Bitcoin holds above $87,000

Bitcoin climbed past $87,000 as concerns over potential US import tariffs eased. On Binance, the price briefly hit $87,564.

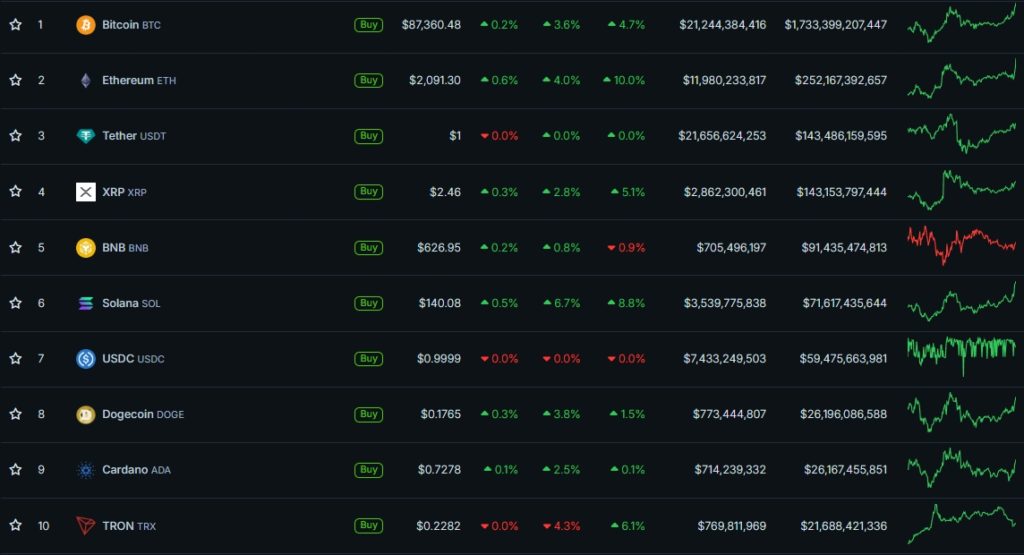

Over the past 24 hours, the price rose 3.6%. Among the largest altcoins by market value, memecoin Dogecoin added 3.8% and Ethereum 4%. Solana gained 6.6%. Tron remained in the red, down 4.3%.

Crypto market capitalisation returned to $2.96 trillion, up 1.3% in 24 hours.

Macro signals add optimism

On Saturday, Bloomberg, citing its own sources, reported that the administration of US President Donald Trump is shifting to a more “targeted” approach to the announced trade tariffs. The president is said to be ready to drop fixed rates across a broad range of countries and blocs. The policy is expected to be more flexible, with an emphasis on “reciprocal” proposals and the use of non-tariff barriers.

“Crypto markets are rising as investors respond positively to Trump’s more accommodating stance on tariffs that will go into effect on April 2, as well as the Fed’s focus on long-term inflation trends,” Kronos Research investment director Vincent Liu told The Block.

Annual inflation in the US in February came in at 2.8%—the lowest since November 2024. At its March meeting, the central bank left the key rate unchanged in a 4.25–4.5% range. Starting in April, the Fed will slow the runoff of securities, cutting the monthly cap on Treasuries from $25 billion to $5 billion.

Former BitMEX CEO Arthur Hayes saw this as signs of a slowdown in quantitative tightening by the regulator. That, he argued, means bitcoin has already put in a bottom at $77,000.

On March 24, Hayes reaffirmed his view that the Fed has effectively shifted to quantitative easing in Treasuries.

I bet $BTC hits $110k before it retests $76.5k.

Y? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause “transitory inflation”. JAYPOW told me so.

I’ll expound on that in my next essay, that’s the TLDR for your TikTok peanut brain.

— Arthur Hayes (@CryptoHayes) March 24, 2025

“I bet that bitcoin will reach $110,000 before it retests $76,500,” the expert said.

10x Research noted that it had previously anticipated a deeper correction in the leading cryptocurrency after the $95,000 level failed. In light of a possible softening of Trump’s tariff policy and the Fed’s decisions, its analysts also suggested the asset has likely found a bottom, with a subsequent rise toward $90,000.

Bitcoin Bottom Forming? Fed Eases, Trump Softens Tariffs, Altcoins Break Out?

?1-13) We anticipated a deeper correction after Bitcoin broke below $95,000, confirming the breakdown from its ascending broadening wedge. However, over the past week, we’ve adopted a more… pic.twitter.com/2VU7suBvdq

— 10x Research (@10x_Research) March 23, 2025

They pointed to reversal indicators that have returned to levels that preceded the start of previous bull runs—in September 2023 and August 2024.

“In short, the technical backdrop has now reached a point where a new uptrend is quite likely,” 10x Research wrote in a note to investors.

Even so, the firm expects “significant resistance” around $90,000 and sees no “clear catalyst for an immediate parabolic rally”.

Bear already, or still bull? Forecasts diverge

In February, Matrixport forecast that the correction in the leading cryptocurrency would end in March or April.

Some Wall Street analysts allowed for a resumption of gains for bitcoin in April. However, several capped the prospective uptrend at resistance around $90,000, arguing the coin is unlikely to clear it without a meaningful catalyst for a reversal.

CryptoQuant founder and CEO Ki Young Ju said in March that the bull market had ended for bitcoin. In his view, prices will fall or move sideways over the next six to 12 months.

Later, responding to the main counterarguments, the analyst dismissed the notion of a coming wave of retail investors as a growth driver. He noted that most retail participants have already gained exposure to “digital gold” via ETFs, which on-chain data do not capture.

Let me respond to a few counterarguments:

1/ Retail hasn’t entered the market yet based on on-chain metrics

Retail is likely entering through ETFs — the paper Bitcoin layer — which doesn’t show up on-chain. This keeps the realized cap lower than if the funds were flowing…

— Ki Young Ju (@ki_young_ju) March 19, 2025

Economist Timothy Peterson, author of “Metcalfe’s Law as a Model for Bitcoin’s Value”, noted that since 2015 the cryptocurrency has endured ten bear markets, defined as a 20% drop from all-time highs.

Every Bitcoin Bear Market Since 2015

Since 2015 there have been 10 Bitcoin bear markets, defined as a 20% decline from ATH. About one every year, these are common.

Of those, only 4 have been worse than this one in terms of duration: 2018, ’21, ’22, ’24.

In terms of… pic.twitter.com/ywVw8InId0

— Timothy Peterson (@nsquaredvalue) March 22, 2025

“Judging purely by baseline adoption value, bitcoin is unlikely to fall below $50,000. From a price-dynamics perspective, it will struggle to break even $80,000, especially given that central banks are leaning toward looser monetary policy,” Peterson said.

He estimates the current bear market will last 90 days from the ATH. A further dip is possible, but from around mid-April prices would then rise by 20–40%, he forecast.

Earlier, QCP Capital questioned the strength of bitcoin’s support around $80,000, while analysts at Material Indicators explained what is keeping the price below $87,500.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!