Mining in 2025: The Worst Profitability Crisis in History Amid Bitcoin ATH

Record bitcoin price, record pain for miners: margins squeezed, AI pivot accelerates.

Bitcoin set a new all-time high, yet miners faced the toughest operating economics on record. Their responses included both ramping up hashrate and accelerating diversification into AI.

Here is what else defined 2025 for the industry that secures the original cryptocurrency.

- Bitcoin hashrate topped the symbolic 1 ZH/s mark.

- Rising network difficulty and a flat price squeezed mining economics.

- “Trump tariffs” did not dent America’s dominance in mining.

- Miners’ diversification into AI accelerated.

Technically, the network strengthened markedly

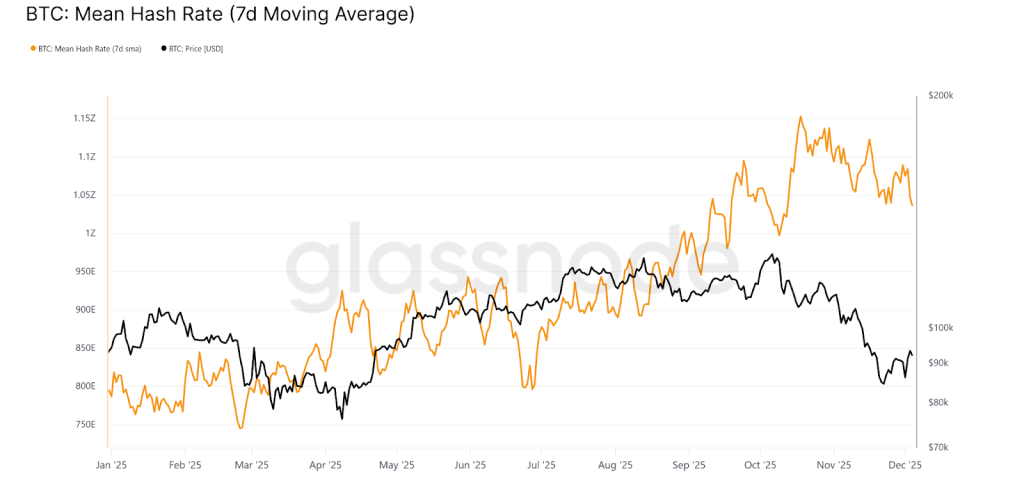

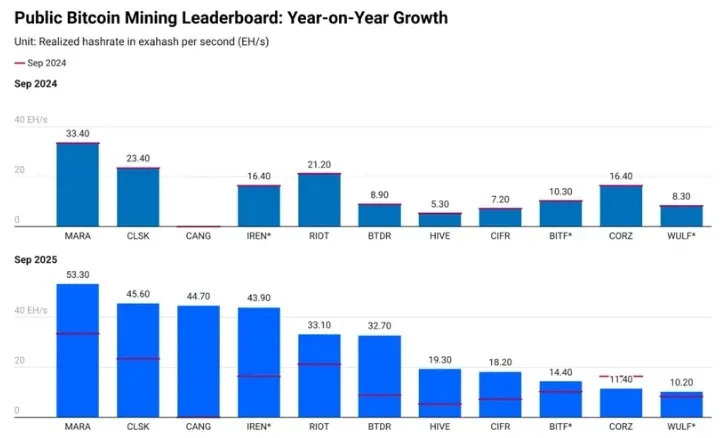

Hashrate started the year around 800 EH/s and in October reached an all-time high of 1.15 ZH/s (7 DMA). After the autumn sell-off, the metric corrected but held the late-August level of 1 ZH/s.

