Bitcoin whale selling hits highest level since July 2022

Analyst predicts selling pressure on bitcoin to persist in the coming weeks

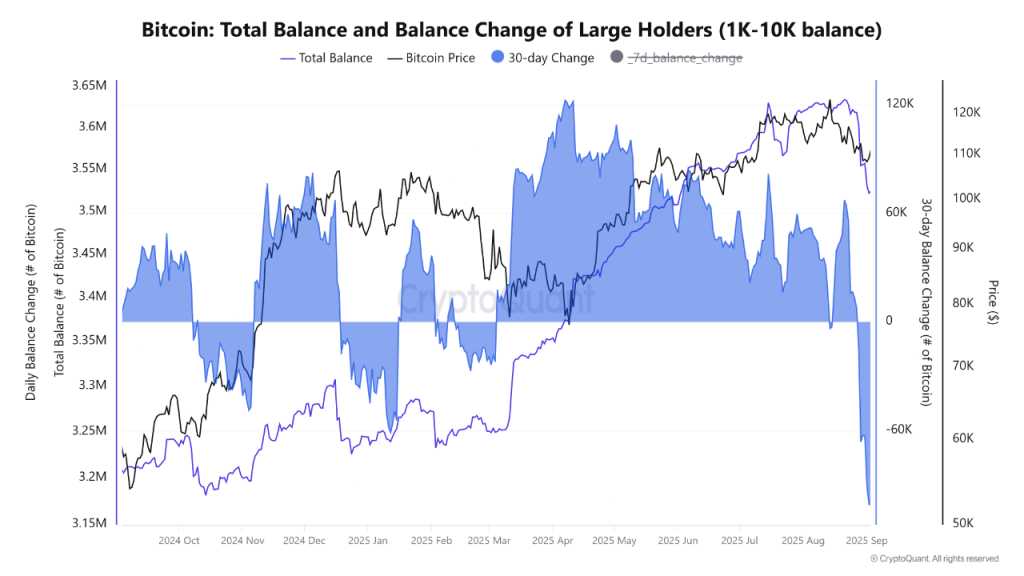

Over the past month, large holders of digital gold sold more than 115,000 BTC worth $12.7bn — the highest since July 2022, noted CryptoQuant analyst using the pseudonym caueconomy.

This dynamic signals “strong caution among large investors”. Selling peaked on 3 September: within a week whales liquidated more than 95,000 BTC — the most since March 2021.

Amid selling pressure, bitcoin briefly dipped below $108,000.

“We continue to observe large players reducing their portfolios, which could keep pressuring the leading cryptocurrency in the coming weeks,” they said.

Early this month, Bitcoin Magazine CEO David Bailey accused two whales of “stalling” digital gold.

At the time of writing, bitcoin trades around $111,200, up 0.5% over the past 24 hours.

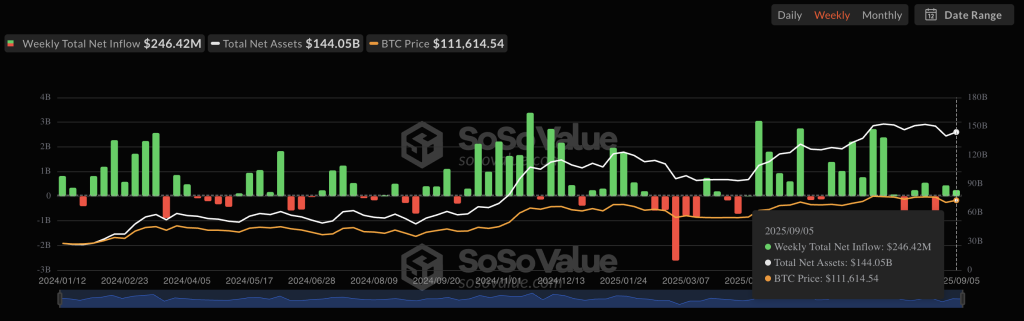

LVRG Research director Nic Raak noted that institutional investors and ETF demand “counterbalance the sell-offs”. They support market resilience, preventing the leading cryptocurrency from slipping below current levels.

