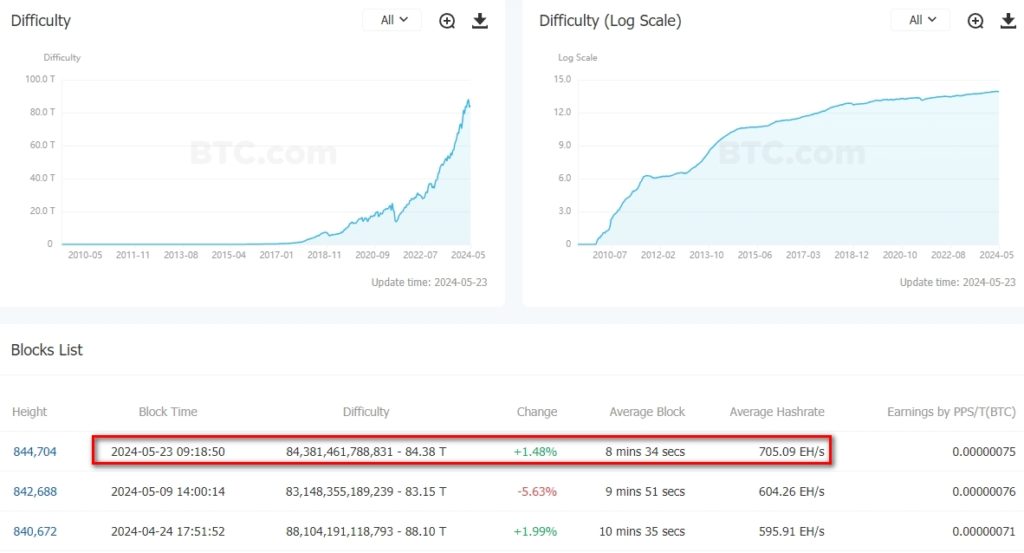

Bitcoin Mining Difficulty Rises by Nearly 1.5%

The latest recalibration has increased the difficulty of mining the leading cryptocurrency by 1.48%, reaching 84.38 T.

The average hash rate since the previous adjustment was 705 EH/s. The interval between blocks has shortened to approximately 8.5 minutes instead of the algorithm’s intended 10 minutes.

Despite the increase, the difficulty has not yet recovered from the nearly 6% drop that followed the halving.

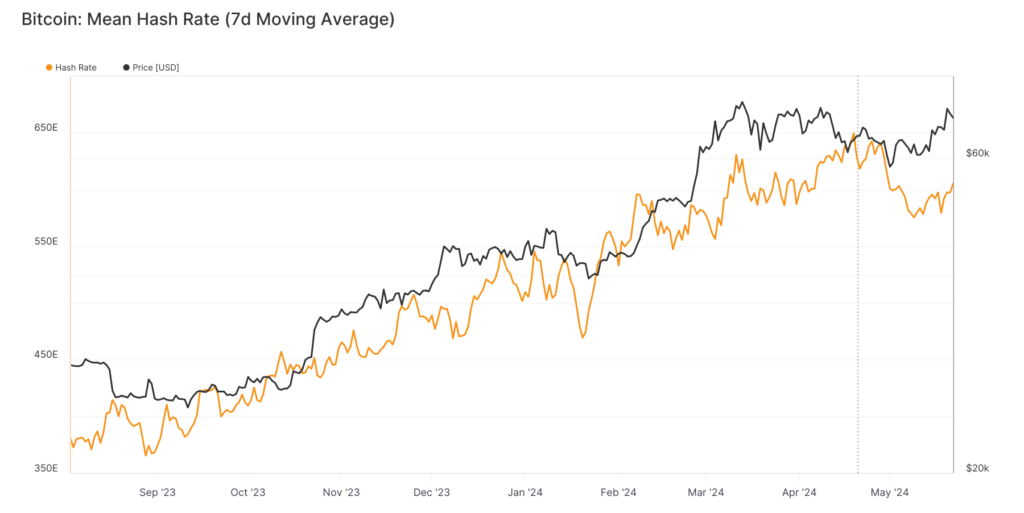

According to Glassnode, the network’s computational power, smoothed by a 7-day moving average, peaked at 649.7 EH/s on April 19, just before the block reward reduction. It then fell to 575.3 EH/s but has since recovered to around 605 EH/s at the time of writing.

Experts had predicted that miners would shut down some equipment post-halving due to economic inefficiency. Estimates varied from 15-20% by Galaxy Digital specialists to 5-10% by Hashlabs Mining co-founder Jaran Mellerud. His forecast proved closer to reality.

According to Hashrate Index, hash price fell from ~$100-120 per PH/s per day to around $50. In early May, miners’ total revenue plummeted to 2023 lows.

The resurgence of Bitcoin’s price towards $70,000 helped the hash price recover to ~$55 per PH/s. However, the increase in difficulty will exert additional pressure on mining profitability.

According to Bernstein analysts, a flat trajectory in the cryptocurrency’s price post-halving benefits large public companies in the industry, which are expanding their share of the hash rate through organic growth. Their expansion is facilitated by substantial cash reserves and accumulated Bitcoin holdings.

Earlier, ForkLog detailed miners’ operational results for April amid the halving in its traditional digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!