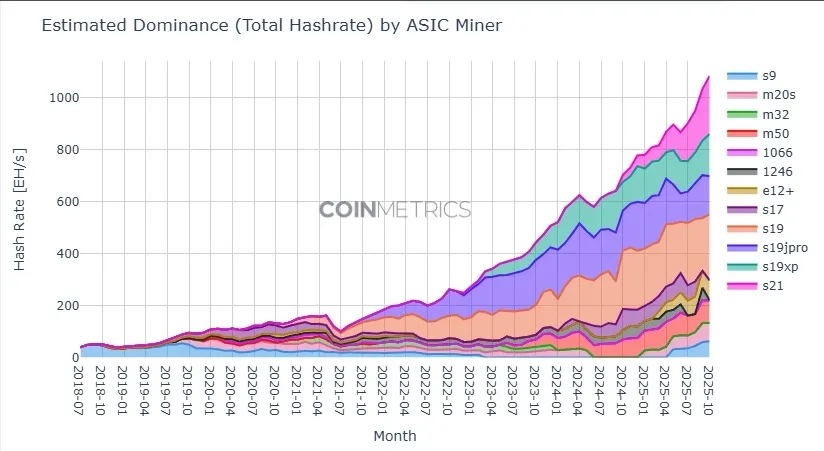

The increase since January was about 25%. According to Coin Metrics, mass deployment of Antminer S21 rigs with energy efficiency of 13–16.5 J/TH, depending on the model, contributed significantly. By October their share of aggregate hashrate had reached roughly 20%.

The bitcoin rally that began after Donald Trump’s election as US president in November 2024 brought back fairly old Whatsminer M32 units. Launched in August 2020, they run at around 50 J/TH. Since January the share of Antminer S9s, first released in 2017 and rated at ~93 J/TH, has also been rising. Together these ASICs generate ~15% of hashrate.

Various Antminer S19 variants remain the backbone of the global fleet, accounting for about half of the network’s compute.

Difficulty, which correlates with hashrate, hit an all-time high in late October at 155.98 T. Against this backdrop, MARA Holdings CEO Fred Thiel stated that the industry had entered an exceptionally tough period owing to rising competition and falling profitability.

The most severe profitability crunch in mining

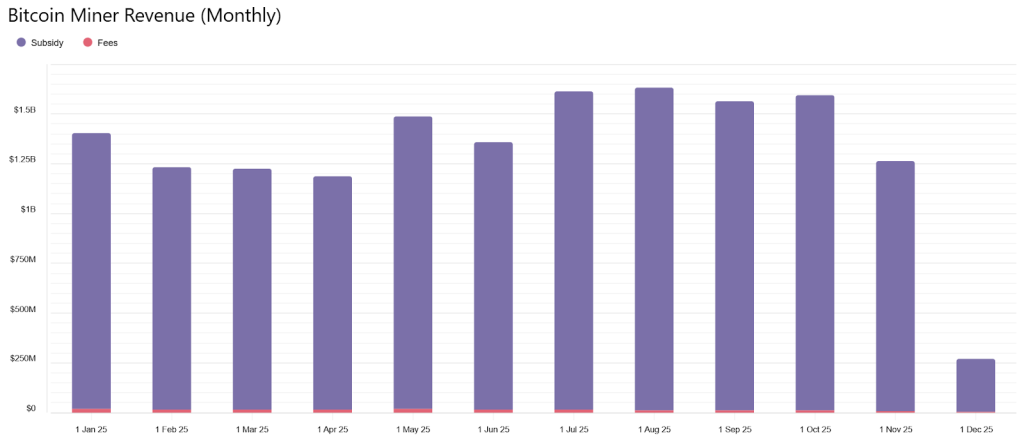

Through the year, miners’ revenue broadly followed bitcoin’s price. Since July, fees’ share of total revenue fell below 1%; income was almost entirely from block rewards. Following the April 2024 halving, the reward is 3.125 BTC—roughly 450 BTC per day.

Monthly revenue ranged from about $1.19bn (April) to about $1.63bn (August).

