Bitcoin hints at an October upswing

Analysts point to bitcoin’s renewed correlation with gold

Bitcoin rose 5% in September despite volatility. Analysts have highlighted several key indicators pointing to a potential “big move”.

CryptoQuant pointed to a drop in the RSI of the Stablecoin Supply Ratio to multi-month lows — to 21. The metric measures the purchasing power of stablecoins relative to digital gold and currently sits in accumulation territory.

Stablecoin Supply Ratio RSI Signals Buy 🔍

The Stablecoin Supply Ratio (SSR) RSI is at 21, and is ‘buy’ territory. The Stablecoin Supply Ratio (SSR) measures the buying power of stablecoins relative to Bitcoin.

It’s calculated by dividing Bitcoin’s market cap by the market cap… pic.twitter.com/ZXV9UE7p5y

— CryptoQuant.com (@cryptoquant_com) September 30, 2025

Similar readings in May coincided with the formation of a price bottom for bitcoin below $75,000. A 67% rally followed, to an all-time high near $124,500.

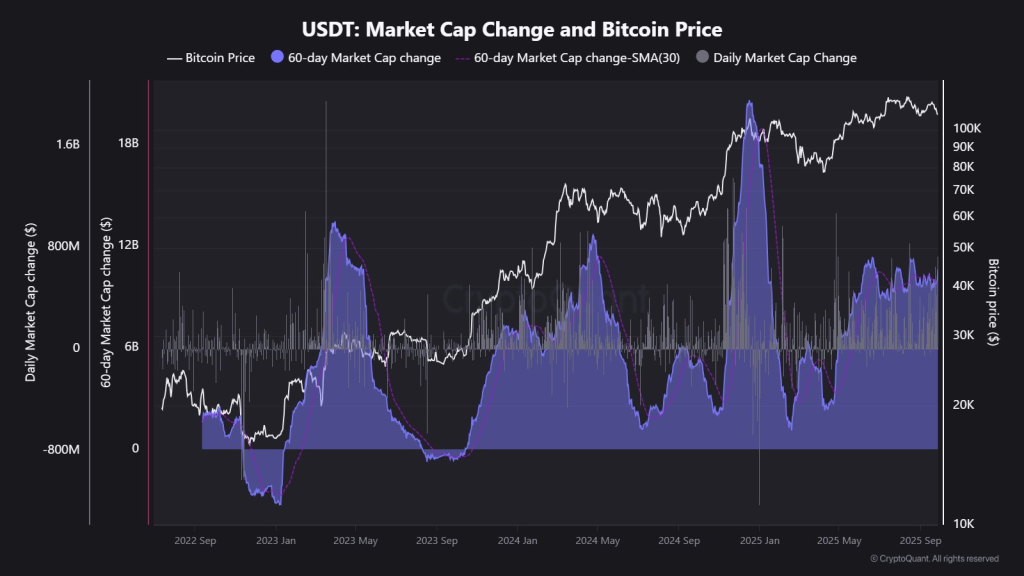

The ratio’s decline points to rising stablecoin purchasing power, corroborated by growing liquidity — issuance of more than $10bn of USDT over the past 60 days.

“This is a clear sign of fresh liquidity flowing into the market. The growth in the supply of stablecoins creates a powerful foundation for a bull market,” the experts stated.

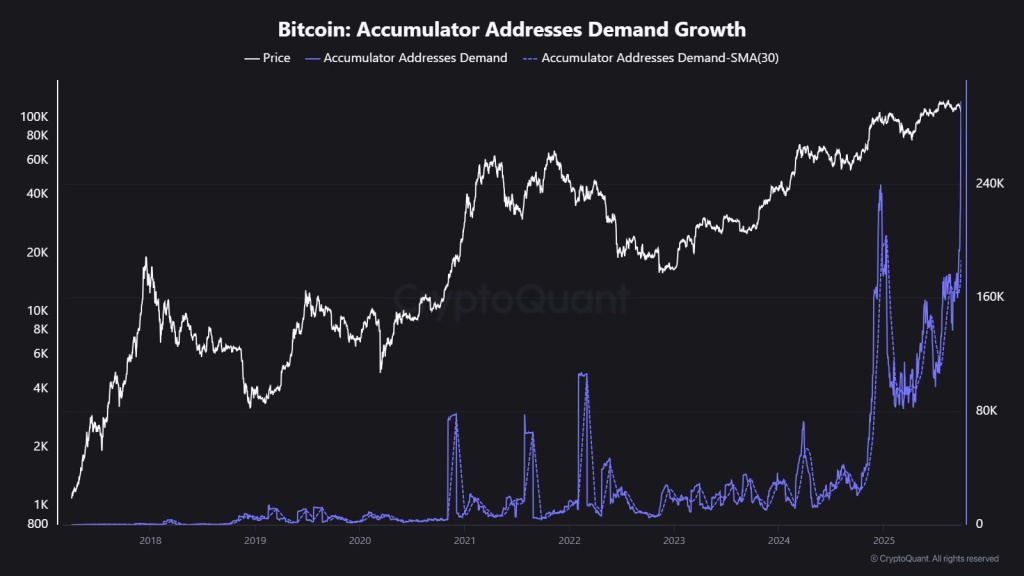

CryptoQuant also noted that long-term bitcoin holders continue to add to positions. Their addresses now hold a record 298,000 BTC.

