Bitcoin Rebounds Above $93,000

Bitcoin rebounds 7.9% to ~$93,800 after slumping to $84,500.

Over the past 24 hours, Bitcoin’s price rose 7.9% to about $93,800, recouping losses after a sharp drop to $84,500.

Ether climbed 9.7%, back to $3,000.

All top-ten cryptocurrencies by market capitalisation advanced. Solana jumped 13.2%, and Dogecoin 11.4%.

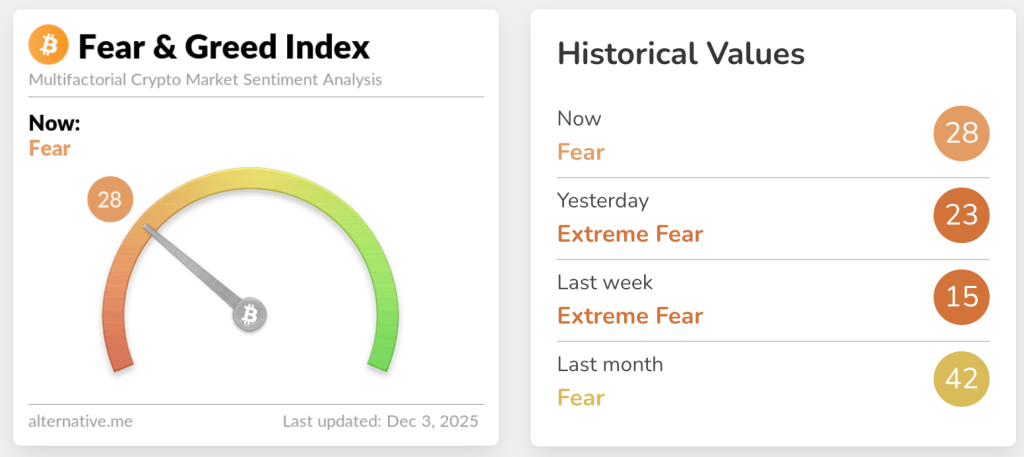

The popular market sentiment indicator reached 28 points, still in the “fear” zone. A day earlier it read 23.

The rebound came as the Fed ended its quantitative tightening programme. Traders expect a cut to the key rate on 10 December. The market puts the odds of that scenario at 89.2%.

Additional support came from major US financial institutions. They increased the volume of repo operations, adding liquidity to financial markets.

A rally to $100,000?

Analyst Michaël van de Poppe called the rebound a positive sign.

This is what you’d want to see. $BTC coming back up again, after a weird move down on the 1st of this month.

Now, again, breaking the $92K area is crucial.

If that breaks, then I’m sure we’ll start to see a new all-time high and a test at $100K.

A great day on the markets. pic.twitter.com/uy6WPabnQ8

— Michaël van de Poppe (@CryptoMichNL) December 2, 2025

In his view, the asset needs to hold above $92,000 to extend the rally. A break of that level would pave the way for a test of $100,000 and a new all-time high.

Van de Poppe also noted that the latest correction surpassed the market routs sparked by the collapse of Luna, the downfall of FTX and the COVID-19 pandemic.

“What if the drop was bitcoin’s final shakeout? What if we are indeed copying the previous cycle—not in time, but with exact price moves at several of its stages, only in a more extended form?” he asked.

Shortly before the rebound, a CryptoQuant analyst under the handle Crazzyblockk stressed that the $86,000–88,000 range remains a critical support zone for digital gold.

The key marker is the realised price of highly active addresses ($86,574) — the average acquisition price for wallets making more than 100 transactions a month. These seasoned participants shape the market’s short‑term dynamics.

“The level has withstood 60 tests in recent months without breaking, which makes any breach particularly significant. […] Last year bitcoin spent 97.8% of the time above this mark, reflecting a sustained upward impulse,” the expert noted.

Loss of $86,000 typically triggers a three-stage correction, as seen before. First, the price falls to $80,000–82,000, then slides to $75,000–77,000. Full capitulation brings the coin into the $70,000–72,000 range.

“Holding the $86,000–88,000 zone will preserve the market structure,” the analyst concluded.