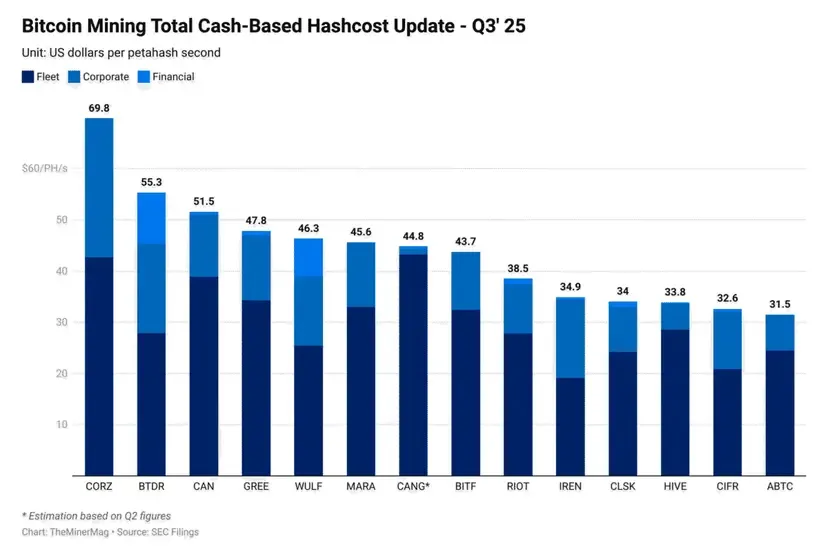

Per CoinShares, in the second quarter the average direct cash cost to mine a bitcoin at public miners was about $74,600. Including non-cash expenses such as depreciation and stock-based compensation, the figure rose to $137,800.

Bitcoin only reached a record $126,080 in early October.

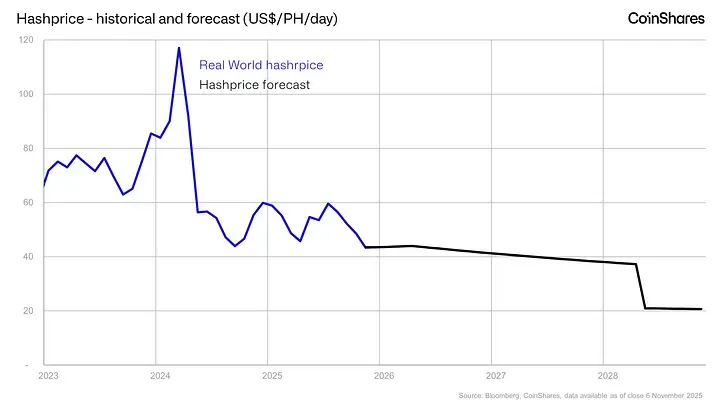

Hashprice hit a year-to-date high in July of $63.9 per PH/s per day. In subsequent months the mining profitability metric fell steadily under pressure from rising difficulty and competition.

After November’s plunge of the original cryptocurrency below $83,000, hashprice fell to a yearly low of about $35 per PH/s. Despite a later rebound, it did not rise above $40.

Meanwhile the median “cost of hash” among public miners in the third quarter was roughly $44 per PH/s. The figure includes equipment operating costs, corporate expenses and financing. It signalled that even operators with efficient fleets and competitive power tariffs were hovering around breakeven.

TheMinerMag’s experts concluded miners faced the harshest profitability conditions in history.

Payback periods for latest-generation rigs exceeded 1,000 days—well beyond the time left until the next halving. Around April 2028 the block reward will drop to 1.5625 BTC.

CoinShares projects hashprice will stay in a $37–55 range until then. Breaking out would require a substantial rise in bitcoin’s price, as rising hashrate would absorb a moderate rally. The firm estimates network compute will reach 2 ZH/s in early 2027.

Commenting on the tough economics, CoinShares’ head of research James Butterfill said:

“Against this backdrop, a clear strategic divergence has formed in the industry. A growing cohort of miners has accelerated its pivot toward AI and high-performance computing infrastructure, seeking to diversify the business away from an increasingly competitive and less profitable bitcoin mining.”

Diversification into AI gathers pace

The pivot by bitcoin miners toward serving the higher-margin AI sector was already evident last year. In 2025 it broadened, and deals ran into the billions of dollars.

At the SALT conference in Jackson Hole in August, CleanSpark CEO Matt Schultz noted that where industry attendees once talked about hashrate, they now “discuss how to monetise megawatts”. TeraWulf CFO Patrick Flaherty admitted that even with the digital gold trading above $110,000 (at the time), electricity costs consume up to half of miners’ revenue.