According to him, whale activity limits bitcoin’s short-term upside. The fundamentals remain solid, Raak stressed.

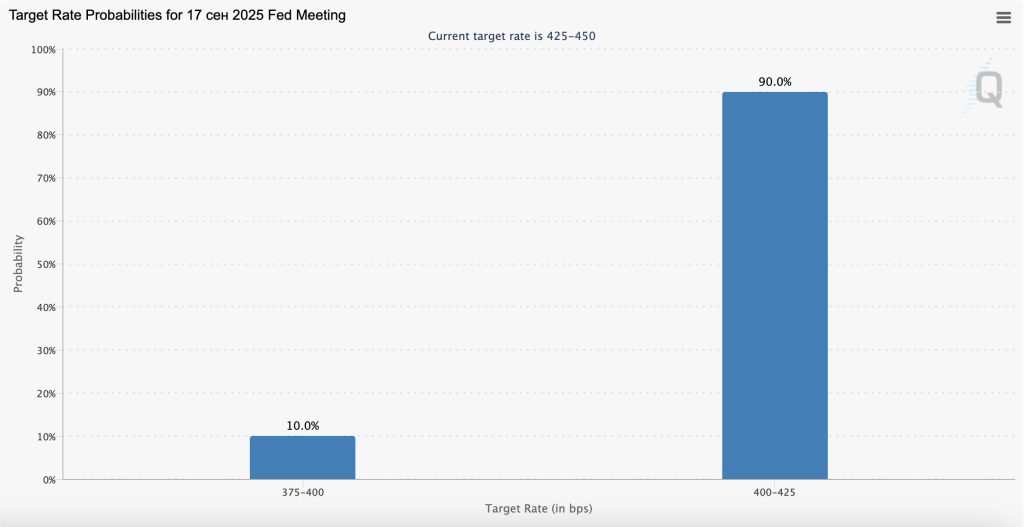

“Traders should watch whether institutional support on dips outweighs whale pressure, though ultimately macroeconomic triggers — for example, the Fed’s September rate decision — could set the market’s overall direction,” he added.

Last week, spot bitcoin ETFs attracted $246m. Public companies continued to accumulate the cryptocurrency but slowed the pace.

A Fed rate cut may not spark a rally

The 17 September meeting will decide the policy rate. Market participants assign a 100% probability to monetary easing.

Some experts say a rate cut could trigger a sharp bitcoin rally next quarter. Others remain unconvinced about a potential rally or a new all-time high.

“The US jobs report did strengthen expectations of a more accommodative Fed, which typically supports risk assets like bitcoin. However, the market has partly priced this in. We’re seeing profit-taking by institutional players, and ETF inflows remain relatively subdued,” said BTC Markets analyst Rachel Lucas in a comment to The Block.

She added that the combination of these two factors is restraining bitcoin’s upward momentum.

Kronos Research CIO Vincent Liu agrees that even with a rate cut, the price of the leading cryptocurrency may remain under pressure.

“Absent stronger ETF inflows or a genuine expansion in liquidity, levels above $120,000 remain a difficult barrier,” he stressed.

What to watch

According to Lucas, the leading cryptocurrency’s key support currently sits at $110,000.

“As long as bitcoin holds above this level, market structure remains constructive. Resistance sits at $113,400; subsequent levels are $115,400 and $117,100. A break above these barriers would suggest the market has absorbed recent selling pressure and is ready to re-test the highs,” she explained.

Beyond the Fed meeting, analysts also recommended watching other factors:

“From on-chain metrics, we see stablecoin volume near record highs, creating ‘dry powder’ for possible growth. At the same time, bitcoin and Ethereum balances on exchanges are declining, which reduces near-term selling pressure,” Lucas said.

Among external factors, she highlighted regulatory changes, including work by the SEC and CFTC on unified rules for the crypto market.

Earlier, a bitcoin trader pointed to a “2024-style” bear trap. He said the leading cryptocurrency is preparing for a “serious short squeeze”.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!