Bitcoin’s Resilience Forecast Amid Rising Hashrate

The surge in Bitcoin’s hashrate to record levels is expected to contribute to the stability of its price, according to CryptoQuant.

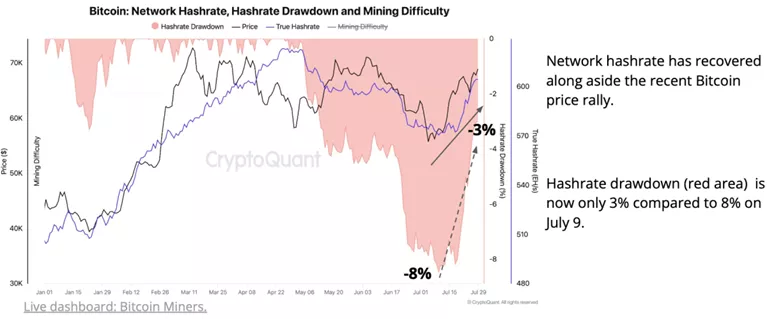

“The metric’s drop from its historical maximum is only 3% compared to 8% as of July 9, and the recovery of the hashrate is usually associated with a sustained rally,” explained the specialists.

Analysts attributed the growth in the aggregate computing power of mining equipment to the recovery in digital gold prices.

Following the halving in April, miners’ revenues plummeted, and now the selling pressure from them may decrease, they added.

Experts observed a shift among this category of market participants towards accumulating coins.

“The daily outflow of bitcoins from miners’ wallets in July remained within the range of 5,000–10,000 BTC compared to 10,000–20,000 BTC in early March, when the rate firstreached $70,000 and below the spikes observed in April-May, after the halving,” the report states.

According to experts’ calculations, the total balance of major miners of the first cryptocurrency increased from 61,000 BTC at the beginning of the year to the current 65,000 BTC. Their smaller competitors reduced their reserves from 59,000 BTC to 51,000 BTC over the same period.

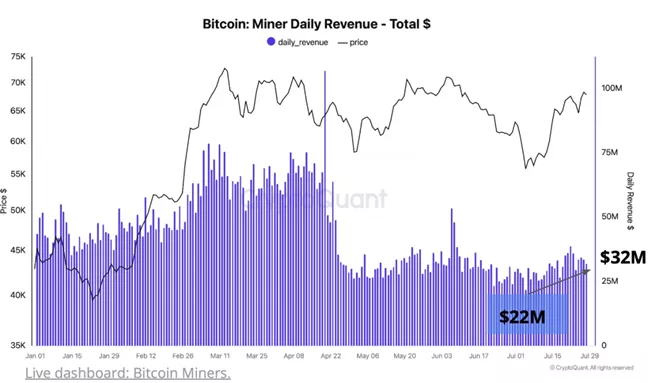

“Daily miners’ revenue rose to ~$32 million from a yearly low of $22 million in July. This supports the recovery of the hashrate,” they added.

As a risk for miners, CryptoQuant pointed to low transaction fees. According to specialists’ estimates, daily fees plummeted to 8 BTC from 150 before the halving.

Following the latest recalculation, the difficulty of mining the first cryptocurrency increased by 10.5% to 90.67 T.

Bernstein positively assessed the impact of the “Trump factor” on digital gold mining companies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!