CleanSpark doubled annual revenue thanks to AI initiatives. Others in the industry also made notable moves:

- TeraWulf signed a 10-year contract with cloud platform Fluidstack worth $3.7bn. Google acted as financial guarantor, becoming the miner’s largest shareholder;

- Cipher Mining entered into a lease with Amazon Web Services (AWS) worth $5.5bn to support AI computing;

- IREN will provide Microsoft with GPU-based cloud services. The total value of the five-year agreement is about $9.7bn.

One of the oldest public mining firms, Bitfarms, announced it would gradually wind down bitcoin mining by 2027 and pivot to AI infrastructure.

Galaxy Digital also decided to repurpose the Helios mining centre entirely for AI under an agreement with the hyperscaler CoreWeave. In late 2022 Mike Novogratz’s company bought the facility for $65m from Argo Blockchain, which was experiencing financial difficulties, becoming a significant hosting player for miners.

Riot Platforms vice-president Josh Kane said the firm no longer sees mining as the end goal, but rather as a means to achieve it.

Its core aim is to maximise the value of access to electricity, including via more profitable lines of business.

Even miners focused on AI diversification continued to expand their own hashrate, albeit at different speeds.

Among major public companies, Core Scientific was the exception, which CoreWeave sought to acquire for $9bn. The hyperscaler was already a partner and suggested that, after a merger, crypto-mining operations would gradually be wound down. Core Scientific’s large shareholders rejected the deal as undervaluing the company.

One reason even miners expanding into AI still raised hashrate, analysts said, is the cash flow generated by established crypto-mining. It helps fund operations, since repurposing infrastructure requires significant capital and time.

CoinShares analysts noted that building and operating a bitcoin mine typically costs around $700,000–1m per MW, whereas an AI data centre can cost up to $20m per MW. The gap reflects the redundancy and reliability needed to achieve 99.99% uptime.

To cover rising costs—both for upgrading mining fleets and refitting infrastructure for high-performance computing—companies tapped financing. As a result, miners’ aggregate debt rose sixfold over the year, from $2.1bn to $12.7bn.

Another reason to maintain a meaningful share of bitcoin’s hashrate was a bet on potential attrition: if many miners operating at a loss switch off, the network’s difficulty will fall and profitability for those left standing will jump.

MARA’s chief was blunt. The company’s task is to keep mining costs such that economic pressure forces at least 75% of competitors offline. Yet lowering costs is everyone’s goal—firms are shoring up balance-sheets, cutting corporate expenses and improving fleet efficiency. Equipment makers are responding to miners’ demands.

ASIC manufacturers kept up the arms race

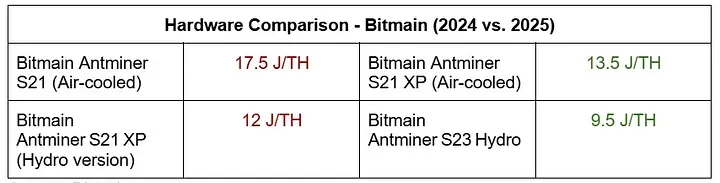

In May Bitmain unveiled the flagship of its newest bitcoin-miner series, the Antminer S23 Hydro, with a stated efficiency of 9.5 J/TH. The comparison below shows how the leading manufacturer has improved that parameter over the past two years.

In October Canaan unveiled a new generation of ASIC miners. The line-up includes two air-cooled models—Avalon A16 (282 TH/s) and Avalon A16XP (300 TH/s)—with power efficiency of 13.8 J/TH and 12.8 J/TH respectively.

Early in the year the company also launched the Avalon Mini 3 and Nano 3S, which combine bitcoin mining with home heating. The Avalon Mini 3 delivers 37.5 TH/s and provides up to 800 W of heat. The Avalon Nano 3S at 6 TH/s is a more powerful variant of the existing model.

In August Jack Dorsey’s Block introduced modular Proto Rig systems for bitcoin mining. The developers say the units offer several advantages, including longer service life and better repairability. The solution cuts mining costs by 15–20%.

As part of its roadmap, Bitdeer presented the SEALMINER A3 series in September. The air-cooled ASIC delivers 260 TH/s at 14 J/TH. The A3 Hydro model is rated at 500 TH/s and 13.5 J/TH.

