Bitcoin retreats from record as Evergrande default fears mount

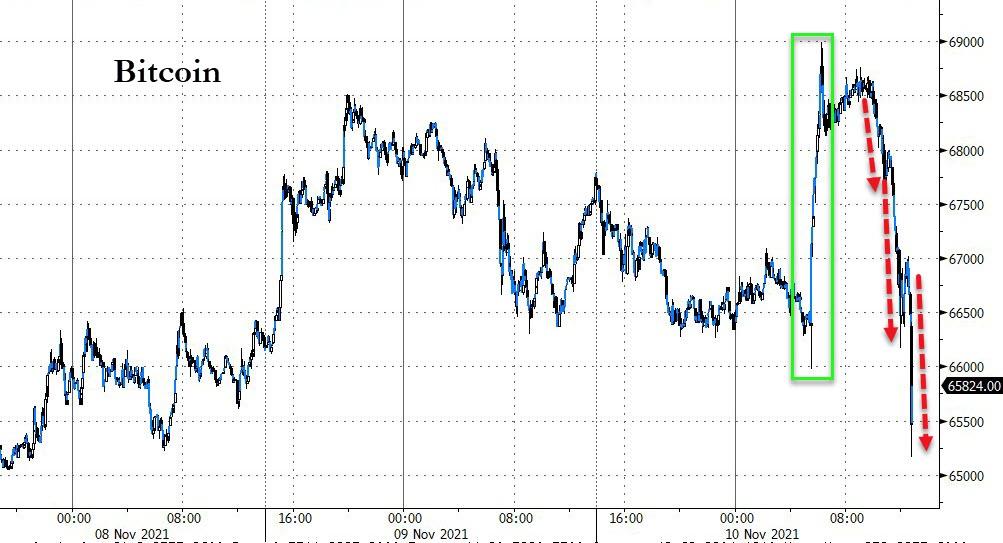

On November 10, after an all-time high as it approached $69,000, Bitcoin fell almost 9%, slipping below $63,000. CoinDesk linked this to rumours of a potential default by one of China’s biggest developers, Evergrande.

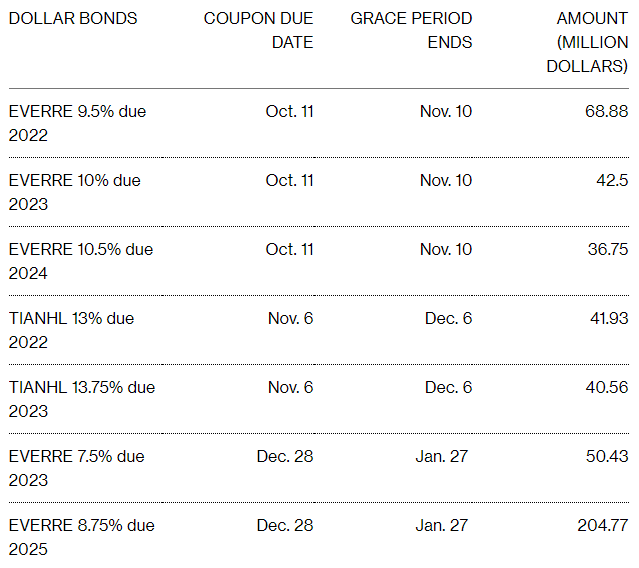

By the end of the day, Associated Press reported that some holders of the company’s bonds did not receive interest payments after the end of a 30-day grace period following the due date.

The investor-protection agency Deutsche Markt Screening Agentur (DMSA) announced the initiation of bankruptcy proceedings against the developer and urged affected parties to join the process.

“DMSA is preparing bankruptcy proceedings against Evergrande. The court will officially declare the company bankrupt; this is a matter of days,” said in a press release.

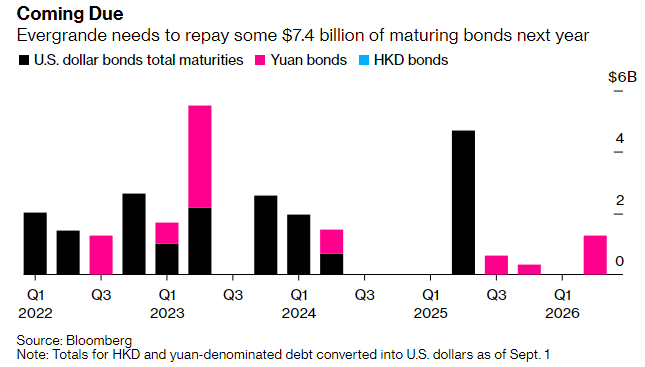

A formal recognition of a technical default could trigger cross-default on other obligations totalling 2 trillion yuan (~2% of China’s GDP). The developer’s troubles have already strained the debt market and posed challenges for the property sector. This would slow the world’s second-largest economy.

Concurrently with the Evergrande default fears, on the evening of November 10 an auction of 30-year U.S. government bonds took place. Weak demand, amid inflation accelerating to a 6.2% year-on-year rate — the highest since 1990 — sparked price declines and a sharp rise in yields. Against this backdrop the dollar strengthened markedly, weighing on risk assets as well as gold and Bitcoin.

Deutsche Bank conceded that Bitcoin would become ‘digital gold of the 21st century’.

In October, Apple co-founder Steve Wozniak stated that Bitcoin outperforms the US dollar.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!