Bitcoin price tests $35,000 as rally resumes

- Bitcoin cleared $35,000 on the back of a surge in trading volumes. The last time the cryptocurrency traded at such levels was in early May 2022.

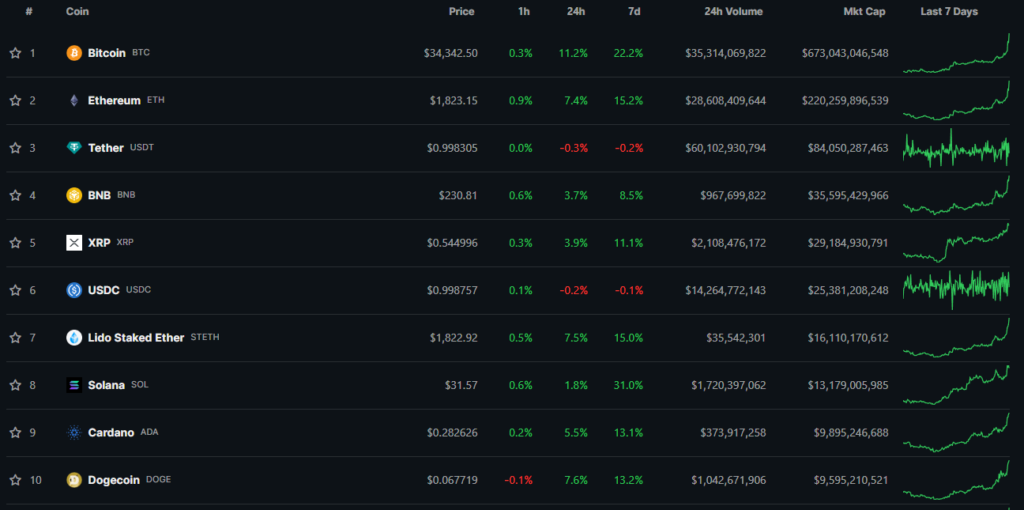

- The rally of the market leader revived altcoins. For example, Ethereum rose above $1,800.

- Tech analysts expect the rally to continue. Many believe that, amid positive expectations regarding the approval of a spot ETF, Bitcoin could reach $40,000 in the coming months.

The leading cryptocurrency rose by 11.7% in the last 24 hours, testing the $35,000 level.

At a local peak, the market value of digital gold reached $35,280 (BTC/USDT pair, Binance exchange).

At the time of writing, the asset was trading around $34,400, up 22.2% for the week.

“As is typical, Bitcoin led the broader market higher, but none of the top-10 alts outperformed the flagship in daily gains.”

Total market capitalization of cryptocurrencies reached $1.3 trillion. Bitcoin dominance index at 51.3%, according to CoinGecko.

Hype ahead of the ETF

Many experts point to expectations of approval for a spot ETF in the United States as one of the main drivers of the current rally.

“Over the past few days we have seen a very rapid rise in Bitcoin price. This is directly linked to heightened expectations for a Bitcoin ETF this year,” — отметила senior trader at Metalpha Lucy Hu.

According to her, another possible reason is the ongoing tensions in the Middle East, prompting institutional investors to diversify risks via the leading cryptocurrency.

WOO Network co-founder Jack Tang also suggested that digital gold is rising in anticipation of a spot ETF. In addition, the asset serves as “a hedge against geopolitical shocks that require higher government spending and money printing.”

Analyst and founder of MN Trading, Michaël van de Poppe, expressed confidence that new financial products will be approved with a 99% probability.

Good morning

— #Bitcoin hits $35,000 overnight and reaches new yearly high.

— Spot ETF has 99% chance to be approved.

— Matter of time until altcoins will be picking up pace.Great times.

— Michaël van de Poppe (@CryptoMichNL) October 24, 2023

The trader added that the altcoin rally is only a matter of time.

What’s the next target?

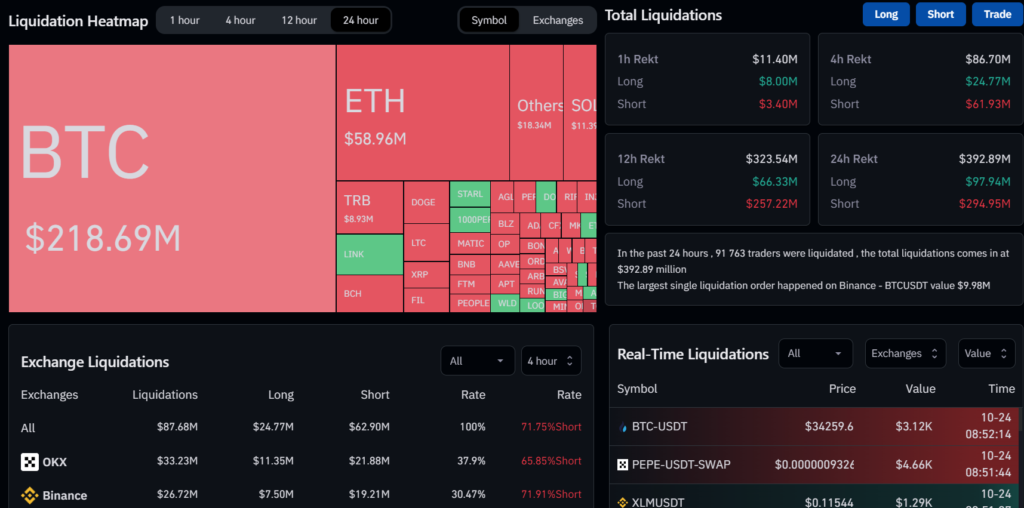

Matrixport analysts drew attention to a sharp rise in the Bitcoin futures funding rate, signaling a “FOMO-driven market”.