In November, US firm Auradine opened pre-orders for third-generation Teraflux units. The miners are fully designed and manufactured in the United States, it said. In Eco mode the air-cooled model delivers 240 TH/s at 10.3 J/TH.

The liquid-cooled system delivers 600 TH/s at 9.8 J/TH. The immersion variant delivers 240 TH/s at the same efficiency.

In December at the Bitcoin MENA 2025 conference in Abu Dhabi, MicroBT presented its new WhatsMiner M70 series. The line-up spans three efficiency classes:

- 14.5 J/TH (entry model M70);

- 13.5 J/TH (M70S);

- 12.5 J/TH (M70S+).

Air-cooled units deliver 214–244 TH/s.

Immersion-cooled variants (M76 and M78) deliver 336–476 TH/s.

Thus, over the past year every leading manufacturer of bitcoin miners refreshed its model range.

In February it emerged that import issues for the latest Antminer S21 and T21 devices in the United States, which arose in the autumn of 2024, had worsened. Customs began detaining products from MicroBT and Canaan, also based in China. According to Bloomberg, Bitmain is the subject of a US investigation over potential national-security risks.

Meanwhile, the trend toward opening assembly operations in the United States continued to expand. The process accelerated after the the announcement of Trump’s “liberty tariffs”. Rates of 24–36% on goods from Malaysia, Thailand and Indonesia—where most ASIC production is located—threatened to hit demand from US miners. In 2024 they imported $2.3bn of equipment.

Following Canaan, MicroBT and Bitmain, Bitdeer also announced localisation in the United States.

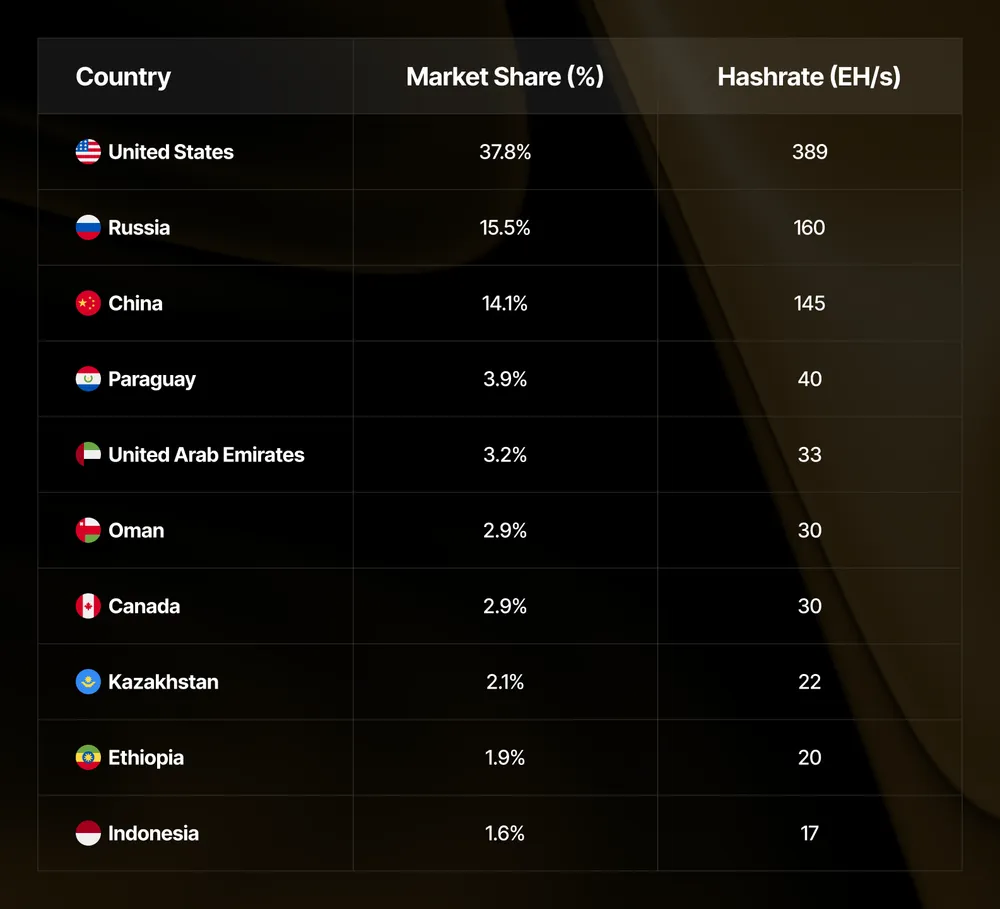

Some experts suggested tariff wars could shake America’s dominance in hashrate; they did not.

