Bitcoin tumbles below $75,000

- Bitcoin slid roughly 10%, dropping below $75,000.

- Equities opened the week lower amid expectations of US trade tariffs taking effect.

- Correlation with stocks will be a key driver of bitcoin’s next moves.

By the evening of April 6, bitcoin turned lower. At press time it traded around ~$74,950.

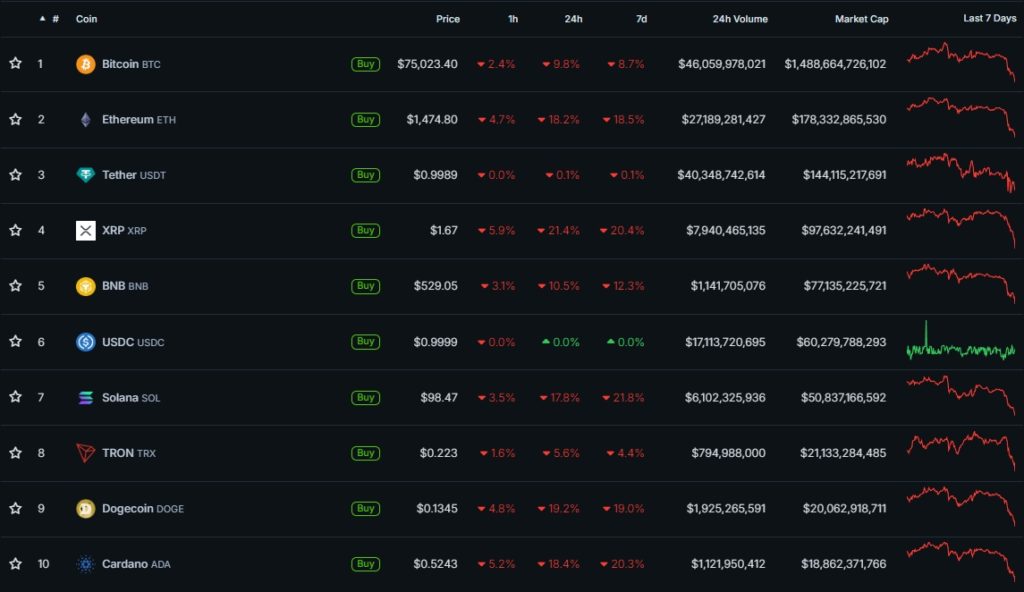

Over 24 hours, the “digital gold” fell nearly 10%. Most top-10 altcoins dropped more sharply. XRP lost about 21%, Dogecoin roughly 19%. Ethereum failed to hold $1,500, falling by ~18%.

Total crypto market capitalisation fell by ~12.5% to $2.46 trillion. Bitcoin’s dominance topped 60%.

Bitcoin bounced back toward $80,000. The likely catalyst was rumours that the US president would delay “reciprocal tariffs” against major trading partners by 90 days.

But users could not find direct confirmation of this in remarks by Kevin Hassett, a presidential adviser. Bitcoin pulled back to ~$79,000.

Stocks slid as the week of Trump’s “reciprocal tariffs” began

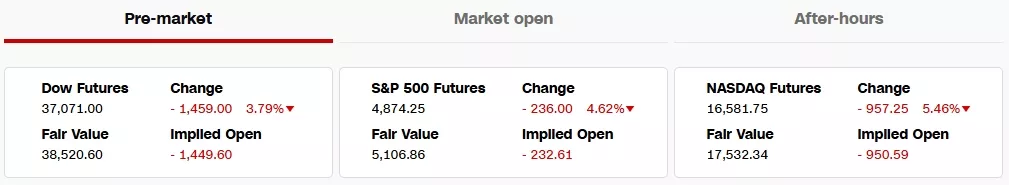

The crypto sell-off followed Sunday’s open in futures on the main US equity indices. S&P 500 futures fell 4.6%, the Nasdaq 100 5.5%.

Losses in traditional assets intensified as Asian sessions opened. At press time the Nikkei was down 7.8%, South Korea’s KOSPI 5.6%.

According to media outlet The Kobeissi Letter, the US stock market has been falling for 32 straight days, shedding on average $400bn per trading session.

The free fall continues:

Today’s drop in US stock market futures puts S&P 500 futures down -22% and in bear market territory.

The US stock market has now erased an average of $400 billion PER TRADING DAY for 32-straight days.

Is it time to BUY stocks yet?

(a thread) pic.twitter.com/MMtYgQXhh2

— The Kobeissi Letter (@KobeissiLetter) April 6, 2025

On April 2 the US president, Donald Trump, announced new tariffs for trading partners. A 10% minimum applies to all countries from April 5. For a number of partners, “reciprocal tariffs” roughly half the level those countries impose on American goods will take effect from April 9.

