Bitcoin hits a new rally, US seizes 69,370 BTC from Silk Road, and other events of the week

In reviewing the passing week, we recall Bitcoin’s new local high, the US authorities’ seizure of 69,370 BTC from Silk Road, the launch of the Ethereum 2.0 deposit contract, and other key events.

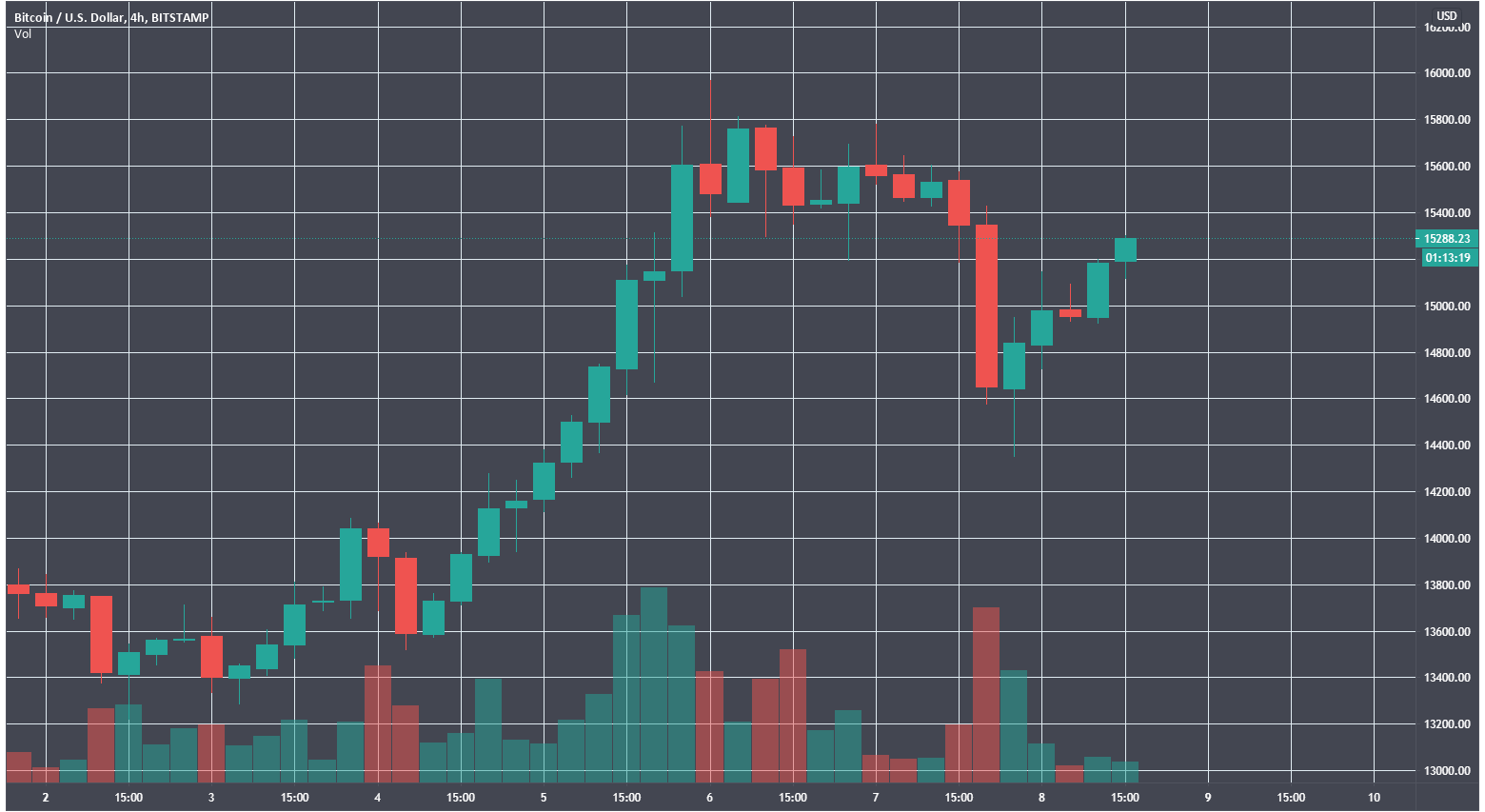

Bitcoin price hits its highest level since January 2018

On Tuesday evening, November 3, Bitcoin again breached the $14,000 mark but failed to sustain above it.

In the night of November 6, prices neared to $16 000 (Bitstamp).

This level could not be conquered, and a correction began. The price briefly dipped below $14 500, but at the time of writing had risen back above $15 000.

Source: TradingView.