Mining geography: the leader remains the same

By the end of the third quarter, the US share of global hashrate was close to 40%. Russia held second place with 15.5%, and China exceeded 14%.

Together the three countries controlled about 67.5% of the network’s compute. But trends diverged. Contrary to fears, the United States continued to extend its lead, while Russia gradually lost share.

China’s mining history shows that access to cheap power remains one of the most important drivers of geography. Reuters confirmed that, after authorities banned crypto mining in 2021, it did not cease—it went underground.

After China’s share of global hashrate fell to zero, it recovered. Surplus electricity in former mining centres such as Xinjiang and Sichuan played a large role, as owners of remote coal, wind and hydro plants often struggle to find buyers.

Contrary to concerns about a miner exodus from the US because of “Trump tariffs”, hashrate in other jurisdictions did not show significant changes. Neighbouring Canada held around 3%. The top ten also included Paraguay (3.9%), Oman (2.9%) and Ethiopia (1.9%).

Not every country’s infrastructure can support crypto-mining loads. In Kyrgyzstan an electricity deficit forced the authorities to shut down all mining farms. Because of elevated loads, the conservation regime will last until the end of the heating season.

In Iran, authorities continued to crack down on illegal miners—over 95% of the country’s 427,000 devices are said to operate without licences.

Prospects for a wider geographic footprint also emerged. In March Belarusian president Alexander Lukashenko approved data-centre construction in the Mogilev region. Pakistan’s authorities signalled plans to direct surplus electricity to crypto mining and to power data centres that serve AI.

Turkmenistan’s president Serdar Berdymukhamedov signed a virtual-assets law that permits mining and crypto exchanges. It takes effect on January 1, 2026.

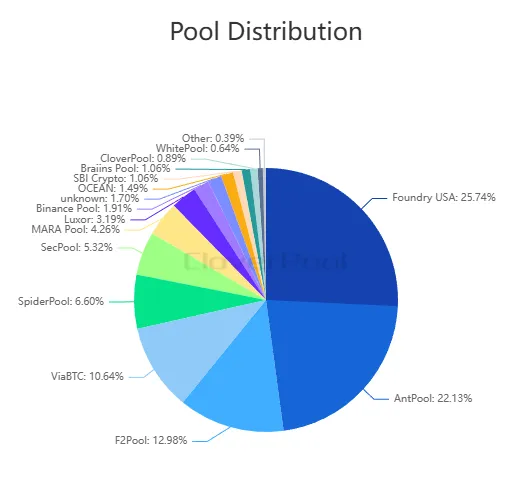

By pool, Foundry USA’s 25.7% share confirms US dominance in bitcoin’s hashrate. Add MARA Pool (4.3%) and Luxor (3.2%).

Bitmain-affiliated AntPool (22.1%) and F2Pool (13%), also registered in China, round out the top three.

In all, platforms from the two leading bitcoin-mining countries control more than two-thirds of network compute.

***

AI-service revenue still accounts for a small share of miners’ total takings, but it will grow as data centres are repurposed. Capex trends suggest a significant share of bitcoin mining is likely to shift again from large data centres, dominant in recent years, to smaller sites.

Under a more distributed model, miners will target cheap energy not wanted by traditional users—for example, idle capacity at remote power plants, flared gas on oilfields and other wasted resources. Participating in grid balancing is another option. That implies farms in container or even trailer form factors, offering compactness and mobility.

Just over two years remain until the next halving. With little reason to expect a step-change in price and/or on-chain activity in the interim, miners will have to adapt to economics that will tighten further after the next reward cut.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!