Bitwise CIO says crypto treasuries risk irrelevance without complex strategies

Bitwise CIO: DATs need complex strategies or ETFs will win.

Companies with digital-asset treasuries (DATs) need to adopt more sophisticated strategies or risk losing out to ETFs for good, Bitwise chief investment officer Matt Hougan said.

1/ A lot of people have asked me what I think of DATS. My view: Some DATs should trade above NAV and others should trade below NAV.

A thread on how to tell the difference.

— Matt Hougan (@Matt_Hougan) November 5, 2025

“Buying cryptocurrencies and putting them on balance sheets is not hard. It used to be hard, but it isn’t anymore. If DATs limit themselves to that strategy, users are better off investing through exchange-traded funds,” he explained.

According to the expert, the same goes for companies offering staking. ETFs have already incorporated this feature — including Bitwise, which in late October unveiled an investment product with coin-locking for rewards.

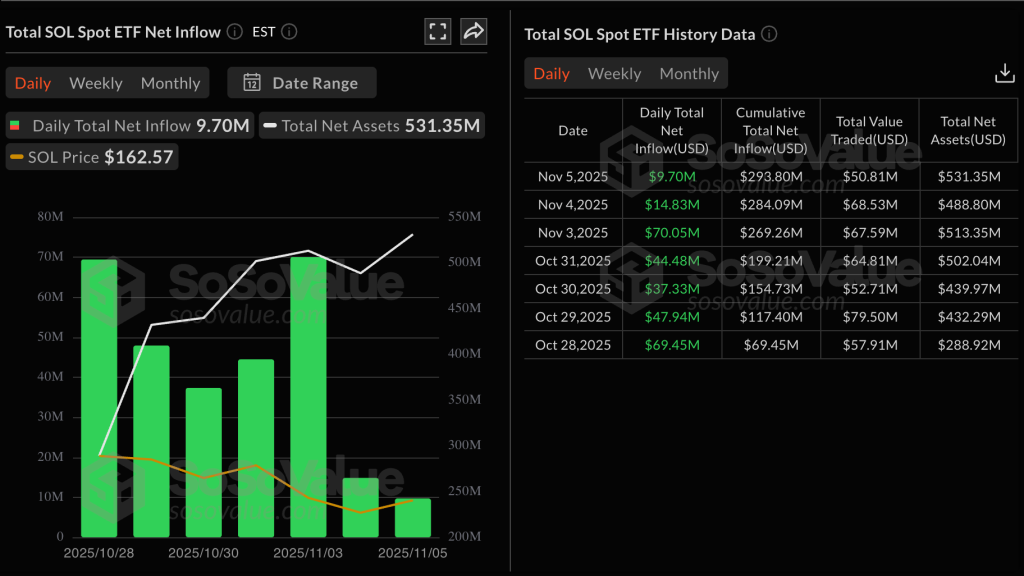

The firm’s Solana-based ETF has already gathered $282 million. Net inflows have been positive for seven straight trading sessions.

Hougan stressed that to create additional value, crypto treasuries should master more complex strategies such as participating in DeFi, smart lending and options trading.

“Not all of these ideas are necessarily good, and not everyone will be able to execute them successfully. They are complicated, but, if done well, there is a chance to be rewarded for the effort. DATs that take the easy road by simply buying and holding a cryptoasset will trade at a discount to its value,” he added.

Many experts agreed with Hougan. Mario S., a researcher at Artemis, also pointed to the importance of transparency and systematisation.

Great thread. Even better if the DATs are transparent about it. Sell covered calls when IV is >x%. Issue equity when mNAV is above y turns. The more systematic the better, and allows investors to evaluate DATs against spot, ETFs, futures, and the rest of the ecosystem.

— Mario S. (@covered_call) November 5, 2025

“They could sell covered calls when implied volatility exceeds a certain percentage, or issue equity when mNAV is above a set level. […] The more systematic and transparent the approach, the better. Investors will be able to evaluate DATs against spot ETFs and other instruments,” he noted.

Another Artemis analyst, Anthony, added that strategy should depend on the asset. In bitcoin’s case, he said, a promising line would be to find ways to generate income or raise capital using non-debt methods — for example through preferred-share issuance.

“As for Ethereum and Solana, in my view the key determinant of success will be the ability of the treasury management teams to integrate effectively into the DeFi ecosystem and to generate income creatively beyond simple staking,” he also stressed.

A benchmark for crypto treasuries

As an example of effective crypto-treasury management, Hougan cited Strategy, which uses debt instruments to expand its positions.

“Try to raise $60 billion of equity capital to buy bitcoin through a corporate structure — now that is genuinely difficult,” the expert emphasised.

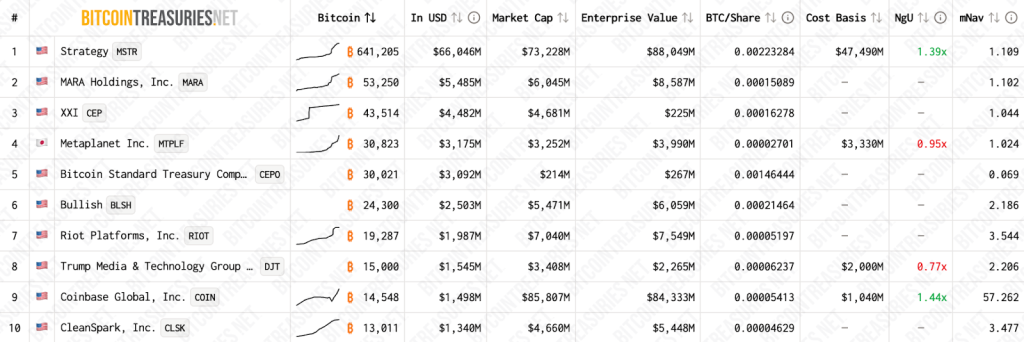

At the time of writing, the company led by Michael Saylor holds 641,205 BTC worth more than $66 billion. The firm is the world’s largest corporate holder of the first cryptocurrency.

In total, 207 companies have adopted a digital-gold accumulation strategy.

Seventy firms have added Ethereum to their balance sheets. Together they hold 6.14 million ETH worth $20.7 billion (5% of the cryptocurrency’s total supply).

Another ten companies have included Solana in their reserves. They manage 15,998 SOL worth $2.5 billion (2.8% of the coin’s total supply).

Some are also accumulating BNB, Chainlink, Dogecoin, Hyperliquid, Sui and many other assets.

In early November, the DAT firm Sequans sold 970 BTC to repay debt. The company’s shares fell 16% on the news.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!