The Miner’s Dilemma: Choosing Between Bitcoin and AI for Computing Power

Bitcoin miners weigh dwindling margins against AI’s richer returns.

In November, experts reported the most severe profitability crisis in the industry to date. The costs per mining efficiency unit have risen significantly due to the adoption of advanced cooling technologies and next-generation ASICs.

In this environment, only miners with sufficient financial reserves can stay afloat and are effectively capturing hash rate share from weaker companies. Even these players are partially or fully diverting their computing power to AI infrastructure.

The 2028 halving will create even tougher conditions for survival and will heighten the industry’s dependence on the Bitcoin price. If the community fails to find ways to revitalise the on-chain economy to increase the share of transaction fees in miners’ revenue, the network of the original cryptocurrency risks becoming a collection of a few centralised conglomerates and governments—those with the strength to endure the “marathon of unprofitability.”

The Perfect Storm

For the first time in Bitcoin’s history, miners are facing a systemic crisis. Experts at TheMinerMag noted the unprecedented severity of current conditions in their weekly industry review.

While the industry entered the third quarter with a hashprice of $55 per PH/s per day, the figure plummeted to $34.21 per PH/s per day in November amid a sharp market crash.

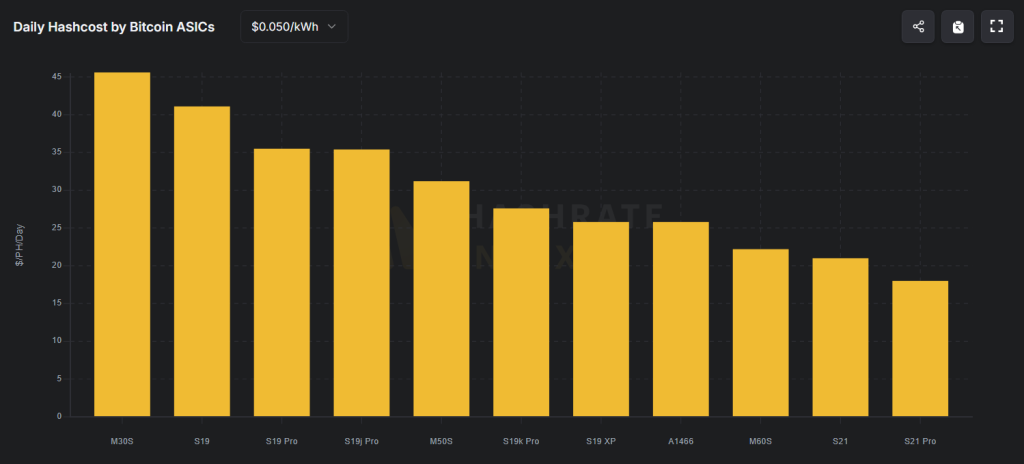

What is also concerning is the fact that even industry leaders, equipped with efficient hardware fleets and competitive electricity rates, are operating at the very edge of profitability. According to analysts, their median “hash cost” in Q3 was approximately $44 per PH/s per day.

So, what happens after the next reward cut? The next halving is expected around April 2028 and will reduce miners’ primary revenue from the current 3.125 BTC to 1.5625 BTC per block.