According to the specialists, that points to optimistic sentiment about the potential of the leading cryptocurrency among investors.

Forming a bottom

Earlier, Bitwise noted the end of bitcoin’s decline phase. The experts said sellers look “increasingly exhausted”.

Analytics platform Swissblock also stressed that the crypto market has shifted into a “reset”. This is shown by the Impulse Signal indicator, which tracks price dynamics across 350 leading assets. The metric has fallen from 100% a few weeks ago to 20% now.

3/ At that exact point, the Impulse Signal collapses to zero.

That’s the moment panic exhausts and new buyers step in.

Since early 2024, this reset has only happened 3 times.

Each one marked a cycle bottom.

Each one was followed by a sustained recovery.We are approaching that… pic.twitter.com/a6szs47CtH

— Swissblock (@swissblock__) September 30, 2025

“This is the moment when panic exhausts itself and new buyers step in,” the experts noted.

They added that since early 2024 this has happened only three times, and each marked a “cycle bottom” for digital gold. A sustained recovery in the cryptocurrency’s price followed.

“We are approaching that configuration again,” Swissblock concluded.

Correlation with gold resumes

Over the past 24 hours, bitcoin’s price has risen by 3.5%. At the time of writing the leading cryptocurrency trades around $116,500.

The asset’s recovery coincided with a rise in gold, which reached a new all-time high. On October 1 the precious metal climbed to a record $3,895 per ounce.

Technical analysis confirmed a resumption of bitcoin’s correlation with gold: a trader under the handle HTL-NL published a chart of BTC priced in the metal. It shows an attempt to break a key long-term resistance.

$BTC in gold. pic.twitter.com/XhVxMk655A

— HTL-NL 🇳🇱 (@htltimor) October 1, 2025

The head of Bitwise’s European research unit, Andre Dragosch, believes that gold’s rally has run its course. In his view, that could benefit risk assets, including cryptocurrencies.

“Green” September

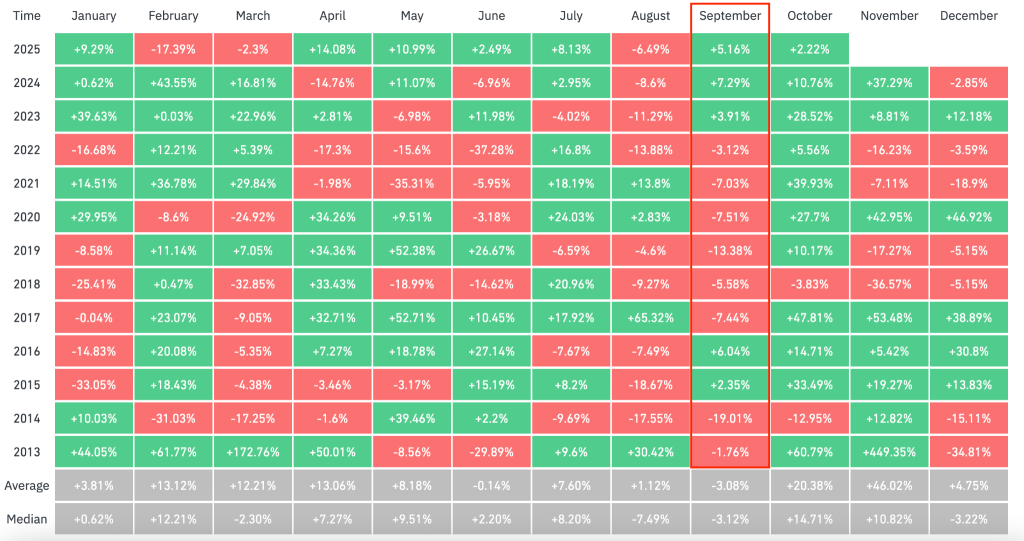

For the third year running, bitcoin finished September in the green. Historically, the month has been one of the worst for digital gold.

An analyst going by Mikybull Crypto noted that after each positive September for the cryptocurrency “a large-scale rally in the fourth quarter followed”.

Earlier, experts forecast Uptober despite signals of fear.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!