Bitcoin steadies near $86,700 as markets await a ‘friendly’ Fed chair

Bitcoin steadies near $86,700 as traders await a 'friendly' Fed chair and policy shift.

Bitcoin held around $86,700 after US President Donald Trump pledged to appoint a new Fed chair who would support significant interest-rate cuts, Reuters reported.

On 17 December the price briefly touched $90,000. At the time of writing it trades at $86,828, up 0.03% on the day. Swings are driven by thin liquidity amid macroeconomic uncertainty.

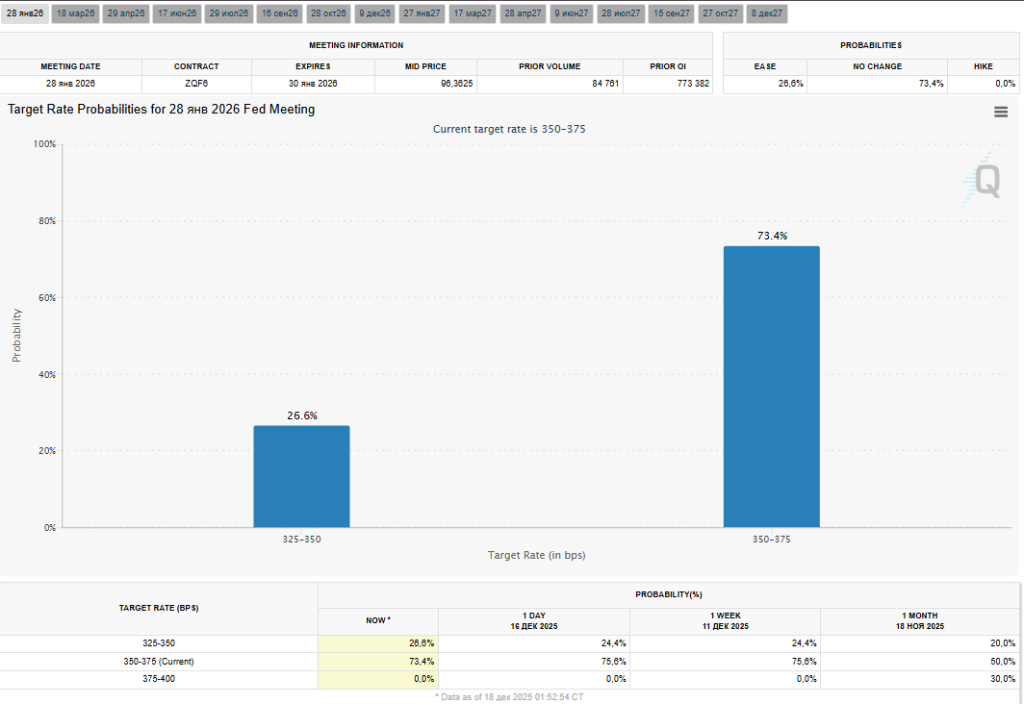

At a press conference, Fed chair Jerome Powell signalled the central bank may not cut in January. Market participants put the odds of holding the current range (3.50–3.75%) at 73.4%.

The picture could change in May after a leadership shift. Trump aims to lower the target to 1%.

The president has already interviewed crypto-friendly Christopher Waller. Other contenders include former Fed governor Kevin Warsh and National Economic Council head Kevin Hassett.

LVRG research director Nick Ruck linked crypto’s instability to a global retreat from risk. The market is also weighed down by slower inflows into ETFs, deleveraging in derivatives and a high correlation with equities. He noted that investors are rebalancing into year-end and hopes for a “Santa Claus rally” are fading.

Kronos Research CIO Vincent Liu sees a fundamental repricing rather than a temporary seasonal factor.

“The market has shed leverage and is waiting for a real catalyst. Until fresh liquidity appears, we face sideways action,” the specialist said.

Liu does not view the pullback as the start of a “crypto winter”. He said the risk of a prolonged decline would rise only if $81,000 is lost, which he calls the market’s “true mean”.

The Fed withdraws its 2023 guidance

The Federal Reserve withdrew its 2023 directive that had restricted some banks’ work in the crypto industry. The regulator cited an “evolution in views on risks”.

Previously, state-chartered financial institutions faced a de facto “presumption of prohibition”. They were not allowed to engage in “new activities” (including crypto services) if these were unavailable to national banks.

The Fed noted that since the publication of the earlier rules, the financial system and understanding of innovative products have evolved.

The regulator’s approach is now more flexible:

- insured FDIC banks remain under strict limitations under the Federal Deposit Insurance Act;

- uninsured institutions can now request approval for digital-asset activities on a case-by-case basis.

The 2023 policy did not impose a blanket ban, but in practice prevented banks from holding bitcoin or Ethereum on balance sheet or issuing stablecoins.

The decision was not unanimous. Fed vice chair for supervision Michael Barr dissented, arguing that uniform rules prevent regulatory arbitrage. He recalled that in 2023 the restrictions were adopted with full board support.

Fox Business journalist Eleanor Terrett linked the change to the Custodia Bank case. It was the rescinded rules that underpinned the Fed’s denial of Caitlin Long’s bank access to master accounts.

🚨NEW: Big news from the @federalreserve today: It’s withdrawing its 2023 guidance that effectively blocked uninsured banks from becoming Fed members and engaging in crypto.

This guidance underpinned the Fed’s denial of @custodiabank’s master account. pic.twitter.com/2qlFqhnPAv

— Eleanor Terrett (@EleanorTerrett) December 17, 2025

Custodia operates as an uninsured institution with 100% reserves. The bank can now seek approval for activities that were previously unavailable.

Earlier, Bitwise and Grayscale forecast a new price record for bitcoin in 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!