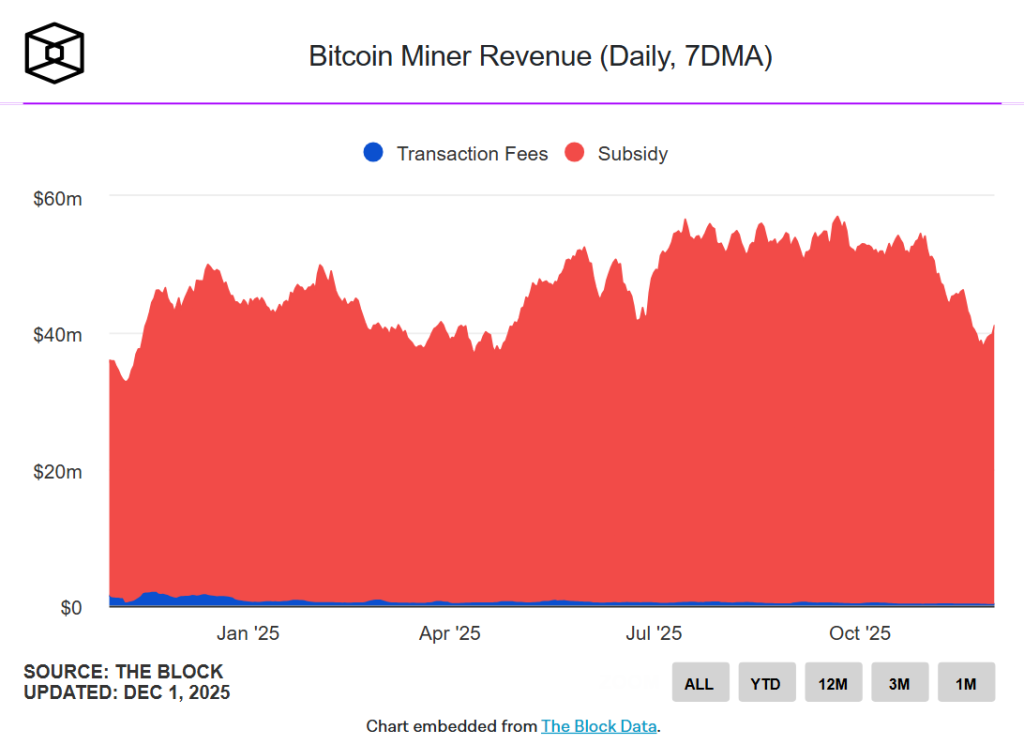

By Satoshi Nakamoto’s design, Bitcoin network transaction fees should act as a balancing force for miner motivation. However, reality paints a starkly different picture. In November, the share of miners’ income from fees fell below 0.7%, a far cry from the historical spikes of 5-15%.

The halving block in April 2024 brought a record $2.4 million in fees from speculation on the Runes protocol, but the figures soon dropped to multi-month lows. This raises long-term concerns about maintaining network security due to the diminished motivation of its “guardians.”

The paradox of the situation lies in the simultaneous growth of the network’s hash rate and the decline in its profitability.

According to Hashrate Index, on October 16, the hash rate reached an absolute record of 1.16 EH/s. The mining difficulty also hit a new high, approaching 156 T.

According to BlockEden.xyz,

large-scale miners with electricity costs below $0.05/kWh maintain a profit margin of 30–75%. Among them:

-

MARA — the cost to mine 1 BTC is approximately $39,235, with total production costs amounting to $26,000–28,000;

-

Riot Platforms — energy expenses range from $0.025 to $0.03 per kWh (Texas).

-

CleanSpark — the production cost is roughly $35,000 per 1 BTC.

At the current Bitcoin price, the breakeven electricity cost is $0.05-0.07/kWh for the latest hardware, rendering home mining (averaging $0.12-0.15/kWh) economically unviable. Smaller players using older Bitmain Antminer S19-series hardware are approaching unprofitability, as the S21 dominates with a 20–40% efficiency advantage.

According to MARA CEO Fred Thiel, the market will self-correct when miners hit their profitability limit. He predicts that by 2028, participants will have to either generate their own power, become part of energy companies, or partner with them.

“The days of miners simply plugged into the grid are numbered,” said Thiel.

He believes the growth in hash rate and difficulty is also linked to manufacturers launching their own mining operations.

“Equipment manufacturers are spinning up their own farms because customers are buying fewer devices. The global hash rate continues to grow, meaning the profitability for everyone else declines,” explained MARA’s CEO.

