Bitcoin’s Path: Analysts Predict a Dip to $76,600 Before Rebound

The price of the leading cryptocurrency may retest lows at $76,600 before resuming its upward trajectory, according to analyst and MN Trading founder Michaël van de Poppe.

It seems to be vital that we’re seeing some more downwards momentum on the markets for #Bitcoin.

Trend is still lower highs and lower lows.

Test at the lows before reversing back up? pic.twitter.com/8ULlJqoGRh

— Michaël van de Poppe (@CryptoMichNL) March 28, 2025

On April 1, the specialist noted “good signs” due to the rise in Bitcoin’s price. Van de Poppe expressed expectations of a return to an upward trend following a “volatile day” [following U.S. President Donald Trump’s announcement of new import tariff parameters].

#Bitcoin climbing upwards, good signs coming in.

Tomorrow will be a volatile day and I suspect that we’ll rotate into an upwards trend from that point. pic.twitter.com/r4R1zJh1Y5

— Michaël van de Poppe (@CryptoMichNL) April 1, 2025

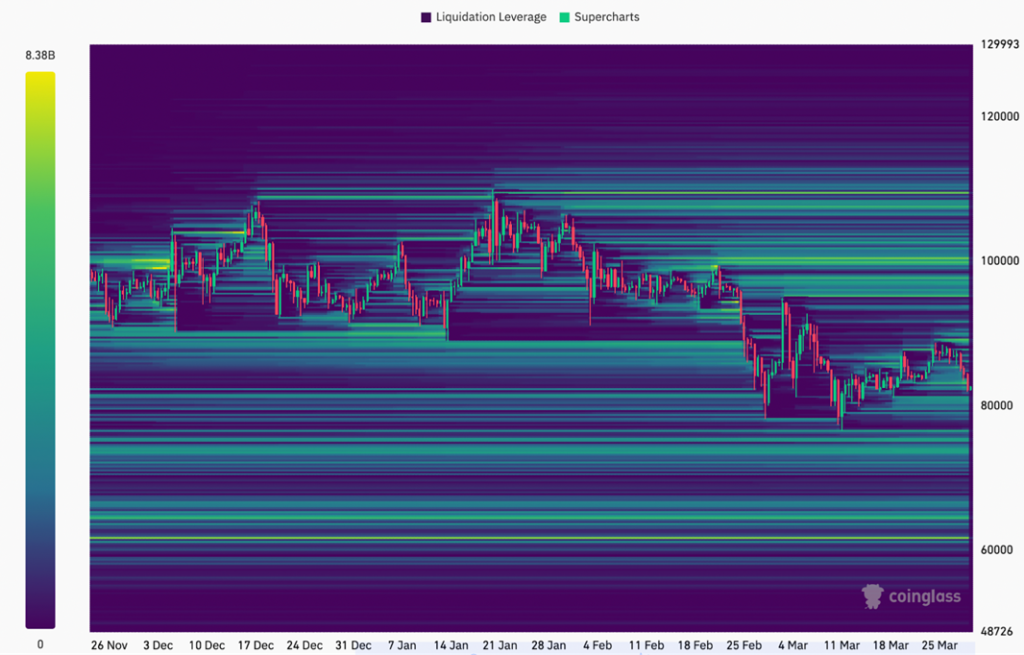

The bearish sentiment is shared by the analyst known as Stockmoney Lizards. The expert pointed out that Bitcoin has “taken a lot of liquidity.” In his view, the digital gold’s price will find a local bottom in the $80,000-82,000 range.

for the short-term, my scenario is: we are nearing a local bottom between 82-80k. A lot of liquidity has been taken. Major short liquidation levels are > 88k.

Typical weekend dump with next week reversal? At least this is a possible scenario. pic.twitter.com/HZSm2Fxn3v

— Stockmoney Lizards (@StockmoneyL) March 29, 2025

Cointelegraph reported the formation of a “bearish wedge” pattern, suggesting a drop to $62,000, approximately 25% below the current level.

The negative signal is reinforced by the relative strength index, which remains below the midline, and the price settling below the 200 DMA.

Peter Brandt reached a similar conclusion. The technical analyst identified a similar pattern, which, if realized, would lower the price to $65,635.

Don’t shoot the messenger.

Just reporting on what the chart says until it says something different

Bear wedge completed with 2X target from the double top at 65,635 pic.twitter.com/yxZis2bKAT— Peter Brandt (@PeterLBrandt) March 28, 2025

On-chain researcher and CryptoQuant author Axel Adler Jr. is less pessimistic. He believes that April-May could become a consolidation zone—a calm before the next impulse.

The average selling pressure on top exchanges has dropped from 81K to 29K BTC per day.

Welcome to the zone of asymmetric demand.

The market has successfully absorbed waves of profit-taking following the break above $100K.

Sellers have dried up, and buyers seem comfortable with… pic.twitter.com/mgzrCacMMq— Axel ?? Adler Jr (@AxelAdlerJr) April 1, 2025

“The market has successfully absorbed waves of profit-taking following the break above $100,000. Sellers have dried up, and buyers are comfortable with the current price level, creating conditions for a structural supply deficit,” the expert noted.

Earlier, a user known as Cyclop forecasted Bitcoin’s rise to $150,000, with a risk of a further 30% pullback.

CryptoQuant highlighted alarming signals for the asset across four indicators. One of the firm’s verified authors confirmed that MVRV does not yet indicate a bottom has been reached.

Previously, experts surveyed by Bloomberg suggested a “bull trap” in the digital gold’s price rebound.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!