Ethereum lags

Investor sentiment toward Ethereum remains cautious. This is especially evident in derivatives: positioning is tight, signalling a lack of conviction among bulls.

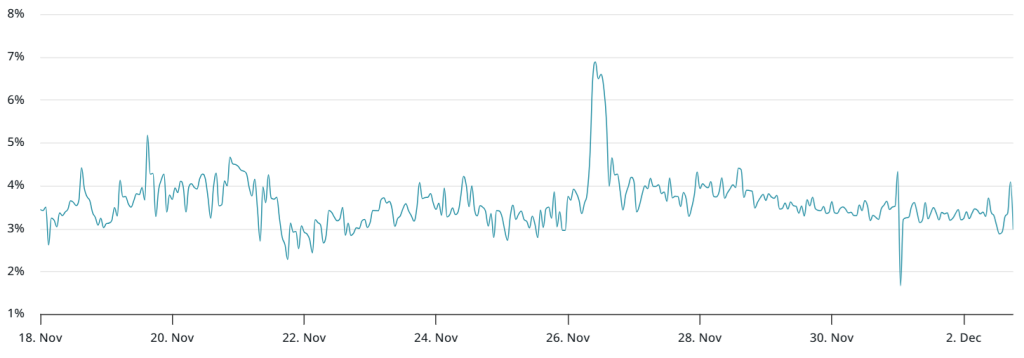

The annualised premium of monthly futures over spot is stuck at 3%, unchanged from the previous week. Readings below 5% suggest little demand for leveraged long exposure.

Put options on Ethereum trade at a 6% premium to calls, pointing to prevailing bearishness. As recently as 28 November this was neutral at 4%. The shift suggests persistent stress in the segment, in contrast to rising risk appetite in traditional markets.

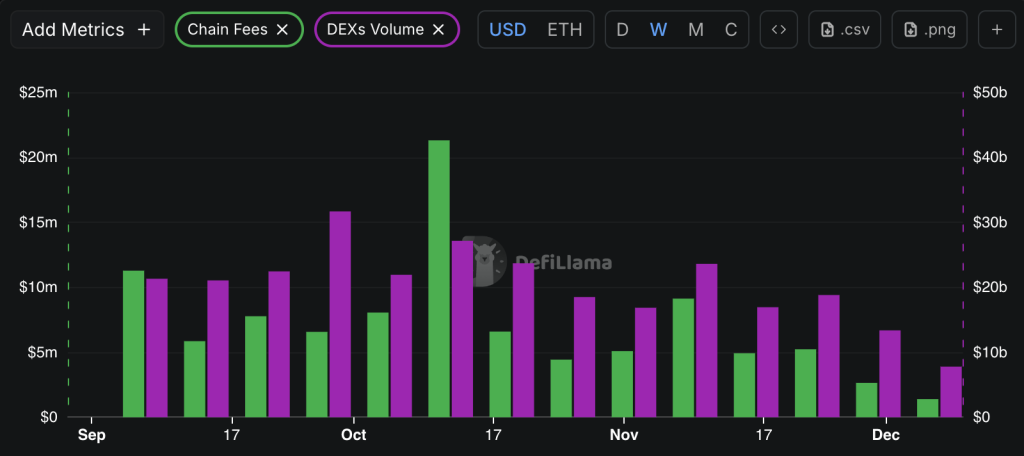

Another warning sign is network fees, which have fallen to a three‑year low: $2.6m over the past week, down from $5.1m a month ago.

That is partly due to softer activity on decentralised exchanges: their weekly volume has slipped to $13.4bn from August’s $36.2bn peak.

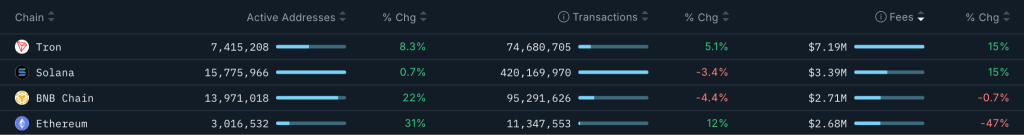

Meanwhile, rivals such as Tron and Solana recorded a 15% rise in fee revenue.

In late November, Ethereum whales that received coins during the ICO became more active.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!