документе.

As noted by Dmitry Kirillov, senior lawyer at the tax practice of Bryan Cave Leighton Paisner (Russia) LLP and lecturer at Moscow Digital School, this effectively deprives miners of rewards without banning their activities.

The issuance and circulation of digital rights and digital currency bypassing Russian information infrastructure, in connection with earning large income, are punishable by a fine of up to 1 million rubles or imprisonment of up to four years. In cases of especially large damage, offenders face up to seven years in prison and a fine of up to 1 million rubles.

Illegal circulation of digital financial assets is punishable by a fine of up to 100,000 rubles for individuals and up to 1 million rubles for legal entities. Receiving payment in DFAs risks confiscation and a fine of up to 50,000 rubles for individuals and up to 500,000 rubles for legal entities.

Ukraine tops the world in cryptocurrency usage, says ministry

Ukraine’s citizens are the most active users of cryptocurrencies in the world, the Ministry of Digital Transformation said, citing a study by analytics firm Chainalysis.

The ministry explained that the crypto-usage index was calculated based on the value of transferred digital assets per capita, balances of coins on online wallets, and the volume of retail and P2P transactions under $10 000, calculated at purchasing-power parity.

The ministry attributed the popularity to the absence of a stock market, limited access to global capital markets and remittance channels, and high barriers to entry into the real-estate market.

The large community of Bitcoin developers in the country also contributes to cryptocurrency use, the ministry noted.

Investor loses 1,400 BTC using old Electrum wallet

Hackers похитили 1,400 bitcoins (~$14.3 million at the time of writing) from a cryptocurrency investor who had held the coins since 2017. He disclosed this on GitHub.

A user under the handle 1400BitcoinStolen said he stored the BTC in an Electrum wallet that he had not accessed since purchase.

Deciding to move the funds, he installed an older version of the app, but could not complete the transaction. A security prompt asked him to update the wallet to the latest version. After installing the update his funds moved to the attacker’s address.

Commenters noted that similar attacks have been ongoing since 2018. Last year, a DoS attack on Electrum servers saw hackers steal $4.6 million from 152,000 accounts.

Ethereum 2.0 testnet staking reaches 1.1 million ETH

As of August 31, the amount of coins locked for staking in the Ethereum 2.0 testnet called Medalla превысил 1.1 million ETH, according to Beaconcha data.

The number of validators reached 37 742, with another 11 558 in waiting. The average deposit size stood at 32.2 ETH.

The final Ethereum 2.0 testnet was запустили on August 4. On the first day подключились it, 20 349 validators locked more than 650 000 ETH. Medalla uses test coins with no value.

Исследователь выяснил, как Сатоши Накамото добыл свой первый миллион биткоинов

Сергio Лернер, head of innovation at IOV Labs and a developer of the RSK platform, объяснил how Bitcoin’s creator, Satoshi Nakamoto, mined his first million bitcoins.

In the study, the expert found that the miner could have used a multi-threaded hashing method not included in the first version of the client.

Lerner calls the miner “Patoshi” since there is not enough proof that he really is Satoshi Nakamoto. The researcher first wrote about the mysterious scheme in March 2013.

Modeling the mining of the first 18 000 blocks, Lerner concluded that Patoshi used a multi-threaded hashing method. It is believed the miner could have used about 50 CPUs or a single processor with threading extensions.

In Uniswap fork, assets locked at $800m after three days; administrator action hammered the token

Assets locked in SushiSwap превысил $815 million in the first three days of the DeFi project’s operation, according to Zippo.io.

According to the project’s blog, the fork differs from the original by the presence of the governance token SUSHI.

The project allocates SUSHI to liquidity providers at 0.05% of collected trading fees; 0.25% of the fees received are sent to them directly, whereas in Uniswap — 0.3%. The obtained tokens can be traded on the market or used in governance votes.

Creators of SushiSwap said they expected migration of liquidity providers to Uniswap pools. To incentivise the migration, they decided to mint ten times more tokens in the platform’s first two weeks than the planned 100.

According to the creators’ plan, once the migration is complete, transformed liquidity would support the initial SushiSwap pools and immediately launch the protocol.

Auditors agreed to review its security; experts from blockchain startup Quanstamp.

As a result, they выявили ten vulnerabilities in the code, but none were critical. Only two were rated as moderately dangerous by Quanstamp, three as minor, and the rest were informational, the startup noted.

Партнер Cinneamhain Ventures Адам Кокран обнаружил, that the SushiSwap administrator, nicknamed “Chef Nomi,” could at any moment dump $27 million in SUSHI, crashing the token price. The funds belonged to a developer fund controlled by Nomi.

Администратор заявил в ответ, что упомянутая сумма является его долей и он вправе ей распоряжаться.

Позднее Номи перевел половину средств фонда в Ethereum. Цена SUSHI за сутки упала на 50% — с отметок в районе $4,60 до $2,26.

Cochran отметил, that the sale of tokens from the fund was not planned and that Nomi did this without the knowledge of the other developers. He came to this conclusion based on a tweet by SushiSwap’s co-founder.

Subsequently, Nomi заявил that control of the platform would be handed to its founder and CEO of the FTX exchange, Sam Bankman-Fried.

According to one of his tweets, users speculated that the administrator would indeed leave the project. Fantom Foundation technical adviser Andre Cronje asked whether Nomi would consider returning $14 million to the developers’ fund. Some users supported him; Sam Bankman-Fried weighed in favor of partial refunds.

Thanks to the SushiSwap boom, Uniswap вышла to the lead among DeFi projects by the volume of assets locked. By week’s end, the DEX ceded first place to the Aave protocol, according to DeFiPulse.

Attempts by Pizzafinance.com and Hotdogswap to repeat SushiSwap’s success обернулись in a classic Pump & Dump. They also positioned themselves as Uniswap forks. Less than a day after listing on exchanges, their native tokens effectively collapsed.

Vitalik Buterin сравнил DeFi activity to the Federal Reserve’s printing press and said he avoids the space until it takes a more stable form.

OKEx CEO Jay Hao предупредил investors about the risk of losing money in the “DeFi bubble,” while expressing confidence in the sector’s prospects.

What else to read and watch?

This week ForkLog вышел a piece on the use of the “Belarusian Solidarity Fund” to pay compensation to Belarusians fired for active civic stance and participation in protests against President Alexander Lukashenko.

ForkLog разобрал research on the current development of central bank digital currencies (CBDCs). It details why central banks are betting on CBDCs and what conclusions they drew from the study and experiments.

Also вышел a traditional digest of blockchain projects and initiatives in recent weeks.

During ForkShow, experts discussed the prospects of Belarus’s IT sector amid the protests.

In a new ForkLog video, we explored what DeFi is, the opportunities and risks the sector presents.

Follow ForkLog on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!