BlackRock: Gold’s inflation-hedge status overstated

Gold does not justify the status of an inflation-hedging asset. This is stated in the analytical note by BlackRock’s Global Allocation Fund portfolio manager Rassa Kesterikha, cited by Bloomberg.

“The ability of gold to hedge inflation has been somewhat overstated. While over centuries the main precious metal has confirmed its status as a store of value, this is not so obvious for the investment horizons of most investors”, — wrote Kesterikha.

In his view, in 2021 gold lost its appeal as the economy’s recovery after the pandemic gained momentum, and rising yields on US government bonds prompted investors to turn to this asset. The BlackRock executive noted that gold had been a good hedge against dollar debasement, but does not cope with this role with respect to equities and inflation risks.

According to the publication, gold has fallen 8% since the start of the year, while the S&P 500 has risen 4% over the same period, and the dollar index against a basket of currencies is up 1.8%.

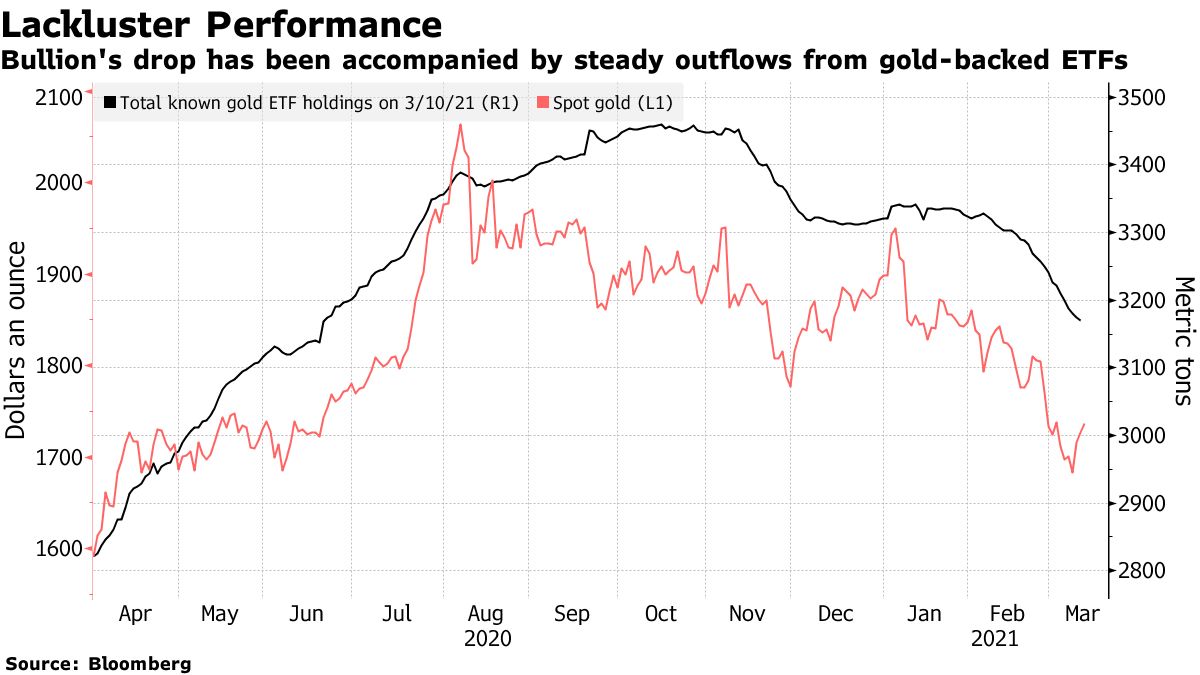

Bloomberg presents a chart illustrating the decline in the price of the precious metal, accompanied by outflows from gold-based exchange-traded funds (ETFs).

Price dynamics of gold and assets under management in “gold” ETFs. Data: Bloomberg.

Freed funds are being directed to Bitcoin. This trend was noted by CoinShares, a digital-asset management firm, as far back as December 2020. In particular, such a move was adopted in the Jefferies firm.

Last November, BlackRock’s chief investment officer Rick Rieder stated that the first cryptocurrency is capable of replacing the primary precious metal.

Prior to this, Citibank managing director Tom Fitzpatrick called Bitcoin the digital gold of the 21st century.

Back in 2021, Bank of Singapore analysts stated that there could be competition between digital assets and gold as a safe-haven asset.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!