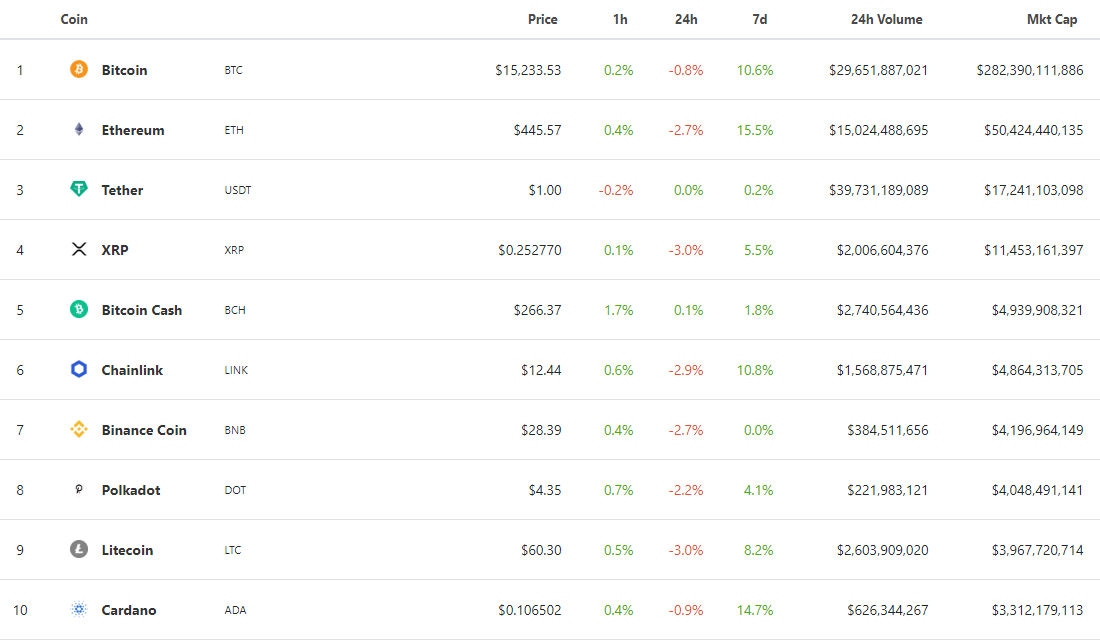

Some altcoins outpaced Bitcoin on growth. Cardano (ADA) and Ethereum (ETH) rose by 14.7% and 15.5% respectively over the period, vs Bitcoin’s 10.6% (Coingecko).

Source: Coingecko.

The cryptocurrency market capitalization surpassed $446 billion, and the dominance of the leading cryptocurrency stood at 63.2%.

Bloomberg analyst Mike McGlone said that Bitcoin could endure a parabolic rise in 2021, in analogy with 2013 and 2017.

According to the popular Twitter analyst PlanB, this is indicated by repeated RSI-patterns in Bitcoin’s chart.

I have seen this show before 😎 2012/2013 and 2016/2017 pic.twitter.com/tRGPDJ1ffR

— PlanB (@100trillionUSD) November 5, 2020

The growth of the DeFi token market continued, with tokens from several leading projects, including Aave, Synthetix, and yEarn.Finance, rising over the week by far more than the largest cryptocurrencies.

Source: Coingecko.

US Department of Justice takes control of 69 370 BTC

On November 3, from the fourth-largest Bitcoin wallet 69 370 BTC worth over $1 billion at the time were moved.

Analytical company Elliptic found that these coins left the Silk Road darknet wallet in 2012. The Bitcoins lay dormant for a year, then they were moved to a new address, where they remained until November 2020. Only in 2015 was 101 BTC sent from the wallet to the BTC-e exchange, later shut down by American authorities as part of an investigation into a large money-laundering scheme.

For several years, the wallet.dat file was sold on hacker forums. After the movement of funds, many concluded that someone managed to obtain the private key.

But the US Department of Justice announced that it had confiscated the coins. The department explained that the hacker, who goes by the alias Invidividual X, stole the Bitcoin from Silk Road. The founder of the darknet market, Ross Ulbricht, serving a life sentence, threatened Invididual X in an attempt to recover the funds. The hacker did not do so and kept almost all of the stolen coins.

Law enforcement later revealed the identity of Invididual X, after which he signed an agreement to surrender the Bitcoins.

The DOJ also obtained corresponding amounts in Bitcoin Cash, Bitcoin SV and Bitcoin Gold. The department stressed that this is the largest seized cryptocurrency amount in its history.

The investigation was assisted by the analytics firm Chainalysis.