? Bitcoin Update: FOMO Returns! ?

The #Bitcoin futures funding rate is sky-high, signaling a FOMO-driven market. Bitcoin dominance at 52.1%, with volumes soaring at $29bn traded in 24 hours.

Our 2023 target of $45,000 is on track, thanks to our proven trading models.… pic.twitter.com/tiTqRMQl2b

— Matrixport (@realMatrixport) October 24, 2023

Experts are confident that, this year, digital gold will reach $45,000. This is, in particular, indicated by the bullish technical-analysis figure the “Ascending Triangle”.

The trader known as Titan of Crypto looked at the monthly chart and saw a “Bullish flag.” According to his calculations, Bitcoin will reach $40,300 as early as next month.

#Bitcoin at $40,300 next month. ?

On the Monthly timeframe a MASSIVE Bull flag ⛳️ could be playing out in a no so distant future.

If it were to play out the target would be target 2 at $40,300 ?.

An intermediate target would be the SSB line of the kumo cloud at $36,000.… pic.twitter.com/HyP25BVYx0

— Titan of Crypto (@Washigorira) October 22, 2023

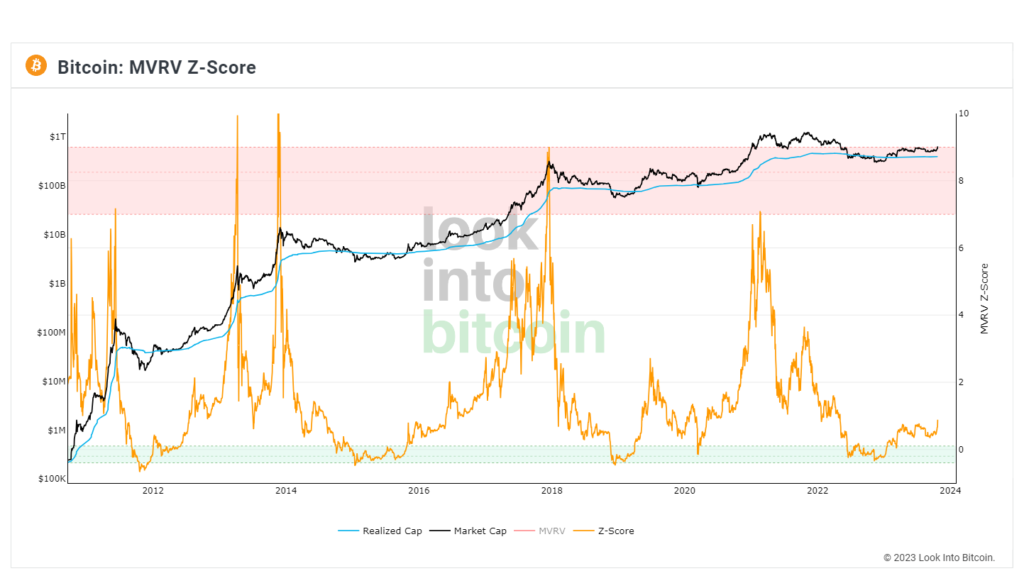

The on-chain indicator MVRV Z-Score is far from the red overbought zone. This suggests ample room for substantial growth in the medium term.

The trader Rekt Capital is convinced that a “clean break” of the $31,000 highs is the final step to fully invalidate the Bearish Bitcoin Fractal.

A clean break of the ~$31,000 highs is the final step to fully invalidating the Bearish Bitcoin Fractal$BTC #Crypto #Bitcoin pic.twitter.com/gT5IXSoSQG

— Rekt Capital (@rektcapital) October 23, 2023

A market participant known as Philakone noted that the price crossed a resistance level formed nearly three years ago. The analyst believes this “officially means we are in a bull market.”

Michaël van de Poppe emphasised that Bitcoin held above $30,200 and “began breaking the yearly high.”

#Bitcoin did hold above $30,200 and started breaking the yearly high.

Quite surprised with this strength, but that’s what you get pre-ETF approval.

As long as we stay above $31K, everything is all right and we’ll see $40K this year.

Times are good. Buy the dips. pic.twitter.com/3UkZUve1ES

— Michaël van de Poppe (@CryptoMichNL) October 24, 2023

“As long as we stay above $31,000, all is well. And this year we will see $40,000. Times are good. Buy the dips,” urged the expert.

As noted above, on 23 October Bitcoin rose above $31,000 for the first time since June 2022.

Earlier, Binance chief Changpeng Zhao ruled out a blowout rally in the leading cryptocurrency immediately after the mining reward halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!