Companies like Bitmain, Canaan, and Bitdeer have begun operating their own unsold ASICs.

In October 2024, the Chinese automotive company Cango unexpectedly become the holder of 32 EH/s of hash rate. It is likely that Bitmain transferred its unrealized Antminer S19 XP ASICs, worth $256 million, to Cango through its subsidiary, Antalpha.

A Side Hustle in AI

In September alone, the profitability of mining the original cryptocurrency fell by more than 7%. Against this backdrop, miners have turned to diversification.

According to many experts, the growth in hash rate is linked to mining company executives’ desire to maximize cash flow to build out GPU farms for AI infrastructure.

Over the year, the industry’s cumulative debt has increased sixfold—from $2.1 billion to $12.7 billion. Analysts at VanEck attribute this to the simultaneous need to invest in equipment and fulfill orders in the artificial intelligence sector.

In July 2024, experts at Bernstein noted that miners had secured significant power supply volumes. At that time, they had access to about 6 GW. Analysts believe this figure will double by 2027.

Firms that mine digital assets have an advantage in connecting to major power grids and can help partners gain faster access to the necessary capacity.

“Bitcoin data centers are ideal for repurposing due to their powerful servers, cooling infrastructure, and operational capabilities,” the analysts wrote.

According to forecasts, by the end of 2027, 20% of Bitcoin mining capacity will be redirected to AI, and the five largest U.S.-based digital gold miners will account for 25% of the global hash rate.

The reasons include:

-

AI workloads generate 2–5 times more revenue per kWh than mining the original cryptocurrency;

-

tech giants like Microsoft and OpenAI are in need of GPU capacity;

-

mining centers already possess two key resources essential for AI infrastructure: “cheap power outlets” and industrial cooling.

Companies have redirected their energy capacity towards AI and high-performance computing. A wave of acquisitions and investments in 2025 marked the beginning of a structural shift in the industry. One of the largest deals was the $9 billion purchase of mining center operator Core Scientific by AI hyperscaler CoreWeave in July.

In August, Google increased its stake in TeraWulf to 14% by expanding financial guarantees to $3.2 billion. In September, the latter announced raising $3 billion to build data centers.

Earlier, IREN also invested in AI computing, with the deal amounting to $193 million.

Additionally, Bitfarms announced a gradual phase-out of its Bitcoin mining operations by 2027 and a transition to developing AI infrastructure.

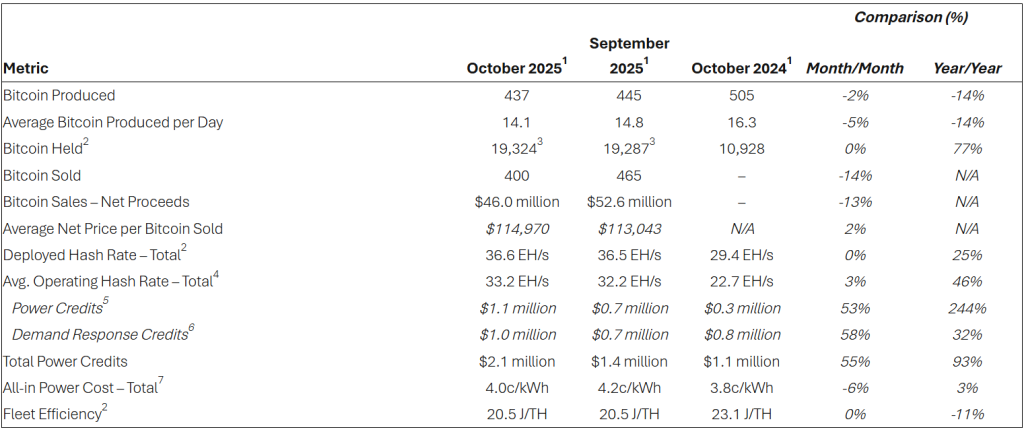

One of the industry leaders, Riot Platforms, abandoned its long-term HODL strategy in April 2025, which it had adhered to since January 2024. The sale included all 463 BTC mined that month, plus an additional 12 BTC from reserves.