Developers confirm Ethereum 2.0 genesis block date

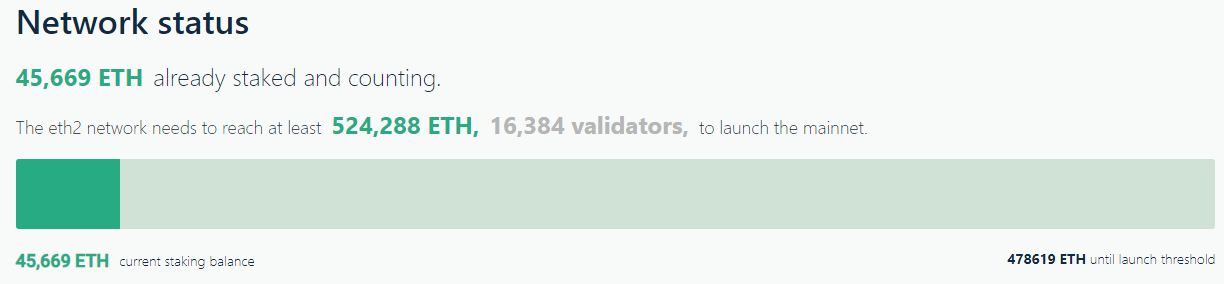

In the Ethereum Foundation, officials confirmed the launch of the ETH2 deposit contract, and named the genesis block date — December 1, 2020 at 15:00 (MSK).

The deposit contract allows sending ETH from the current network to ETH2, confirming the stake of validators.

The minimum threshold to obtain validator status in Ethereum 2.0 is 32 ETH. The launch condition for the main Ethereum 2.0 network is the participation of 16,384 validators, who by the stated date must contribute in total 524,288 ETH.

Source: launchpad.ethereum.

Vitalik Buterin sent 3,200 ETH to the deposit contract.

What is Ethereum 2.0?

Bitcoin network experiences largest drop in difficulty since 2011

As a result of another retargetting, Bitcoin mining difficulty decreased by 16.05%, according to BTC.com.

The drop occurred at block 655,200, mined on November 3 at 11:28 MSK. The value fell from a previous high of 20 T to 16.79 T.

This is the largest difficulty drop since October 2011. Its cause was a recent decrease in hashrate by 27% amid the end of the monsoon season in Sichuan and the related migration of miners.

On the eve of the hard fork, the largest Bitcoin Cash client loses community support

On November 15 a planned hard fork will take place in the Bitcoin Cash network, which is likely to yield the new Bitcoin Cash Node (BCHN) chain. Earlier this month it became clear that BCHN dominates, confidently ahead of the largest Bitcoin Cash ABC by node count.

Over the past seven days, more than 80% of nodes signaled support for BCHN, while only 0.4% supported ABC.

Source: Coin Dance.

Lead Bitcoin Cash ABC developer Amori Seshe announced a network update for August this year. By November 15 all nodes must upgrade their software, otherwise they will remain on the alternative chain.

The update will implement a new difficulty-adjustment algorithm named ASERT. It is expected that, along with it, the problem of delays in forming new blocks will disappear.

Another innovation is the implementation of the Coinbase Rule. It will reject blocks that do not contribute 8% of rewards to the Bitcoin Cash Development Fund. This provoked major disagreements — a significant portion of the community did not agree with such a proposal, releasing the BCHN client without support for this option.

Justin Sun reports a major attack on the Tron network

Tron founder Justin Sun said that the mainnet was subjected to a large-scale attack that halted block production.

According to him, the attacker targeted Tron with a malicious contract during the protocol upgrade to version 4.1. The attack occurred on November 2 at 1:14 (MSK).

The hacker exploited the contract developer’s privileges and initiated malicious transactions, forcing super representatives to halt block creation. In Sun’s view, the attacker aimed to extract value.

«The community reacted immediately, localized and fixed the issue, while also working with super representatives to update the nodes», — wrote the founder of Tron.

Block production on the network gradually resumed after 3:29, and Tron’s operations were fully normalised by 4:40.

What to read and watch next?

During the week we published a new part of Dmitry Bondar’s series on non-fungible tokens (NFTs), in which he discussed the common features between cryptocurrencies and collectibles.

Experts told ForkLog what threats the proposed changes to the Currency Regulation and Currency Control law pose for Russian crypto-wallet owners and Bitcoin exchange accounts.

We analyzed scenarios opened up for Bitcoin transactions by including Schnorr signatures and Taproot/Tapscript in the Bitcoin Core client.

On Monday, November 2, ForkLog hosted an online conference, “Centralised Exchanges and DEXs: Pros, Cons, Differences.”

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!