Reciprocal rates are set at 54% for China, 20% for the EU, 46% for Vietnam, 32% for Taiwan, 24% for Japan, 26% for India and 25% for South Korea.

Bitcoin dipped below $85,000. In the following days, however, it held above $80,000, showing better performance than equities.

As the start date for “reciprocal tariffs” approached, expectations grew that Mr Trump might delay them to let partners make counteroffers to “cut a deal”.

One would have to imagine that President @realDonaldTrump’s phone has been ringing off the hook. The practical reality is that there is insufficient time for him to make deals before the tariffs are scheduled to take effect.

I would therefore not be surprised to wake up Monday…

— Bill Ackman (@BillAckman) April 5, 2025

“One thing is certain. Monday will be one of the most interesting days in our country’s economic history,” wrote billionaire investor Bill Ackman.

In a statement on April 6, the US president called tariffs “the only way to fix” the trade deficit with China, the EU and others. He also told reporters he had not intended to trigger a market sell-off, but “sometimes you have to take medicine to fix something”.

REPORTER: “Is there pain in the market at some point you’re unwilling to tolerate?”@POTUS: “I think your question is so stupid. I don’t want anything to go down, but sometimes you have to take medicine to fix something — and we have been treated so badly by other countries.” pic.twitter.com/09QBmfqzYF

— Rapid Response 47 (@RapidResponse47) April 6, 2025

Will bitcoin track US stocks or go its own way?

After April 2, BitMEX co-founder Arthur Hayes argued that bitcoin needed to hold above $76,500 until US tax day on April 15. In his view, that would clear tariff-driven uncertainty and volatility.

After bitcoin slipped toward $75,100, the expert commented on his forecast — “off the mark”.

Volatility is back baby. I fucking love this shit. Going to be a fun week.

— Arthur Hayes (@CryptoHayes) April 6, 2025

“Volatility is back […]. It will be a fun week,” he stated.

Earlier, analyst and MN Trading founder Michaël van de Poppe also allowed for a retest of $76,600 before a move higher. Some pointed to $80,000–82,000 as a local bottom.

However, based on on-chain metrics, Glassnode doubted bitcoin’s ability to stabilise above $80,000. Analysts saw no signs in indicators of a sustained uptrend resuming.

In March, CryptoQuant CEO Ki Young Ju suggested the end of bitcoin’s bull market. Over the next six to 12 months, prices would fall or move sideways, he said.

He reaffirmed the call using bitcoin’s realised capitalisation chart. The cryptocurrency has entered a bear cycle, and even if selling pressure eases, any reversal would take at least six months.

#Bitcoin bull cycle is over — here’s why.

There’s a concept in on-chain data called Realized Cap. It works like this: when BTC enters a blockchain wallet, it’s considered a “buy,” and when it leaves, it’s treated as a “sell.” Using this idea, we can estimate an average cost… pic.twitter.com/xDHRin8N1K

— Ki Young Ju (@ki_young_ju) April 5, 2025

“Short-term upside looks unlikely,” the CryptoQuant head concluded.

The crypto Fear and Greed Index, after edging toward neutral, plunged to 23, signalling extreme investor fear.

“Against a backdrop of mounting caution about the pace and scale of the April 2 tariff rollout, risk assets, including bitcoin, were seized by a ‘sell now, think later’ mindset,” said Peter Chang, head of research at The Block’s Presto Research.

In his view, the path ahead hinges on three main factors:

- how other countries respond to the trade tariffs;

- whether the Trump administration has and executes a coherent long-term plan;

- decisions by the US Federal Reserve.

LVRG research director Nick Ruck noted that, given America’s hardline tariff policy, TradFi companies are navigating “choppy waters”, trying to balance expectations of a prolonged trade war with bitcoin’s volatility.

“This could lead to overselling of digital assets, which are heavily influenced by ever-changing sentiment and the economics of their own ecosystem,” he said.

Santiment noted that social media are awash with mentions of crypto “decoupling” from stock markets. Late last week, digital assets reacted mildly to China’s tariff response, which sent major indices such as the S&P 500 lower.

?️ Social media has been buzzing with mentions of crypto’s “decoupling” from stock markets, according to data from X, Reddit, Telegram, 4Chan, Farcaster, and BitcoinTalk. Following the S&P 500’s -10.5% combined losses on Thursday and Friday alone, traders are optimistic that… pic.twitter.com/MH2I3fi7F4

— Santiment (@santimentfeed) April 5, 2025

“If crypto markets really are becoming less and less dependent on stock markets, that would be an encouraging sign. Historically, most of the biggest bull cycles in digital currencies have occurred when the correlation between the two sectors was zero (neither negative nor positive),” the platform’s analysts said.

Nansen reckons the crypto market could reach a local bottom by June, with subsequent moves shaped by the outcome of US tariff talks with key trading partners.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!