The transaction yielded approximately $38.8 million in net proceeds to support operational activities.

“These sales reduce the need to raise capital through equity issuance, limiting shareholder dilution,” stated Riot CEO Jason Les.

In the following months, the miner actively parted with its mined Bitcoin, selling 465 BTC in September and 400 BTC in October.

In the third quarter, Riot Platforms’ net profit reached $104.5 million, with total record revenue of $180.2 million.

During the reporting period, the company mined 1,406 BTC compared to 1,104 BTC the previous year. As of September 30, Riot had accumulated a cryptocurrency reserve of 19,287 BTC (~$2.2 billion) and held free cash of $170 million.

Riot’s Vice President, Josh Kane, noted that the company is satisfied with its digital gold mining performance. However, the firm is primarily focused on extracting maximum value from its access to electricity.

“As our strategy has evolved, so has our approach to Bitcoin mining. We no longer view it as an end goal, but rather as a means to an end – to maximize the value of our megawatts,” stated Kane.

Since September 2024, the company has increased its deployed hash rate capacity from 20.1 EH/s to 33.1 EH/s. At the same time, the firm has already allocated 126 MW at its Corsicana site for the creation of a “core and shell” data center to serve AI needs.

Only the Strongest Will Survive

Technical progress in ASIC miner development has demonstrated a significant leap in mining efficiency over the past few years. Liquid cooling systems have set a new standard for successful market entry.

The 2024-2025 generation of devices represents an outstanding technological achievement but also points to a slowdown in development pace, in line with Moore’s Law.

Over the past five years, the efficiency of leading device models has improved by approximately 65%, from 31 J/TH in 2020 to the current 11-13.5 J/TH. However, as chips approach the 3-5 nm threshold, efficiency gains have slowed to 20-30%.

Announcements of future models promise a new level of competition in the industry. The upcoming S23 Hydro, slated for Q1 2026, targets an unprecedented 9.5–9.7 J/TH at 580 TH/s.

According to BlockEden, equipment prices reflect economic efficiency. Hydro cooling alone adds $500-1000 per unit, while immersion systems require an initial investment of $2000-5000. These costs are offset by a 20-40% increase in mining efficiency, achieved through a 25–50% boost in hash rate from overclocking.

Advanced cooling technologies have evolved from a nice-to-have optimization into a strategic necessity. Conventional air-cooled miners operate very noisily—at 75-76 dB—and require powerful ventilation. Immersion cooling solves this problem: devices are submerged in non-conductive fluid, which eliminates noise and increases hash rate by 40%.

Few Options Remain

The next two to three years present an opportunity for a complete transformation of the mining industry.

A probable bear market phase will not only pave the way for acquiring cheap digital gold during panic moments but will also free up hash rate for new large players to enter.

In the event of prolonged price appreciation, the redistribution will continue, albeit through less severe methods. This is because, even with rising revenues, keeping pace with cheap electricity and ‘green’ infrastructure will be no easy task.

If major miners continue redirecting their capacity towards AI, the network faces:

-

Slower hash rate growth;

-

A decrease in mining difficulty;

-

Pressure on decentralization;

-

Increased vulnerability to hostile mining pools or state-aligned entities.

Research into incentives for securing the original cryptocurrency’s network proposes various ways out of this predicament. From employing ‘selfish’ mining strategies using game theory to tying block rewards to the current hash rate level.

However, on a practical level, only a few options currently exist to increase the share of transaction fees in miner revenue:

-

Enhancing Bitcoin’s Layer 2 with functionalities like programmable smart contracts and activating opcodes to develop BTCFi;

-

Global adoption of micropayment solutions like the Lightning Network;

-

Widespread acceptance of Bitcoin as a payment method.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!