Circle’s Market Capitalisation Surpasses USDC’s Valuation

As of the trading session on June 23, Circle’s market capitalisation rose to $63.9 billion, surpassing the market supply of its flagship product, the USDC stablecoin.

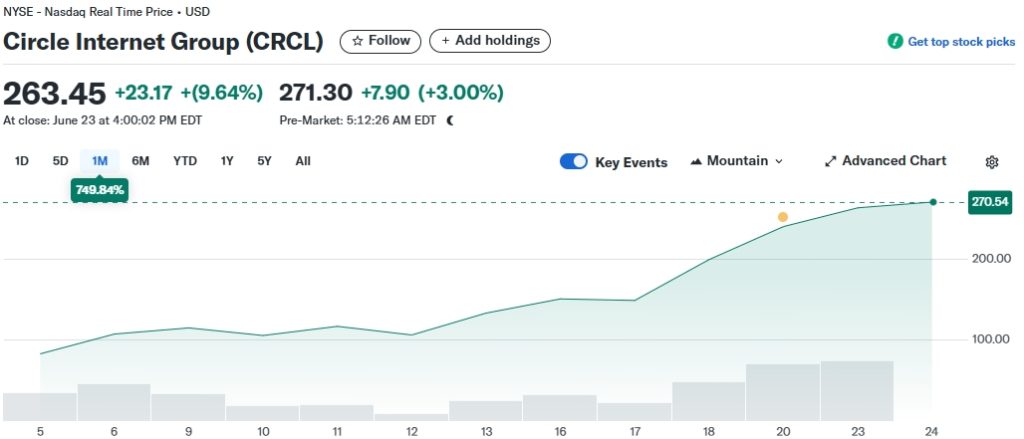

The company’s shares gained approximately 10% in a day. The stock price peaked at $298 but closed at $263.5.

On June 5, Circle went public. During its IPO, the firm raised $1.1 billion with a valuation of $6.9 billion. On its debut day at the NYSE, shares of the USDC issuer under the ticker CRCL soared by 168% — from $31 to $82.

Overall, since the start of trading, the company’s shares have increased by 750%.

Experts Warn of a Bubble

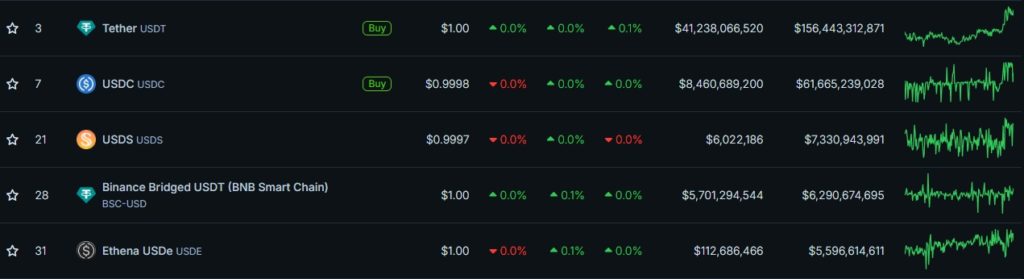

Artemis CEO John Ma noted that USDC’s capitalisation has grown by 90% over the year and now reaches $61.6 billion. In the stablecoin segment, the coin is second only to Tether’s USDT, which stands at $155.4 billion.

Ma pointed out Circle’s unusually high market valuation multipliers — it exceeds:

- annual revenue by 32 times;

- gross profit by 80 times;

- EBITDA by 152 times.

“Such a model lacks significant potential,” commented the manager late last week.

One potential driver of Circle’s stock rally is the advancement of the GENIUS Act stablecoin regulation bill in the US Congress. On June 16, the Senate passed the document, which is now under consideration by the House of Representatives.

According to several experts, the proposed standards could strengthen the position of the USDC issuer in the segment, which has always aimed to operate within the US regulatory framework.

Circle is actively expanding its business, having recently added USDC support in the World Chain and XRP Ledger networks.

The company announced a partnership with payment provider Fiser. The collaboration aims to “jointly explore stablecoin-based solutions for financial institutions and merchants.”

The e-commerce platform Shopify implemented the option to pay in USDC.

However, experts warn of a potential bubble in the stablecoin market following Circle’s successful stock offering.

One of the largest investors in the USDC issuer’s IPO was Cathie Wood’s Ark Invest. Three of the company’s funds acquired a total of 4,486,560 Circle shares on the day of its market debut, according to The Block.

On June 23, the firm sold 415,844 CRCL shares worth $109.6 million, continuing to lock in profits. Prior to this, Ark Invest sold 342,658 shares for $51.7 million.

Circle co-founder and CEO Jeremy Allaire predicted an imminent technological revolution in stablecoins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!