BitMEX Bitcoin reserves fall nearly 40% in a week

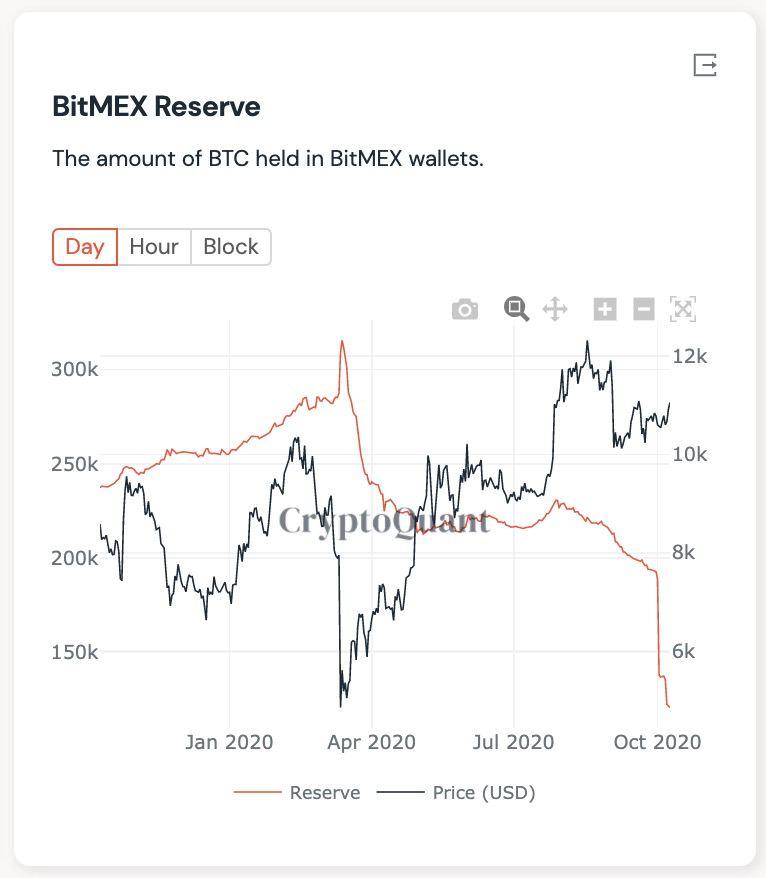

The BitMEX cryptocurrency derivatives exchange continues to feel the consequences of regulatory troubles. Over the past week alone, the amount of bitcoins held in its wallets fell by 38.4% — to 120,889 BTC (~$1.368 billion).

According to data from the analytics company CryptoQuant, BitMEX slid from fourth to sixth place on this metric.

Source: CryptoQuant.

The absolute leader in bitcoin reserves is Coinbase — its wallets hold 861,117 BTC (~$9.74 billion).

Next with a substantial lead are Huobi Global (296,856 BTC), Binance (292,274 BTC), Gemini (171,350 BTC) and Bitfinex (127,404 BTC).

On October 1, it emerged that the U.S. Commodity Futures Trading Commission (CFTC) and the U.S. Department of Justice had filed charges against the BitMEX cryptocurrency derivatives exchange and its owners. They are accused of operating an unregistered trading platform and violating Commission rules.

The allegations against BitMEX led to a drop in bitcoin’s price to around $10,500 and a substantial outflow of funds from the once-leading crypto derivatives exchange. Open interest on BitMEX over several hours fell to 61,869 BTC, below its annual low.

On the same day, October 1, BitMEX CTO Samuel Reed was arrested on charges by the U.S. DOJ for violating the Bank Secrecy Act and for “willful failure to implement robust anti-money-laundering countermeasures at BitMEX.”

On October 8, BitMEX announced a management shake-up. Arthur Hayes and Samuel Reed left the posts of CEO and CTO respectively. The head of business development Greg Dwyer took a leave of absence. On October 9, Reed was released on bail of $5 million.

Following BitMEX’s regulatory troubles, the analytics company Chainalysis classified the exchange as a high-risk platform.

Subscribe to Forklog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!