Bitwise Promotes Ethereum ETF on New York Stock Exchange Facade

- Bitwise advertised ETH-ETF on the NYSE facade.

- Ethereum will continue to face pressure in the coming weeks due to active withdrawals from Grayscale’s ETHE.

Bitwise Asset Management displayed a banner on the facade of the NYSE to promote its newly launched spot Ethereum-ETF under the ticker ETHW.

Bitwise Ethereum ETF banner going up outside the iconic facade at the New York Stock Exchange this evening.

For the fund’s prospectus & risk disclosures, visit: https://t.co/coYFoKerma pic.twitter.com/KKjkmW8hKA

— Teddy Fusaro (@teddyfuse) July 25, 2024

“The [SEC] surrenders to a more powerful regulator. It is Ethereum that now provides standardized market access to all Internet participants. The network defeats the state,” commented former Coinbase CTO Balaji Srinivasan.

The flag of ETH is raised over Wall Street.

And the SEC surrenders to a more powerful regulator.

Because it is Ethereum that now provides standardized market access to all Internet participants.

The network defeats the state.pic.twitter.com/7nlQCxXvWz

— Balaji (@balajis) July 26, 2024

According to SoSoValue, in terms of cumulative inflow, ETHW ($250 million) is second only to BlackRock’s ETHA ($354.9 million).

In terms of NAV, Bitwise’s exchange product also ranks second among “new” instruments — $229 million compared to BlackRock’s $335.7 million.

Prospects for Grayscale’s ETHE

Within three days of the ETF’s approval, investors withdrew $1.16 billion from Grayscale’s ETHE.

ETHE clients are reacting to the higher fees of 2.5% compared to competitors’ 0.19-0.25%. Grayscale also launched the Grayscale Mini Trust Ethereum ETF (ETH), with fees of 0.15%. Some of the $1.6 billion withdrawn from ETHE may have flowed into ETH ($119.2 million).

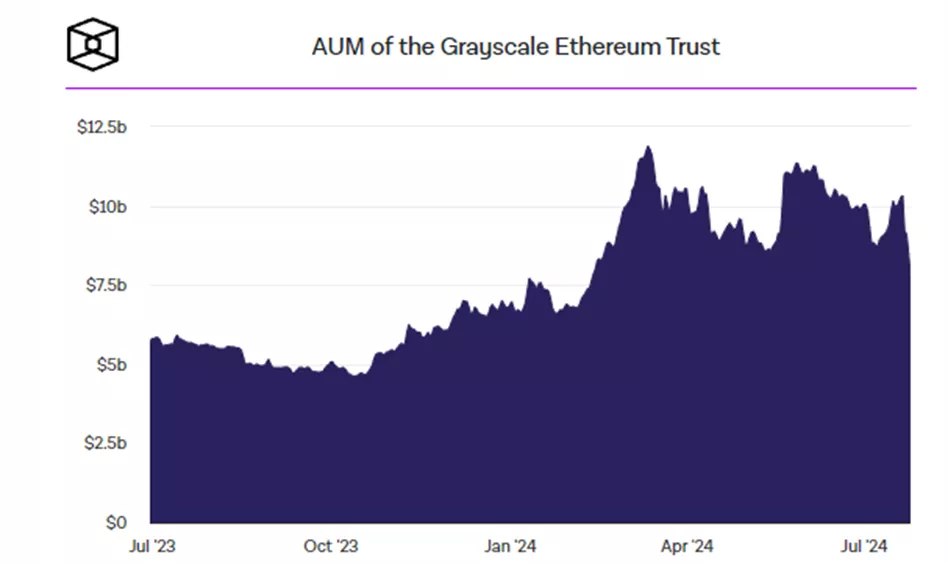

The capital outflow from ETHE, combined with a sharp correction in the price of ether since the ETF’s launch, contributed to a decline in AUM from $9.2 billion to $7.5 billion.

Bloomberg analyst James Seyffart noted that the net outflow from GBTC was slower in proportion to its asset volume.

He explained the heightened incentive to exit ETHE by noting that when the bitcoin fund launched, it was still trading at a discount to NAV, whereas in the Ethereum product, arbitrageurs had already eliminated it.

Here’s the side by side of the first day of trading for #Ethereum ETFs vs #Bitcoin ETFs.

The major difference to me is the comparatively massive $ETHE outflow. I think $GBTC didn’t have that on day 1 because it was still at a meaningful discount when it launched pic.twitter.com/w0nkJDzjX3

— James Seyffart (@JSeyff) July 24, 2024

Impact on Ethereum Price

CEO and co-founder of SynFutures Rachel Lin suggested that analyzing the sales dynamics of Grayscale’s GBTC could provide insights into what might happen next. According to her estimates, the structure lost 50% of its bitcoin assets in the first few months of trading, although the volume of sales subsequently decreased.

“ETHE has already lost or redistributed more than 17% of AUM. At the current pace of net outflows, it will reach this [50%] mark much sooner, indicating an even greater downside for ether,” the specialist suggested.

According to Burak Kesmechi from CryptoQuant, on-chain data on Ethereum flows to custodian addresses can serve as a leading indicator of whether ETHE will continue to exert pressure on the asset’s price.

Six ETH-ETF issuers, including Grayscale, use Coinbase as a partner, VanEck uses Gemini, and Fidelity stores the coins independently.

In the first two trading days, 160,930 ETH were deposited on Coinbase. The specialist indicated that Grayscale’s ETHE, from which $811 million was withdrawn during this period, is likely the source of these large ether flows.

“In the last 48 hours, 47,811 ETH left Coinbase. However, a net inflow of 113,119 ETH created significant selling pressure. Following this situation, the price of ether fell by 12% to $3100,” Kesmechi explained.

Lin also mentioned the largest stock market pullback in two years by the Nasdaq index.

“If the indicator continues to correct, cryptocurrencies are unlikely to stay on the sidelines, at least in the short term,” she emphasized.

In a comment for ForkLog, Allbridge.io co-founder Andrey Veliky noted that the initial phase after the launch of ETH-ETF is accompanied by increased volatility as the market adapts to the new product due to “selling the news.”

In the medium term, the expert expects stabilization in the growth of the cryptocurrency’s price and trading volume.

ETH-ETF is an important step towards the institutionalization of digital assets. It provides traditional financial institutions with a safe and reliable way to invest in cryptocurrencies, which could stimulate their further adoption and integration into TradFi.

In a comment for ForkLog, trader Vladimir Cohen discussed the importance of ETH-ETF and the current state of the market.

Earlier, 10x Research also noted “signs of new problems” following the Ethereum sell-off.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!